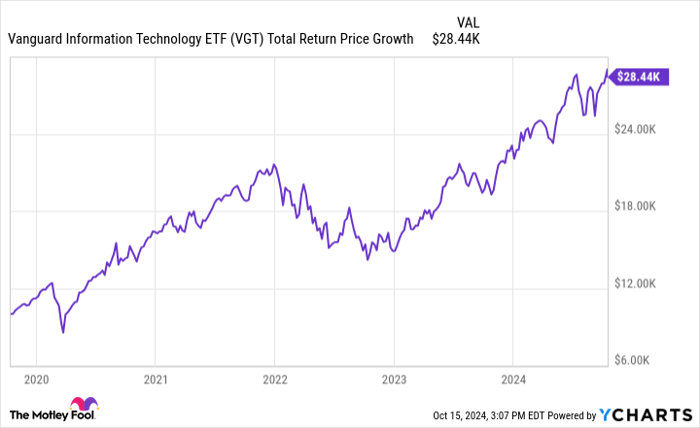

Exchange-traded funds (ETFs) often embody the adage of the tortoise and the hare – slow and steady wins the race. However, not all ETFs conform to this idea. Some funds move swiftly like Aesop’s hare, proving to be lucrative for investors. Enter the Vanguard Information Technology ETF, which managed to turn an investment of $10,000 into over $28,000 in just a span of five years.

Image source: Getty Images.

Unveiling the Vanguard Information Technology ETF

The Vanguard Information Technology ETF (NYSEMKT: VGT) is a standout fund that focuses on U.S. stocks in the information technology sector, aiming to mirror the performance of the MSCI US Investable Market Information Technology 25/50 Index. With notable holdings such as Apple, Microsoft, Nvidia, Broadcom, and Oracle, this ETF has demonstrated remarkable growth since its inception in 2004, boasting an annual return of 13.55%. In the last five years alone, the fund’s market price has surged with an annual compounded average of approximately 23.2%.

Despite some of the held stocks not offering dividends, the fund’s reinvested dividends have significantly inflated its returns from $10,000 to a substantial $28,440 in just half a decade.

VGT Total Return Price data by YCharts

The Secrets Behind Its Ascendancy

The Vanguard Information Technology ETF’s success story is closely tied to the widespread adoption of artificial intelligence (AI), particularly generative AI. The top holdings of the fund, including Nvidia, have been at the forefront of the AI wave, experiencing exponential growth as a result.

Nvidia alone has witnessed a meteoric rise, with its stock price skyrocketing more than 28 times in the past five years, largely due to the heightened demand for its graphics processing units (GPUs) to power AI models. Similarly, other major holdings like Broadcom, Apple, Microsoft, and Oracle have all reaped substantial gains, benefiting from the AI frenzy.

The Vanguard Information Technology ETF’s performance has undeniably been buoyed by the rapid recovery of the U.S. and global economies post the COVID-19 pandemic, defying recessionary forecasts. Moreover, with an annual expense ratio of merely 0.1%, well below the industry average, the fund has been able to maximize its returns further.

Analysts’ Ponderings on Investment Prospects

As enticing as the Vanguard Information Technology ETF’s growth story may be, concerns loom around its valuation metrics, with an average price-to-earnings ratio of 35.6 across its portfolio. Nevertheless, given the nascent stage of the AI era and the promising trajectory of tech stocks focusing on AI, the ETF could potentially sustain its exceptional returns in the long run.

While volatility remains a possibility, particularly with a concentration of assets in a handful of stocks, the Vanguard Information Technology ETF presents itself as a compelling choice for investors eyeing long-term growth.

Final Thoughts on the Vanguard World Fund – Vanguard Information Technology ETF

Before diving into Vanguard World Fund – Vanguard Information Technology ETF, investors should weigh the advice from the Motley Fool Stock Advisor team, who recently spotlighted 10 other stocks poised for substantial returns, excluding this ETF from their list. Nonetheless, the ETF’s potential cannot be discounted, especially given the track record of tech giants like Nvidia showing astronomical returns over time.

For those pondering whether to jump on the bandwagon, remember that even if you can’t replicate Nvidia’s $806,459 from a $1,000 investment back in 2005, the Vanguard Information Technology ETF still holds promise for future growth. As Stock Advisor continues to outshine the S&P 500, the ETF might just prove to be a gem in investors’ portfolios.