We’ve all been cautioned not to judge a book by its cover, and the same wisdom applies to evaluating stocks.

Enter Micron (MU), a semiconductor powerhouse known for its prowess in memory chip design. At first glance, MU may appear overvalued, sporting a seemingly hefty price-to-earnings ratio of 161x based on trailing twelve-month earnings of $0.67 per share. However, a deeper analysis reveals a different narrative when future guidance and forward consensus estimates come into play, shedding a more favorable light on the company’s true worth.

If you want a comprehensive look at Micron’s potential, check out the insightful analysis by Michael Byrne over at Tipranks on MU stock.

Let’s now delve into three key aspects that paint a clearer picture of MU’s valuation from a broader perspective.

- The Vision Ahead: While Micron’s current trailing P/E ratio may seem stretched, the market often focuses on the road ahead. With projected earnings of $1.74 per share for the next quarter and an impressive estimate of $8.93 per share for Fiscal 2025, the prospective P/E ratios of 11.8 and 8.2 respectively illustrate a more palatable valuation, hinting at significant upside potential for investors.

- Benchmarking Against Peers: Comparing MU’s anticipated valuations with industry peers like Nvidia (NVDA) and AMD (AMD) unveils a compelling story. While Nvidia and AMD trade at 46.3x earnings, boasting high gross margins and AI processor design acclaim, Micron’s specialty in memory chips, though less glamorous, aligns well with the future trajectory of AI integration where memory chips play a critical role in GPU processing power. This positions Micron favorably for growth opportunities as AI technology advances.

- Driving Technological Innovation: Micron’s high bandwidth memory chips cater to the evolving demands of cutting-edge GPUs crucial for intensive AI computations. As AI progresses, the need for enhanced RAM capabilities rises, playing to Micron’s strengths and paving the way for robust earnings growth in the foreseeable future.

Setting the Target: What Lies Ahead for MU?

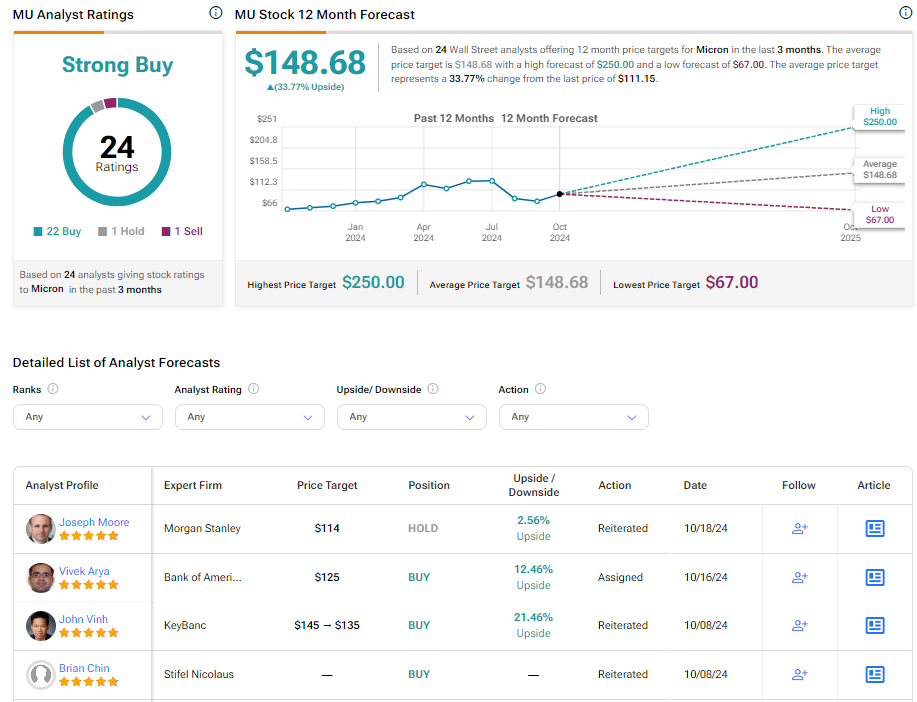

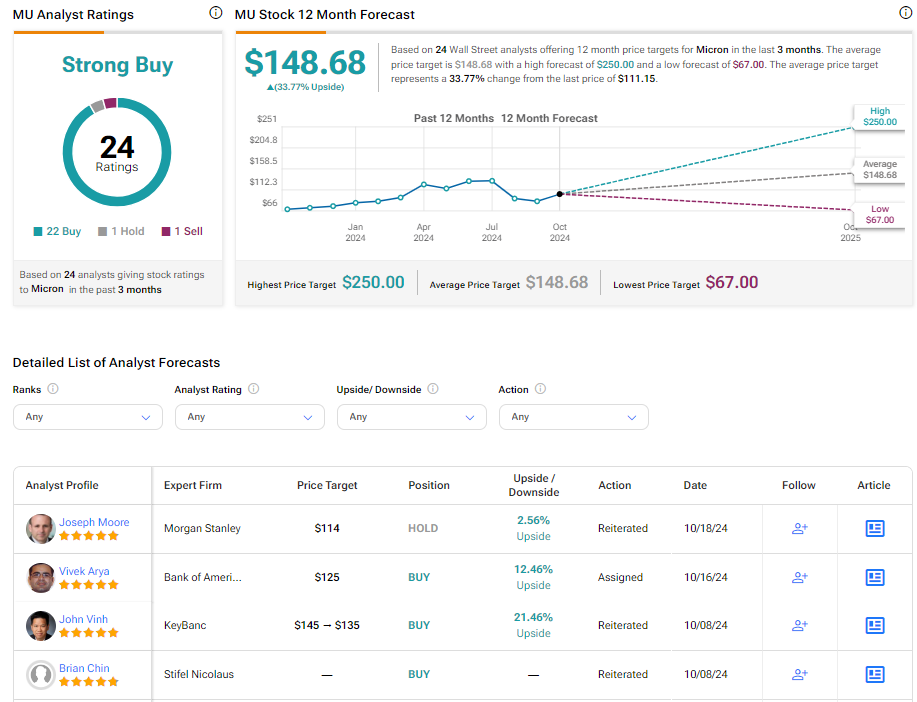

Wall Street labels Micron as a Strong Buy, with an analyst consensus of 22 Buys, 1 Hold, and 1 Sell. The average price target for MU stock stands at $148.68, indicating a promising 33.77% potential upside.

Find more insights on MU’s analyst ratings here.

In Conclusion

While Micron’s price tag may appear daunting on the surface, a deeper analysis of the company’s prospects reveals a compelling story and a potential entry point for investors. Positioned to ride the wave of the AI revolution, Micron’s specialization in RAM could prove invaluable as the demand for memory-intensive applications continues to surge.