Challenges and Triumphs of Tesla’s Full Self-Driving

Despite the mixed success of Tesla’s Full Self-Driving feature, hailed as a significant leap forward in the automotive sector, a recent incident involving a pedestrian fatality has caught the attention of the National Highway Traffic Safety Administration (NHTSA). The NHTSA’s scrutiny has raised questions about the feature’s efficacy in various weather conditions, particularly in fog or glaring sunshine.

While Tesla has rebranded the technology as Full Self-Driving (Supervised), detractors argue that no vehicle operates optimally in reduced visibility. The government’s response remains uncertain, leaving Tesla investors in a state of limbo.

Fulfilment and Fallout in Tesla’s Cybertruck Line

Following the sell-out of Tesla’s entire backlog of Cybertruck orders, customers can now purchase without reservations. However, this achievement unveils a new challenge – the demand has finally met supply, indicating a potential surplus. Surprisingly, despite a staggering two million reservations, only about 30,000 Cybertrucks have been sold, showcasing a relatively low conversion rate.

On the other hand, uncertainty looms over the Robotaxi project, with investors showing signs of skepticism amidst the wavering confidence in Tesla’s Full Self-Driving capabilities. The company’s stock faces scrutiny over its premium valuation in light of emerging doubts.

Analyst Consensus and Price Prospects

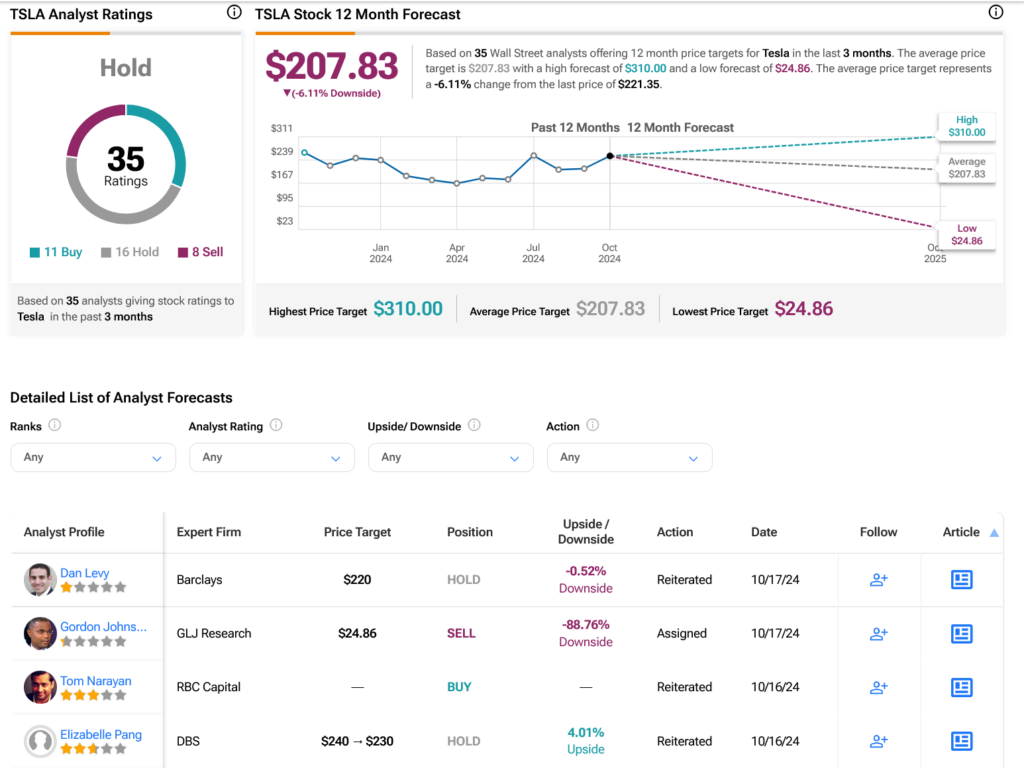

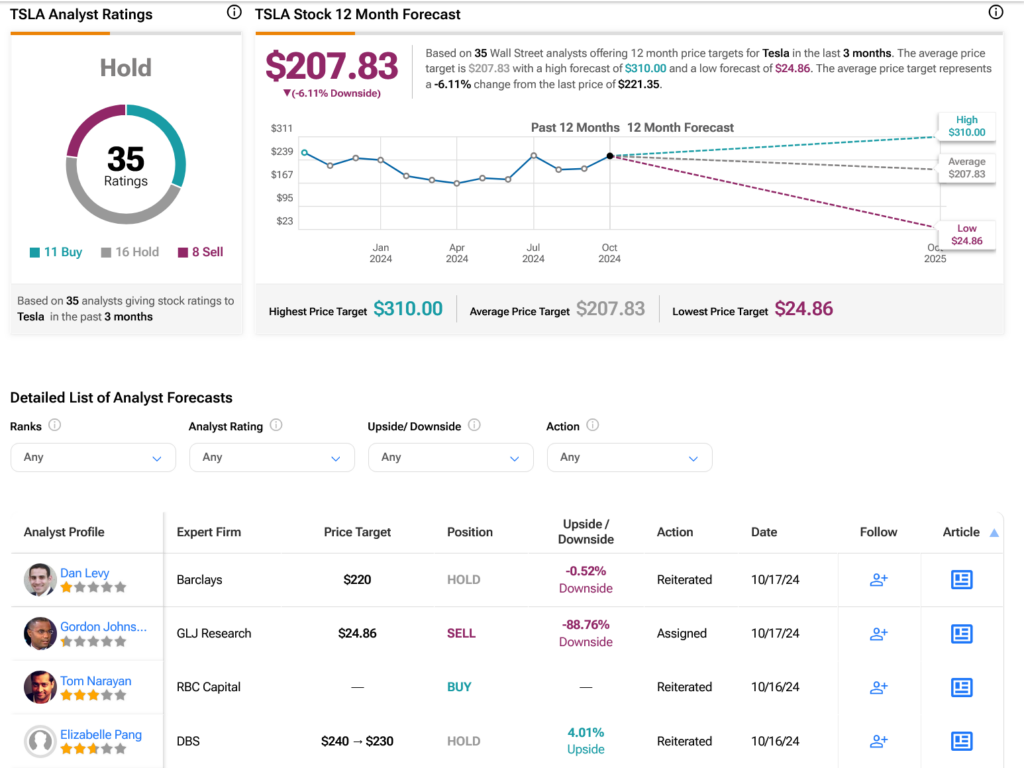

Wall Street analysts offer a mixed assessment of TSLA stock, with a Hold consensus stemming from a combination of 11 Buy ratings, 16 Holds, and eight Sells within the last three months. Despite a modest 0.28% price increase over the past year, the average price target of $207.83 per share suggests a potential downside of 6.11%, leaving investors to contemplate the future trajectory of Tesla’s shares.

Explore additional TSLA analyst ratings