Young consumers are gravitating towards Buy Now, Pay Later (BNPL) services seeking flexibility without the burden of credit card debt. Affirm (NASDAQ: AFRM) is at the forefront of this industry projected to grow over 24% annually in the U.S. until 2030.

Partnerships and Product Innovation Propel Affirm

Affirm has strategically partnered with major retailers, like Shopify and Amazon, to reach a vast consumer base. With 18.6 million users and a significant year-over-year increase in gross merchandise value, Affirm’s innovative approach to BNPL services stands out.

Affirm’s introduction of the Affirm Card, a physical charge card offering BNPL options, positions the company for substantial growth in point-of-sale transactions, tapping into evolving consumer trends.

The Road to Profitability

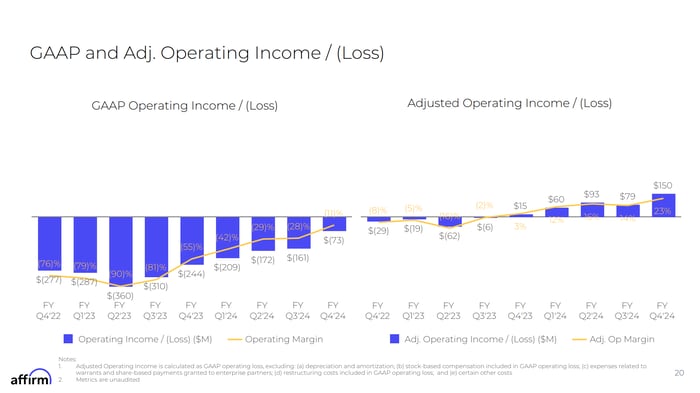

Affirm, while not yet profitable, has achieved milestones towards positive financial performance. Striving towards profitability, CEO Max Levchin emphasizes the importance of increasing transactions.

Affirm’s promising financial outlook is reinforced by its recent non-GAAP operating profit and robust cash reserves, signaling sustainability and growth potential.

Affirm’s Potential to Create Millionaires

Key questions remain about Affirm’s long-term success in the BNPL market: the extent of BNPL’s replacement of traditional credit cards and Affirm’s competitive positioning. Despite the uncertainties, Affirm’s market potential is substantial given the industry’s growth trajectory.

With BNPL appealing to younger consumers and Affirm’s strong retail collaborations, the company is poised for significant market share gains and expansion as the industry matures.

Seize the Opportunity with Affirm

Affirm’s growth presents an opportunity for investors seeking potentially high returns. The company’s trajectory, marked by innovation and strategic partnerships, hints at a lucrative future in the financial sector.