Netflix (NASDAQ: NFLX) has been a soaring behemoth, defying gravity with its stock price rocketing over 1,100% in the past decade. The streaming giant’s upward trajectory remains steadfast in the current year, with a staggering 50% surge in its share value, fueled by robust quarterly performance.

The dominance of Netflix in the streaming landscape persists, marked by a substantial surge in paid memberships during Q3. The company’s optimistic outlook for the upcoming year underscores its unwavering momentum.

Continued Membership Growth

Netflix continues its impressive march with a 14.4% year-over-year surge in paid memberships, reaching a robust 282.72 million members. The ascension of ad-supported subscriptions sees a remarkable 35% sequential uptick, building upon a consistent trend of formidable double-digit growth in paid memberships.

| Metric | Q3 2023 | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 |

|---|---|---|---|---|---|

| Membership growth | 10.8% | 12.8% | 16% | 16.5% | 14.4% |

| Paid members |

247.15 million |

260.28 million |

269.6 million |

277.65 million |

282.72 million |

Data source: Netflix earnings reports.

The membership surge contributes to a 15% revenue hike to $9.8 billion, surpassing the company’s initial revenue projection of $9.7 billion.

Revenue in the U.S. and Canada escalated by 16%, supported by a 10% upturn in paid members and a 5% rise in average revenue per member (ARM). Asia witnessed a leading 19% revenue advance, with European and Latin American sales also notching respectable growth figures of 16% and 9%, respectively.

Earnings per share (EPS) exhibited a robust 45% upswing from $3.73 to $5.40, outpacing Netflix’s former 3-month forecast of $5.10. The expanding realm of ad-supported memberships, constituting approximately 50% of sign-ups in eligible regions, underscores the increasing significance of this tier in Netflix’s revenue stream. The company nears critical mass in advertiser-supported countries, paving the way for further expansion and monetization. Nevertheless, the mounting pace of ad-based services outpaces Netflix’s ability to monetize its burgeoning ad inventory, applying downward pressure on ARM.

Netflix recently implemented price hikes in several markets, signifying a strategic move to enhance profitability. Additionally, the company ceased its basic plan in select regions and hinted at potential pricing adjustments in the U.S. in the future, a strategic shift that hints at an evolving revenue model.

Earnings per share (EPS) climbed 45% from $3.73 a year ago to $5.40. That was well ahead of the $5.10 Netflix had forecast three months earlier.

The company reported that half of the sign-ups in ad-supported countries subscribed to this tier, demonstrating the escalating impact of this model on its financial performance. Nevertheless, Netflix highlighted a challenging landscape where the pace of adding new subscribers outstrips their ability to effectively monetize this user segment’s engagement.

Netflix foresees Q4 revenue expanding nearly 14% year over year to $9.7 billion, with an anticipated EPS around $5.10. Comprehensive guidance for the upcoming year was also disclosed.

In 2025, Netflix anticipates revenue growth in the 11% to 13% range, reaching between $43 billion to $44 billion. The company expects a slight uptick in operating margins to around 28% from the 27% level in 2024.

Image source: Getty Images.

Assessing Investment Opportunity in Netflix

In an era marked by the 2023 Hollywood strikes impacting content production, Netflix managed to sustain membership growth throughout the year. The forthcoming year holds promise with anticipated releases of popular shows like Wednesday, Squid Games, and Stranger Things, propelling content-driven growth.

Netflix’s foray into live events is gaining momentum, evident from upcoming showcases like NFL games and the Mike Tyson-Jake Paul fight. Notably, the commencement of broadcasting WWE’s Monday Night Raw weekly in 2025 signifies a substantial leap in its advertising avenue, poised to be a future cornerstone for revenue expansion.

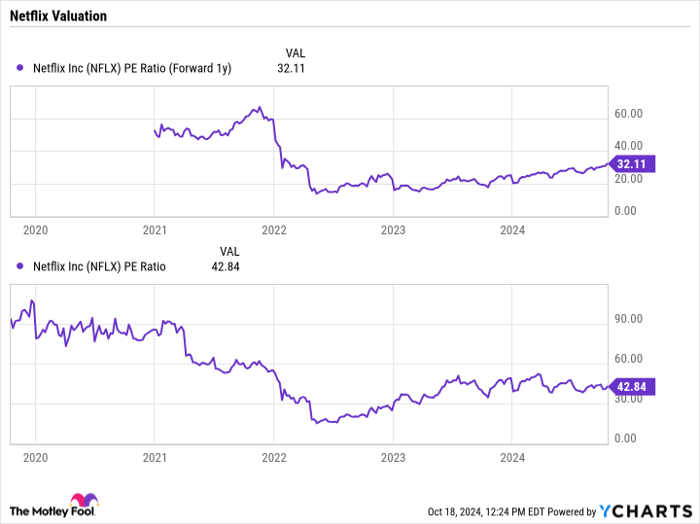

Trading at a forward price-to-earnings (P/E) ratio of 32 times based on 2025 analyst estimates, Netflix retains a favorable valuation, significantly below its historical P/E levels exceeding 40 times. The stock’s valuation, though ascending, remains within reasonable bounds, offering potential for continued growth.

NFLX PE Ratio (Forward 1y) data by YCharts

Netflix bears a plethora of growth opportunities ahead. Membership expansion, coupled with a robust content pipeline and live event offerings, positions the company for sustained growth. With an evolving revenue model and a future focus on advertising, Netflix’s future continues to shine brightly.

Given the promising outlook and the company’s strategic maneuvers, investing in Netflix remains an enticing prospect, with the promise of continued growth on the horizon.

Seizing an Opportunity for Potential Gains

Have you ever regretted missing the boat on lucrative stock investments? If so, buckle up for this.

Periodically, our cadre of experts issues a “Double Down” stock recommendation, identifying companies primed for significant growth. Seize the moment before it slips away – here’s a snapshot of the potential gains:

- Amazon: A $1,000 investment in our 2010 “Double Down” recommendation would yield $21,285!*

- Apple: Investing $1,000 on our 2008 “Double Down” call would amass $44,456!*

- Netflix: Envision investing $1,000 in our 2004 “Double Down” pick – you’d be sitting on a hefty $411,959!*

Act now to seize the opportunity with our current “Double Down” alerts on three promising companies, unlocking potential gains that may not come knocking again soon.

*Stock Advisor returns as of October 21, 2024