For savvy investors looking to capitalize on market fluctuations and identify undervalued opportunities, the real estate sector is currently a goldmine waiting to be unearthed.

One key indicator attracting attention is the Relative Strength Index (RSI), a momentum gauge that juxtaposes a stock’s strength during price upticks with its performance during declines. A stock is deemed oversold when its RSI drops below the 30 mark, suggesting potential for a rebound in the near term.

Let’s delve into the prospects of three real estate stalwarts showing signs of being oversold, hinting at promising returns for investors.

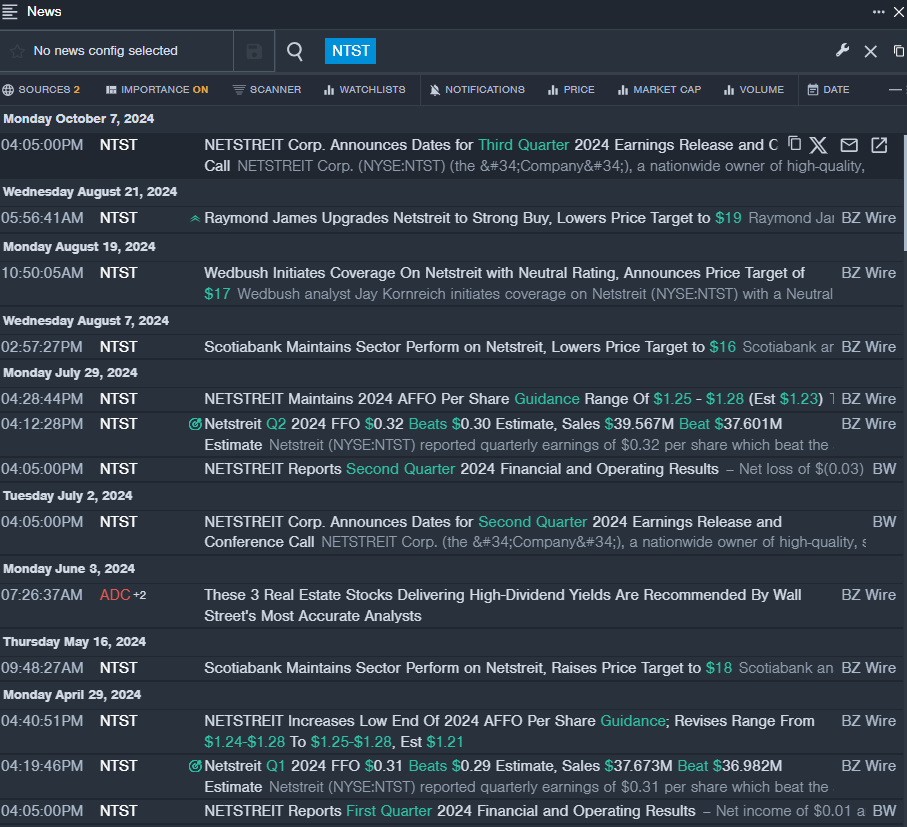

NetSTREIT Corp NTST

- NetSTREIT is gearing up to unveil its financial results for the third quarter of 2024 on November 4, 2024, post-market hours on the NYSE. Despite a recent 10% dip in its stock price and a 52-week low of $13.49, the company remains poised for a potential comeback.

- RSI Value: 27.18

- NTST Price Action: NetSTREIT’s shares concluded at $15.44, showcasing resilience amidst market turbulence.

Lineage Inc LINE

- Set to disclose its third-quarter financial performance on November 6, 2024, Lineage is another player exhibiting strong potential after witnessing a 10% decline in its stock price recently. With a 52-week low of $73.16, Lineage is a compelling option for investors seeking value.

- RSI Value: 26.01

- LINE Price Action: Despite market headwinds, Lineage’s shares closed at $73.99, showing resilience amidst turbulent times.

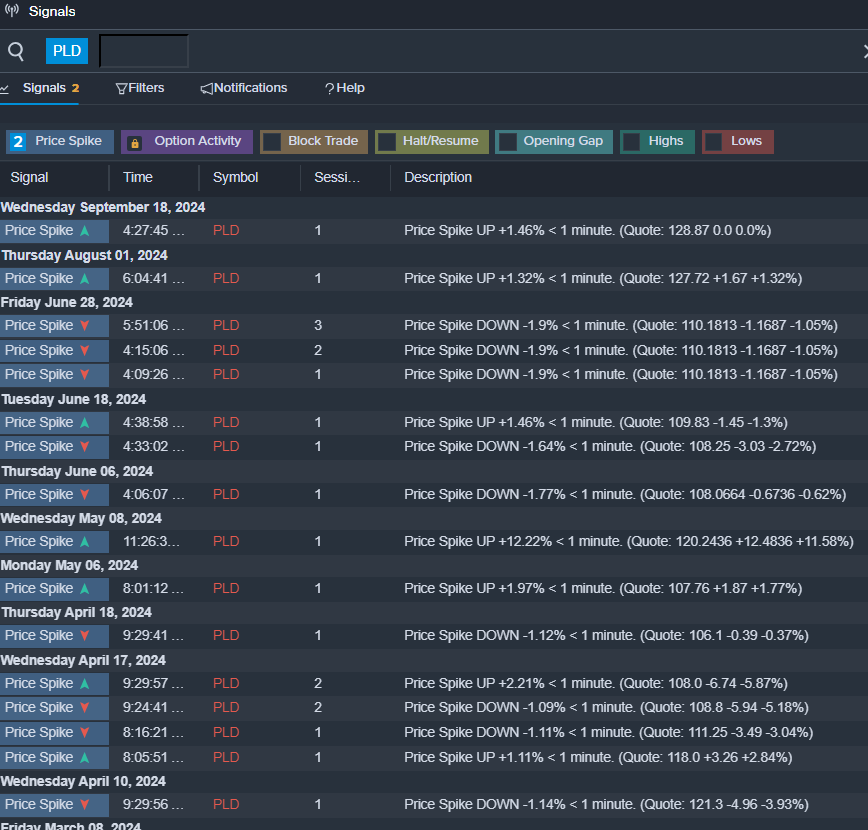

Prologis Inc PLD

- Barclays analyst Anthony Powell’s recent assessment of Prologis underscores its potential, with an “Overweight” recommendation, albeit with a revised price target of $131 from $142. Despite an 11% retreat in its stock price and a 52-week low of $10.02, Prologis remains an intriguing option for investment.

- RSI Value: 28.20

- PLD Price Action: Closing at $118.28, Prologis continues to weather market volatility, showcasing resilience in the face of challenges.

Amidst the backdrop of market volatility, these real estate giants are like sturdy lighthouses guiding investors through turbulent waters, offering a safe harbor in the storm. By strategically positioning oneself in these oversold yet resilient stocks, investors stand to gain from the inevitable market corrections and rebounds.