Amazon’s AI Advantage

In a world where trillion-dollar valuations are no longer a rarity, Amazon stands on the precipice of a historic milestone: being Wall Street’s first $5 trillion stock. While Apple, Microsoft, and Nvidia lead the pack with market caps exceeding $3 trillion, Amazon’s strategic focus on artificial intelligence (AI) positions it to transcend the competition.

The Next Big Catalyst

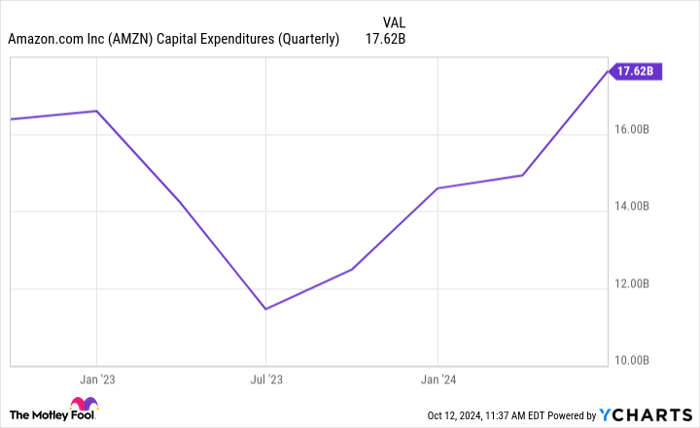

For years, the narrative around AI has been omnipresent but vague. Yet, Amazon’s investments speak volumes. From pouring billions into initiatives like Anthropic to significant capital expenditures in data infrastructure, the tech giant is laying a solid foundation for exponential growth.

Fueling Revenue Growth

Despite macroeconomic challenges impacting segments like e-commerce, Amazon’s cloud computing arm, Amazon Web Services (AWS), emerges as a beacon of profitability. The company’s collaboration with Anthropic has turbocharged revenue and profits from AWS, reshaping Amazon’s financial landscape and promising sustained growth.

The Long-Run Winner

As the tech landscape evolves, Amazon’s competitive edge becomes more pronounced. While peers like Nvidia, Apple, Microsoft, and Alphabet make strides in AI, Amazon’s relentless pursuit of innovation in cloud computing and beyond sets it apart. The road to $5 trillion may be challenging, but Amazon’s trajectory seems poised for victory.

Unmatched Growth Potential: Amazon’s Diversified Ecosystem

Resilient Amidst Cohorts Facing Growth Deceleration

In a landscape where major cohorts potentially grapple with growth slowdown, Amazon stands out as a beacon of resilience. With its multifaceted ecosystem spanning e-commerce, subscriptions, grocery delivery, streaming, and cloud computing, the e-commerce giant enjoys a level of immunity to competition that is unparalleled.

Predicting Sustained Revenue Growth

The prevailing sentiment points to Amazon’s revenue and profits continuing on an upward trajectory for the foreseeable future. As the company’s profitability and earnings soar, the consensus is that Wall Street will gradually shift its valuation, favoring Amazon over its industry peers.

Expanding Valuation Multiples on the Horizon

In light of these factors, expectations are high for Amazon’s valuation multiples to undergo a significant expansion. Such a development would set the stage for soaring share prices, propelling the e-commerce behemoth to a market cap value that surpasses other tech giants.

Seize the Opportunity Without Hesitation

Have you ever felt like you missed out on the chance to invest in groundbreaking stocks? If so, this is your moment. Occasionally, our team of experts issues a “Double Down” stock recommendation, signaling companies on the brink of explosive growth. This opportune moment might be fleeting, making it the ideal time to capitalize on this potential windfall.

- Amazon: Investing $1,000 during our “Double Down” call in 2010 would yield $21,139!*

- Apple: A $1,000 investment during our 2008 “Double Down” would now be $44,239!*

- Netflix: Putting $1,000 in during our 2004 “Double Down” would translate to $380,729!*

Currently, we are highlighting three exceptional companies through “Double Down” alerts, and opportunities as lucrative as this may not present themselves again anytime soon.

Explore the 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024