Nike (NYSE: NKE) embodies the essence of a blue chip stock. For years, it has led the industry, exuding financial stability and boasting a global brand that dazzles the competition. However, even stalwarts like Nike aren’t impervious to stormy market conditions, as demonstrated by its recent turbulent phase.

After hitting a record high in November 2021, the once soaring Nike stock has nosedived by nearly 55%. The year 2024 alone witnessed a staggering 24% plunge. Shareholders weathered a tempestuous period indeed.

A New Chapter: The Potential Revival of Nike

A pivotal moment unfolded when Nike announced the succession of CEO John Donahoe by incoming CEO Elliott Hill, with effect from October 14.

Donahoe’s reign as Nike’s CEO since January 2020 has been dichotomous. The early euphoria spurred by the COVID-19 surge transitioned into a downturn during the latter part of his tenure. Critics attribute his lack of prowess in the creative and design realms of the apparel industry as a significant weak link. As a former eBay CEO, Donahoe’s forte in e-commerce clashed with Nike’s direct-to-consumer strategy, a strategy that partly led to the company’s recent hurdles.

In sharp contrast, incoming CEO Hill’s long-standing association and profound comprehension of Nike’s ethos and the alchemy that forged its domination could herald a renaissance of innovative strides for the brand.

An Equitable Evaluation: The Bright Prospects of a Renowned Company

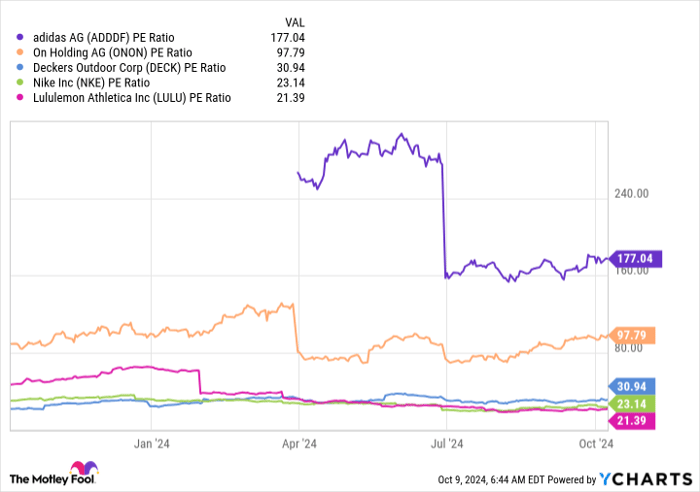

As of this discourse, Nike boasts a price-to-earnings (P/E) ratio slightly above 23.1, a far cry from the dizzying 84 it hit in late 2021. While this metric alone doesn’t categorize the stock as a steal, it positions Nike reasonably alongside competitors like Adidas, On Holding (the parent company of On shoes), Deckers Outdoor (the proprietors of Ugg and Hoka), and Lululemon.

Data indicates that Nike’s peers have been witnessing faster revenue and earnings growth rates than Nike. Nevertheless, the indomitable power of Nike’s brand is a competitive edge that transcends monetary quantification.

In scrutinizing this scenario, recall Warren Buffett’s aphorism: “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” This isn’t a slight on Nike’s competitors; it merely emphasizes Nike’s paramount position in the athletic shoes and apparel domain.

Recent setbacks notwithstanding, Nike’s stumble is likely a mere blip in its illustrious annals of triumphs.

Nike’s Strategic Move: Invested in Excellence

Amidst the stock’s descent, Nike’s management seized the opportunity to amplify its stock buybacks, culminating in nearly $1.2 billion in repurchases during the recent quarter.

| Month | Shares Repurchased | Average Price Paid Per Share | Total Spent |

|---|---|---|---|

| June | 3.26 million | $94.11 | $307 million |

| July | 6.16 million | $74.19 | $457 million |

| August | 5.39 million | $79.76 | $430 million |

Data source: Nike. Total spent rounded to the nearest hundred million.

Reducing the number of outstanding shares provides a fillip to earnings per share, augmenting the returns to shareholders beyond mere stock price appreciation. This reinforced buyback strategy subtly hints at management’s confidence in the stock’s undervaluation as the company sets sail towards recovery amidst its sharp downturn this year.

Although Nike’s resurgence won’t manifest overnight, investors poised for the long haul should seize this opportune moment to acquire shares as the company charts its course of transformation.

Embrace the Moment: A Chance at Lucrative Returns

Ever missed the boat on investing in flourishing stocks? Then heed this.

Occasionally, our panel of experts issues a “Double Down” stock recommendation for companies teetering on the edge of breakthroughs. If you fear missing the entry point for investment, now is the prime juncture to dive in before it’s too late. And the outcomes speak for themselves:

- Amazon: if you had invested $1,000 during our “Double Down” call in 2010, your investment would now stand at $21,266!*

- Apple: if you had invested $1,000 during our “Double Down” recommendation in 2008, your investment would now be worth $43,047!*

- Netflix: if you had bet $1,000 on our “Double Down” advice in 2004, you’d be sitting on $389,794*!

At the moment, we’re advocating “Double Down” alerts for three remarkable companies, and another window of opportunity like this could be elusive.

Explore 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

Stefon Walters has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Lululemon Athletica and Nike. The Motley Fool recommends On Holding. The Motley Fool has a disclosure policy.