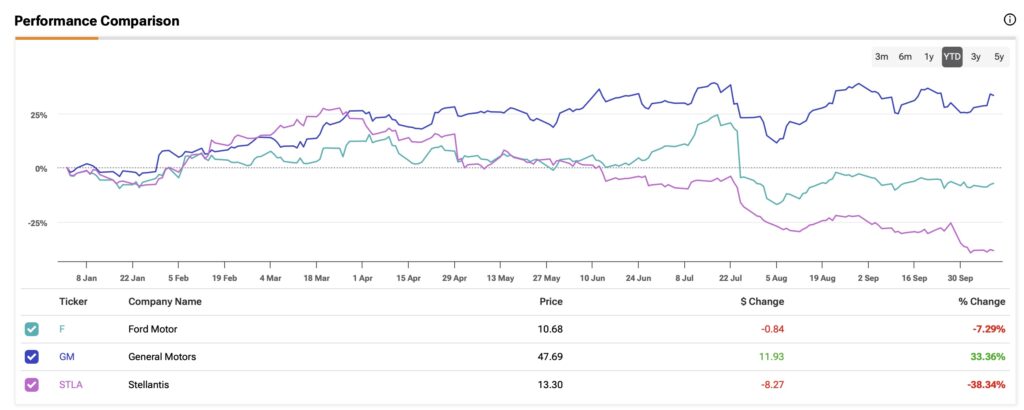

When assessing traditional automakers like Ford (F), General Motors (GM), and Stellantis (STLA), investors navigate a landscape colored by historical rivalry and financial intricacies. While Ford maintains a somewhat shaky footing, facing challenges in transition, General Motors and Stellantis exude a more bullish aura. However, the spotlight ultimately shines brightest on General Motors, hinting at an investment path that may outpace the competition, as dissected below.

An Analytical Glance at Ford

The narrative surrounding Ford echoes tales of a phoenix aiming to rise from its ashes—an emblem of the automotive industry that has endured the tests of time. Despite commendable efforts in restructuring, Ford finds itself at a crossroads, grappling with persistent operational hiccups. The company’s recent financial performance, marred by quality concerns, struggles in shifting to electric vehicles, and wavering investor trust, leaves much to be desired.

A case in point – in Q2, Ford’s EPS fell short, clocking in at 47 cents against the anticipated 68 cents, extending a disheartening trend over three consecutive quarters. Notably, Ford Blue, the segment dedicated to internal combustion engine (ICE) vehicles, witnessed an adjusted EBIT of $1.2 billion, marking a 48% decline from the prior year.

The looming shadow of warranty costs has long plagued Ford, tarnishing its image of dependability. With a staggering 5.9 million vehicles recalled in 2023, Ford faced the highest volume of recalls amongst U.S. automakers, hinting at deeper-rooted concerns surrounding the quality of its combustion vehicles.

Ford’s Strides Amid Warranty Woes and Dividend Rejuvenation

Amidst the gloom, glimmers of hope emerge within Ford’s horizon. The proclamation by CEO Jim Farley heralding imminent resolutions to warranty maladies, along with strategic investments in cutting-edge technologies and testing protocols, instills a sense of promise. Moreover, the reinstatement of dividends post a pandemic-induced hiatus in 2021 underlines Ford’s unwavering faith in its financial robustness and sustainable cash flow credentials. This reinstatement appeals notably to income-oriented investors, boasting a dividend yield of 7.43% and a moderate payout ratio of 47.5%. Valuation metrics further fortify Ford’s allure, trading at a forward P/E ratio standing at 5.6x, approximately 30% below its five-year average.

TipRanks analysts, projecting a Moderate Buy view, set the average price target at $14.40, forecasting a potential upside of 34.33%.

General Motors: Navigating Success Amid Transition

General Motors traverses the investment landscape with an air of confidence, flaunting a robust sales trajectory and a proactive shift towards electric vehicles that has cemented its status as a market frontrunner. An illustrious Q2 performance, marked by a stellar showcase in internal combustion engine (ICE) trucks and SUVs, underscored GM’s financial ascendancy, outpacing EPS estimates for the eighth consecutive quarter at $3.06 per share—a commendable 60.2% year-over-year surge. Garnering $4.4 billion in adjusted EBIT, a 37% escalation, GM bolstered full-year guidance, bumping the range to $13 billion to $15 billion following palpable momentum.

GM’s Triumphs: Share Repurchase, Elevated Valuation

The investment narrative surrounding General Motors paints a picture of resilience and growth, encapsulating a commendable trajectory. As GM eclipses peers with its financial might and strategic foresight, the decision to embark on share repurchases symbolizes a vote of confidence in its trajectory. Bolstered valuation metrics serve as a testament to GM’s promising outlook, indicating a resolute stance to navigate industry dynamics judiciously.

The Drive Forward: Analyzing GM, Ford, and Stellantis Performance in the Automotive Sector

GM’s Electric Vehicle Push

GM’s strategic pivot towards Electric Vehicle (EV) initiatives marks a pivotal moment in the company’s trajectory. With a commitment to electrifying its fleet by 2030 and going fully electric by 2035, GM’s shift in focus is now sensitive to consumer demand, indicating a keen strategic flexibility.

What sets GM apart is its stellar financial performance, outshining industry averages by recording a remarkable 5% revenue growth and a 4.2% increase in EBIT. In stark contrast, competitors like Ford and Stellantis witnessed significant declines in EBIT, highlighting GM’s robust financial health amidst industry challenges.

GM’s Financial Fortitude

GM’s financial prudence is evident in its shareholder-friendly moves. While its dividend yield might be moderate at under 1%, GM’s aggressive $11.5 billion share repurchase over the past year resulted in a staggering buyback yield of 21.6%, far exceeding industry norms. Furthermore, GM’s stock showcases an attractive valuation, trading at a forward P/E ratio of 4.8x, nearly 40% below its historical average despite a solid 55% stock appreciation in the past year.

The Potential of Stellantis

Despite facing headwinds, Stellantis stands at a critical juncture in its evolution post the 2021 merger of Fiat Chrysler Automobiles and Peugeot Groupe. The company’s transitional phase, though marked by disappointing financial results, paves the way for a renewed product cycle, underpinned by a diverse portfolio of 14 iconic brands.

Stellantis’ commitment to investing $50 billion in BEVs and PHEVs signals a forward-looking approach, with consistent positive cash flows and robust operational performance. These factors mitigate concerns around its investment thesis and position Stellantis favorably for the electrification shift in the automotive landscape.

Stellantis’ Positive Prospects

Despite recent setbacks, Stellantis exhibits promising characteristics that could intrigue discerning investors. Noteworthy is the company’s strong capital efficiency, boasting a return on total capital of 9.7%, well above industry peers and indicative of a streamlined operational model primed for success in the EV era.

Stellantis’ generous dividend yield of 10.4% coupled with an attractive valuation at a forward P/E ratio of 4.1x reflects a compelling investment opportunity. While a planned reduction in payout ratio may impact yield in the short term, Stellantis remains well-positioned for long-term growth amidst industry shifts.

Driving Towards a Bright Future

GM’s upward trajectory in the automotive sector underscores its resilience and foresight. With a prudent focus on shareholder value and a strategic approach towards EV adoption, GM emerges as a front-runner in the industry, outperforming peers and delivering robust financial results that resonate with investors.