As the winds of the market blow, opportunities arise for discerning investors to weigh anchor and set sail towards undiscovered lands of financial prosperity.

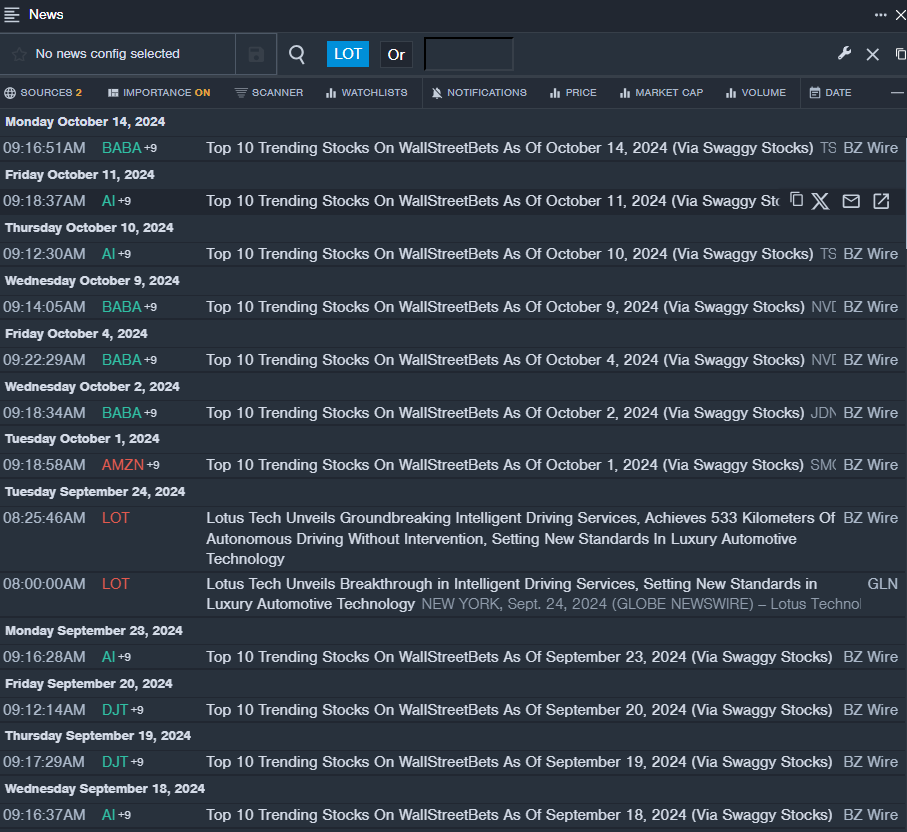

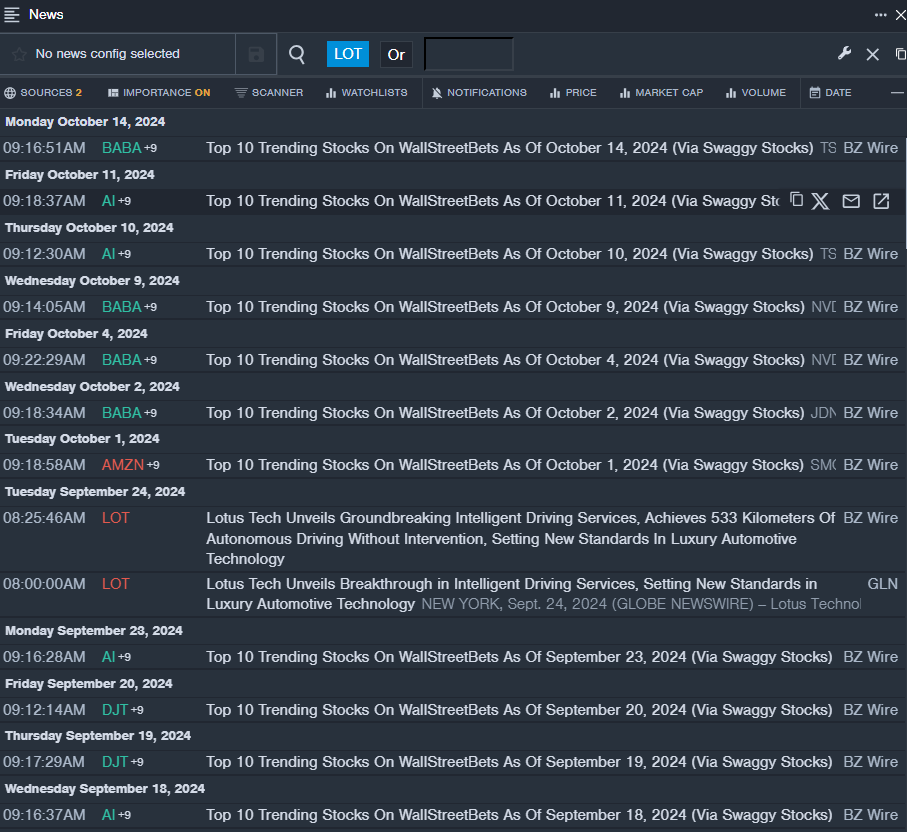

Lotus Technology Inc – ADR – LOT

Diving into the realm of consumer stocks, we find Lotus Technology Inc, standing on the cusp of innovation in intelligent driving services.

- Lotus Tech recently unveiled a groundbreaking advancement in luxury automotive technology, yet its stock value has stumbled, falling approximately 14% over the past month, with a 52-week low of $4.27.

- RSI Value: 27.96

- LOT Price Action: Despite this setback, shares of Lotus Technology persevered, trading at $4.32 on a recent Wednesday, revealing the company’s resilience amidst market fluctuations.

- Like a beacon in the night, Benzinga Pro’s real-time newsfeed shines a light on the latest developments in the LOT universe.

Stride Inc – LRN

Turning our gaze to Stride Inc, known for its resilience amidst the financial storm, we witness a company navigating through turbulent waters with a steadfast resolve.

- Facing tumultuous seas, Stride Inc’s stock descended by approximately 20% in the past month, revealing vulnerabilities amidst the shifting tides, with a 52-week low of $43.77.

- RSI Value: 17.43

- LRN Price Action: Despite the headwinds, shares of Stride valiantly traded at $65.94 on a recent Wednesday, showcasing the company’s unwavering spirit in the face of adversity.

- Benzinga Pro’s charting tool acts as a lighthouse, guiding investors through the stormy seas of LRN stock trends.

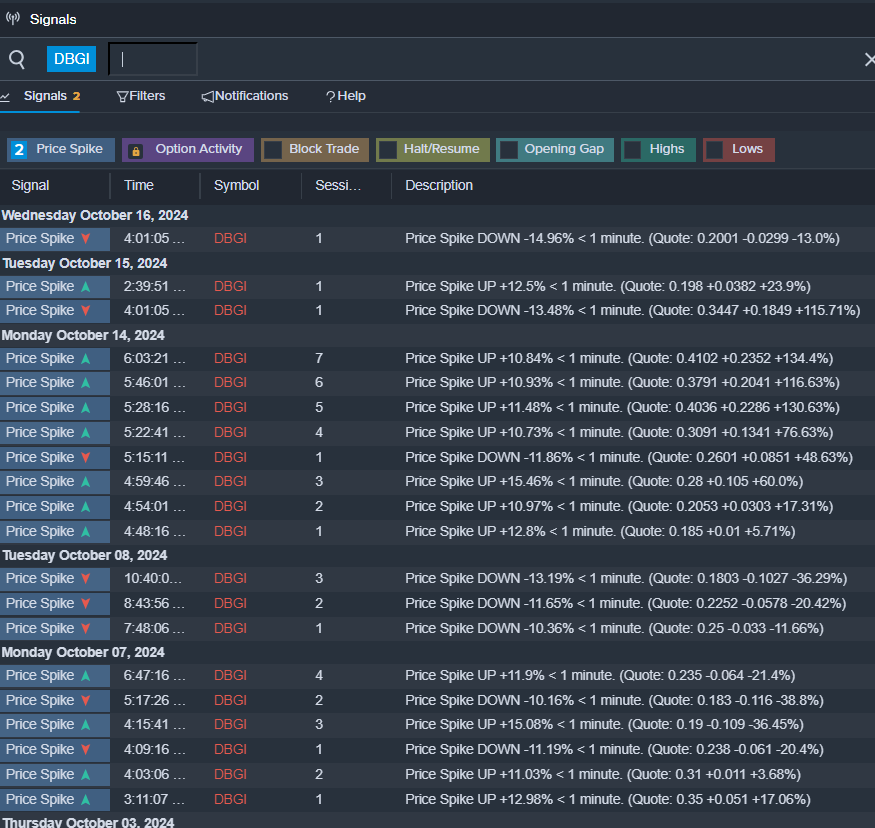

Digital Brands Group Inc – DBGI

Finally, our expedition leads us to Digital Brands Group Inc, a company facing turbulence as it navigates the mighty Nasdaq seas.

- In the tempest of the market, Digital Brands shares plummeted by a staggering 59% in the past month, reminiscent of a ship caught in a ferocious storm, with a 52-week low of $0.14.

- RSI Value: 28.93

- DBGI Price Action: Despite the tumult, shares of Digital Brands valiantly closed at $0.20 on a recent Wednesday, hinting at a resilience that may see the company weather the storm and emerge stronger.

- Benzinga Pro’s signals feature shines like a lighthouse, illuminating the path towards potential breakout opportunities in the tumultuous seas of DBGI shares.

When faced with rough seas, astute investors may find hidden treasures amidst the waves of volatility, ready to set sail towards promising horizons with prudence and a steady hand.