When it comes to investing, Wall Street analysts hold immense sway over the decisions of investors. The changing ratings and insights provided by these brokerage experts can send ripples through the stock market. But are these recommendations truly the guiding light they are perceived to be?

Before delving into the reliability of these evaluations, let’s first glimpse at the landscape for Snowflake Inc. (SNOW) as portrayed by the Wall Street analysts and dissect how investors can harness this information to their advantage.

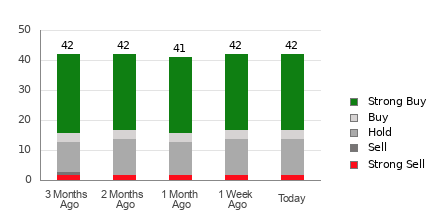

The current average brokerage recommendation (ABR) for Snowflake stands at 1.83, falling between Strong Buy and Buy on a scale from 1 to 5. The ABR is derived from recommendations provided by 42 brokerage firms, with Strong Buy constituting 59.5% and Buy making up 7.1% of the total recommendations.

Insight into Analyst Recommendations for SNOW

The glowing ABR for Snowflake might suggest a buying opportunity, but an investor must exercise caution. Studies have shown that brokerage views often fall short in predicting stocks with the highest potential for price appreciation due to the inherent positive bias of these entities towards the stocks they cover.

These brokerage firms tend to issue significantly more favorable ratings, like “Strong Buy,” outnumbering “Strong Sell” recommendations by a wide margin, indicating a skewed perspective that may not align with retail investors’ best interests.

For a more reliable assessment, consider leveraging Zacks Rank – a robust stock rating tool with a proven track record. This tool categorizes stocks from Strong Buy to Strong Sell, correlating these rankings with future price performance, providing investors with a clearer perspective.

Deciphering Zacks Rank vs. ABR

While both ABR and Zacks Rank adopt a 1 to 5 scale, they serve distinct purposes. ABR hinges on brokerage recommendations, displayed with decimals, while Zacks Rank is underpinned by quantitative models that leverage earnings estimate revisions, yielding whole-number rankings.

Contrary to the optimistic slant seen in brokerage recommendations, Zacks Rank remains grounded in earning estimate revisions, offering a more pragmatic projection of stock performance. Its focus on near-term price movements based on earnings trends has been supported by empirical evidence.

Zacks Rank maintains balance across its rankings for all stocks tracked by brokerage analysts, ensuring a fair and impartial evaluation framework. Furthermore, unlike ABR which may lag in terms of freshness, Zacks Rank swiftly incorporates the latest earnings estimate revisions, enhancing its predictive accuracy.

Should Snowflake (SNOW) Make It to Your Portfolio?

Examining the earnings estimate revisions for Snowflake, the Zacks Consensus Estimate for the current year remains stable at $0.58 over the past month.

Steady analyst sentiment reflected in the unchanged consensus estimate has positioned Snowflake at a Zacks Rank #3 (Hold), suggesting a performance in line with the broader market in the near future.

Given these factors, approaching the Buy-equivalent ABR for Snowflake cautiously is advisable, ensuring a balanced evaluation before making investment decisions.

A Surge in Infrastructure Stocks Looming Ahead

The impending surge in revitalizing the aging U.S. infrastructure is both bipartisan and inevitable. Trillions are earmarked for this rejuvenation effort, promising substantial wealth creation opportunities.

Choosing the right stocks early on to capitalize on this growth spurt is paramount. To aid in this endeavor, Zacks has released a Special Report featuring 5 companies primed to benefit greatly from the infrastructure overhaul.

Download FREE: How To Profit From Trillions On Spending For Infrastructure

Snowflake Inc. (SNOW) : Free Stock Analysis Report