When contemplating investment decisions, many turn to the guidance of analysts in the financial sector. However, the question remains: how much weight should one place on these recommendations?

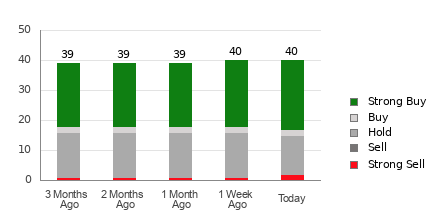

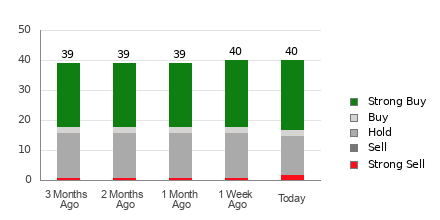

Netflix, amidst its position in the market, has garnered an average brokerage recommendation (ABR) of 1.89 out of 5, suggesting a tendency towards a “Strong Buy.” This valuation is a result of assessments provided by 40 brokerage firms, with 23 advocating for a “Strong Buy” and 2 for a “Buy.”

Shifting Patterns in Brokerage Recommendations for Netflix (NFLX)

Despite the favorable ABR outlook, it is unwise to base investment decisions solely on this metric. Previous studies indicate the limitations of brokerage recommendations in effectively directing investors towards stocks with significant price appreciation potentials.

Why the skepticism? Analysts from brokerage houses, driven by vested interests, often exhibit a strong bias towards positively rating stocks they cover. This predisposition leads to a prevalence of “Strong Buy” ratings compared to “Strong Sell” recommendations, potentially misguiding investors.

For a reliable investment strategy, one might consider leveraging the Zacks Rank – a tool with a demonstrated track record – which categorizes stocks from Rank #1 (Strong Buy) to Rank #5 (Strong Sell). Validating the ABR with the Zacks Rank could offer a more prudent approach to investment decisions.

Deciphering the Distinctions Between ABR and Zacks Rank

While both ABR and Zacks Rank adopt a scale from 1 to 5, they operate on distinct methodologies.

ABR relies solely on broker recommendations, often presented as decimal figures, whereas Zacks Rank is a quantitative model that leverages earnings estimate revisions, reflected in whole number rankings from 1 to 5.

Brokerage analysts, motivated by their employers’ interests, tend to exhibit optimism in their ratings, while the Zacks Rank, driven by earnings estimate revisions, correlates strongly with short-term price movements.

Additionally, the Zacks Rank ensures uniform application across all stocks with current-year earnings estimates, all while maintaining a timely and updated reflection of potential price moves, unlike ABR.

Assessing the Investment Value of Netflix (NFLX)

Currently, Netflix’s earnings estimate for the year has improved by 0.1% over the past month to $19.09, signaling a positive sentiment among analysts. This, coupled with consensus estimate changes and other factors, has led to a Zacks Rank of #2 (Buy) for Netflix.

Thus, the ABR, aligning closely with the Buy-equivalent stance, could provide a reference point for prospective investors.

From numerous investment opportunities, certain stocks stand out with the potential to yield substantial returns in the near future. Emblematic of this trend, Netflix holds promise, with analysts projecting significant growth, echoing the sentiments of Wall Street.

When considering the viability of an investment in Netflix, strategic alignment with reputable tools such as the Zacks Rank could pave the way for informed and potentially profitable decisions.