Investors often rely on analyst recommendations when considering a stock, but are these recommendations truly reliable? Let’s delve into what Wall Street experts think about SM Energy (SM) before making any investment decisions.

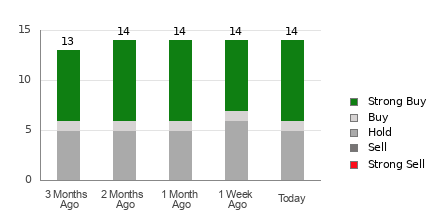

Currently, SM Energy boasts an average brokerage recommendation (ABR) of 1.79, hovering between Strong Buy and Buy on the 1 to 5 scale. Out of the 14 brokerage recommendations contributing to this ABR, 57.1% are Strong Buy and 7.1% are Buy.

Analysis of Brokerage Recommendations for SM

While the ABR advises buying SM Energy, solely relying on this information for investment decisions might not be prudent. Studies have shown that brokerage recommendations have a limited success rate in predicting stocks with the best price increase potential.

Brokerage analysts tend to exhibit a strong positive bias towards stocks they cover, with five “Strong Buy” recommendations for every “Strong Sell” recommendation. Therefore, using this information as a validation tool for your own research or combining it with a proven indicator is advisable.

Our proprietary stock rating tool, the Zacks Rank, categorizes stocks into five groups based on their near-term price performance potential. Combining the Zacks Rank with ABR could greatly aid in making informed investment decisions.

Understanding Zacks Rank vs. ABR

While both Zacks Rank and ABR are rated on a scale of 1-5, they serve different purposes. ABR is solely based on brokerage recommendations, typically displayed in decimals, whereas the Zacks Rank is a quantitative model driven by earnings estimate revisions and displayed in whole numbers.

Brokerage analysts tend to be overly optimistic due to vested interests, often misguiding investors. Conversely, the Zacks Rank, guided by earnings estimate revisions, is strongly correlated with stock price movements, providing a more reliable indicator.

The Zacks Rank ensures a balanced distribution among its five ranks for all stocks with current-year earnings estimates, making it a timely predictor of future stock prices.

Is SM Energy a Sound Investment?

The Zacks Consensus Estimate for SM Energy has declined by 0.3% over the past month to $7.06 for the current year. Analysts’ collective pessimism towards the company’s earnings outlook, mirrored in significant downward revisions, has led to a Zacks Rank #5 (Strong Sell) for SM Energy.

Considering the recent consensus estimate changes and poor Zacks Rank, it might be wise to approach the Buy-equivalent ABR for SM Energy with caution.

Discover Elite Stocks for the Next 30 Days

Experts have identified 7 elite stocks from the Zacks Rank #1 Strong Buys list, predicting these stocks to experience early price pops. Since 1988, this list has outperformed the market significantly, delivering an average gain of +23.7% per year.