Tesla’s Recent Setback

Tesla (NASDAQ:TSLA) faced disappointment last week as its robotaxi unveiling failed to impress investors. Predictions of a stock surge fell flat, leading to criticism of the event’s lack of substance.

Analyst’s Diminished Optimism

Piper Sandler analyst Alexander Potter expressed fading optimism post-unveiling, with hopes for boosted estimates dashed. However, he noted that no estimate cuts were necessary since the revenue from full self-driving (FSD) software was already anticipated to ramp up by 2027/2028.

Back to Basics

With Tesla’s focus returning to car sales, Potter finds potential for growth, dubbing it a “good thing” in the current landscape. Despite recent challenges, he maintains a positive outlook on the company’s core operations.

Projections and Forecast

Looking ahead to Q4, Potter’s forecast of 465,586 units is underpinned by strong demand in China and the Cybertruck production ramp-up. He anticipates annual growth, with 2025 deliveries expected to hit around 1.9 million units, driven by expansion into new markets and sustained demand in existing ones.

Potter’s Take on Tesla’s Future

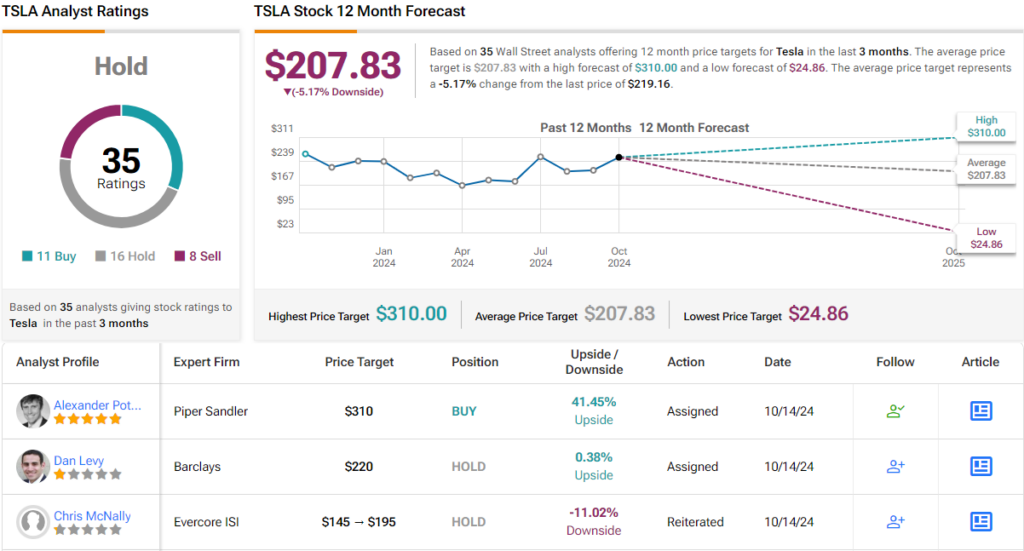

With an upbeat outlook, Potter predicts significant gains for Tesla, rating the stock as Overweight and setting a price target of $310. He anticipates approximately 42% growth in the coming months, balancing cautious optimism with realistic projections.

Market Sentiment and Contrasting Views

While Potter sees potential for considerable appreciation in Tesla’s stock value, his colleagues present a mixed opinion. The consensus rates the stock as a Hold, reflecting uncertainty among analysts. With an average target of $207.83, some predict a slight decline in Tesla’s value by the next year.

Charting the Path Forward

Despite recent setbacks, Tesla’s future trajectory remains a topic of keen interest and speculation. Potter’s projections offer a glimpse into the possibilities for the electric vehicle giant, setting the stage for potential growth and recovery.