Amidst the choppy waters of the stock market, lurk a few diamonds in the rough – stocks that may just be the lifeboat your portfolio needs as waves of volatility crash around. In the consumer staples sector, oversold stocks are emerging as unsung heroes, offering a ray of hope to savvy investors looking to snatch up undervalued gems.

One key metric shining a beacon on potential opportunities is the Relative Strength Index (RSI). By comparing a stock’s strength on up days versus down days, the RSI acts as a crystal ball, hinting at possible short-term performance. Typically, when the RSI dips below 30, alarm bells start ringing for the oversold territory – a signal not to be ignored.

Let’s dive into the current top contenders in the oversold arena within the consumer staples sector and unearth the potential hidden treasures.

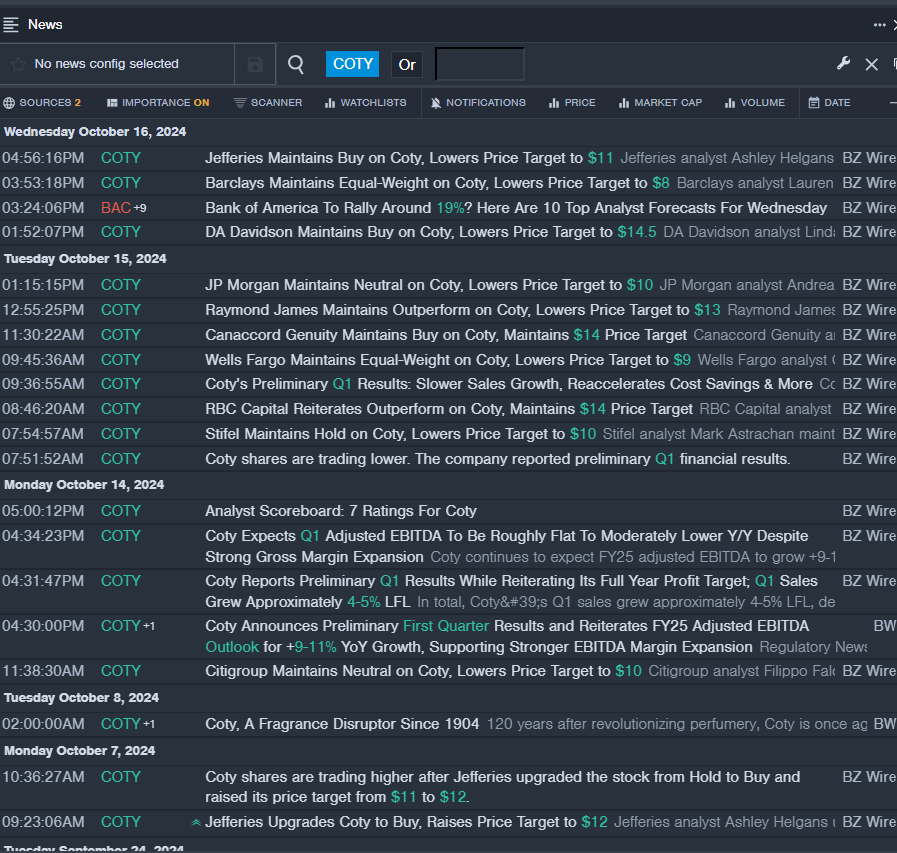

Coty Inc COTY

- Recently, Coty Inc made waves with its preliminary first-quarter results and a reiterated outlook for adjusted EBITDA growth in FY25. The stock took a hit, plummeting approximately 11% over the past five days and flirting with its 52-week low of $7.95.

- RSI Value: 29.19

- COTY Price Action: Despite the storm, Coty shares closed at $7.99 on a recent trading day.

22nd Century Group Inc XXII

- In a recent turn of events, 22nd Century Group Inc’s chairman and CEO, Lawrence Firestone, took a bold step, snatching up 39,000 shares at a bargain price – a move disclosed in an SEC filing. However, the stock tumbled a striking 43% over the past five days, hovering near its 52-week low of $0.10.

- RSI Value: 22.29

- XXII Price Action: Despite the purchase, XXII shares closed at $0.11, signaling choppy waters in the market.

Mangoceuticals MGRX

- Mangoceuticals recently made waves with a 1-for-15 reverse stock split. However, the excitement was followed by a 21% slide in its stock price over the past five days, flirting with its 52-week low of $2.14.

- RSI Value: 29.63

- MGRX Price Action: Despite the turbulence, Mangoceuticals shares closed at $2.47, showcasing the resilience of the company amidst market chaos.

As these companies weather the storm and teeter on the edge of oversold territory, astute investors may find solace in the potential opportunities that lie beneath the surface. In a market rife with uncertainty, these risk-off stocks may just be the silver lining in a cloudy sky, offering a glimmer of hope to those willing to take the plunge.