Big-time investors have thrown their weight behind Unity Software (U) with a bullish fervor that demands attention. A peek into the minds of the market reveals that the high rollers are making moves that seem to signal something major on the horizon.

An Unusual Buzz in Options

A discerning eye on public options records by Benzinga has unearthed a fascinating turn of events today: a total of 12 exceptional options activities revolving around Unity Software. This surge of action is far from the norm in the trading world.

Among these notable options, sentiments are split among heavyweight investors, with 58% leaning bullish and 33% taking a bearish stance. It’s worth noting that 6 puts worth $333,165 and 6 calls totaling $216,458 are in play.

Price Predictions on the Horizon

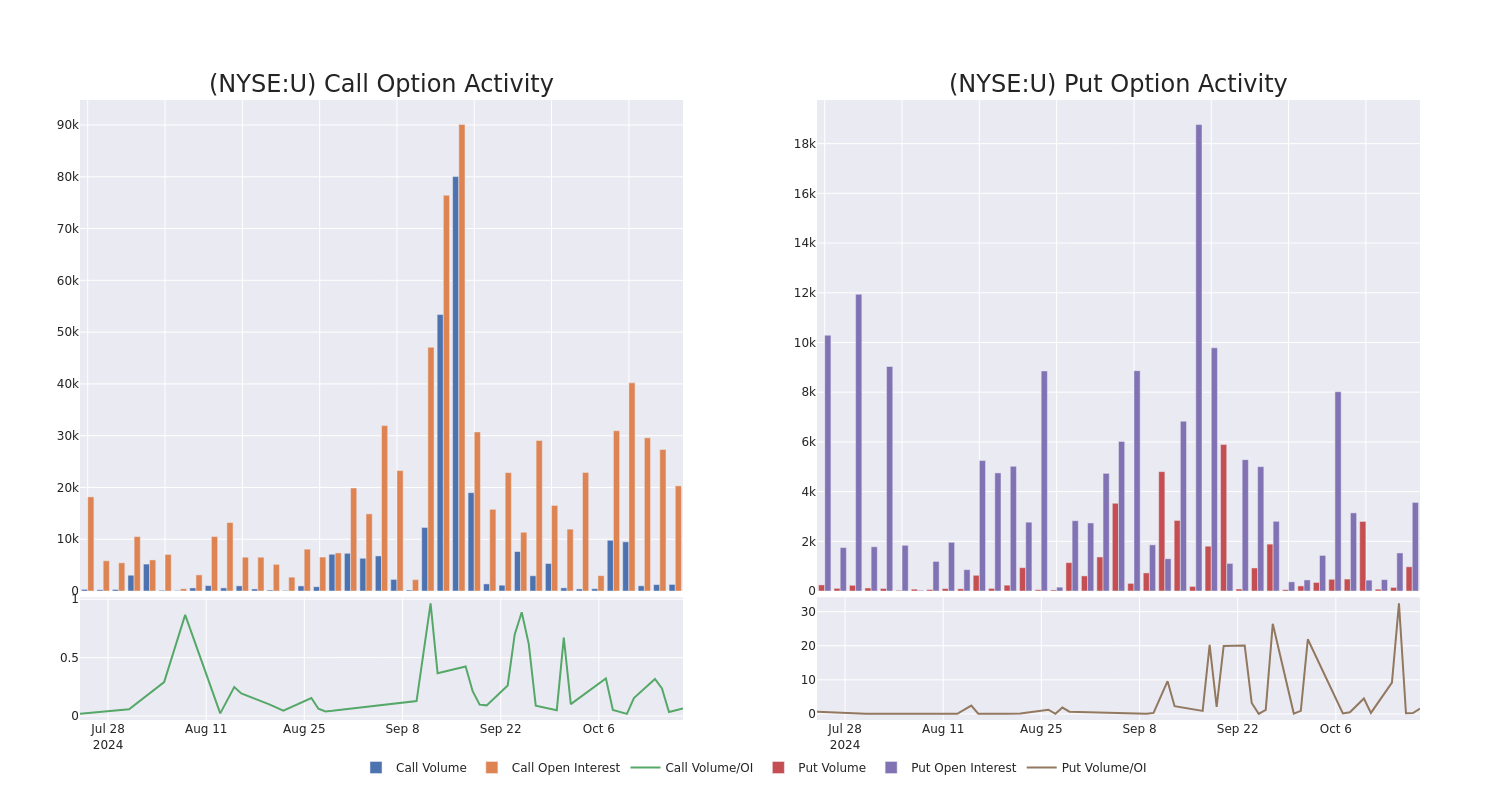

Scrutinizing trading volumes and Open Interest, the bigwigs seem fixated on a price range of $20.0 to $30.0 for Unity Software over the past three months. This targeted band hints at a strategic play unfolding.

Engagement Metrics Unveiled

Examining volume and open interest is a critical maneuver in options trading, unraveling a panorama of liquidity and investor enthusiasm towards Unity Software’s options at specific strike prices. The figures illustrate the ebb and flow of volume and open interest for calls and puts within the $20.0 to $30.0 strike price spectrum over the preceding 30 days.

A Peek into Significant Options Trades

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| U | PUT | SWEEP | BULLISH | 01/17/25 | $7.05 | $6.95 | $6.95 | $28.00 | $107.7K | 598 | 156 |

| U | PUT | SWEEP | BULLISH | 01/17/25 | $8.85 | $8.75 | $8.75 | $30.00 | $64.7K | 400 | 76 |

| U | PUT | SWEEP | BULLISH | 01/17/25 | $8.85 | $8.75 | $8.75 | $30.00 | $63.0K | 400 | 80 |

| U | CALL | SWEEP | BEARISH | 05/16/25 | $4.35 | $4.2 | $4.2 | $22.00 | $48.7K | 266 | 235 |

| U | CALL | TRADE | BEARISH | 10/18/24 | $2.13 | $1.9 | $1.9 | $20.00 | $47.5K | 12.4K | 352 |

Unveiling Unity Software’s Identity

Unity Software Inc offers a dynamic software platform for creating and managing interactive, real-time 3D content. The platform caters to a diverse array of devices, from mobile phones to virtual reality systems. With a footprint across regions like the United States, Greater China, EMEA, APAC, and Other Americas, Unity Software revolves around the gaming, architecture, animation, and design sectors.

Transitioning from the chessboard of options trading, let’s delve into the current standing of Unity Software.

A Glimpse into Unity Software’s Market Performance

- Trading at a volume of 4,509,151, the stock price of U has seen a 3.53% uptick, reaching $22.02.

- RSI indicators are hinting at a potential overbought scenario for the stock.

- The next earnings call is slated for 20 days from now.

Insights from Financial Analysts

In the last month, 1 expert has weighed in on Unity Software, setting an average target price of $20.0 for the stock.

While the volatility of options trading offers a higher profit potential, it comes with its own set of risks. Seasoned traders navigate this treacherous terrain by staying informed, leveraging multiple indicators, and closely monitoring market trends.

For those eager to stay updated on the latest options plays for Unity Software, platforms like Benzinga Pro furnish real-time alerts on trading activities.

Market News and Data courtesy of Benzinga APIs