The Road Traveled

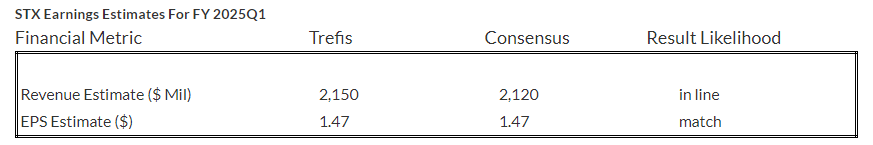

In June 2024, FY’24 came to a close, setting a historical backdrop for Seagate’s forthcoming first-quarter results. The company, specializing in data storage solutions, is poised to unveil its financial standing on October 22. As the curtains rise, investors are bracing for what lies on the horizon.

A Ripple in Still Waters: A Comparative Insight

The journey of Seagate’s stock throughout 2024 thus far has been nothing short of turbulent. Beginning at $85 and soaring to $112, the stock witnessed a 34% surge, overshadowing the S&P 500’s 22% increase. A similar narrative unfolded with its peer, Western Digital stock, which posted a 29% rise. Both companies basked in the resurgence of storage demand, riding the wave of the AI boom towards higher capacity drives and favorable pricing.

The Looming Horizon: Innovations and Shifts

Seagate’s directed focus on HAMR products offers a glimpse into an era of longevity beyond conventional disks. Championing hard disks boasting 30 TB with Heat Assisted Magnetic Recording technology, the company anticipates a surge in the demand for HAMR disks. Against the backdrop of the AI surge fueling an appetite for memory and storage, Seagate stands poised to reap the rewards with its mass-capacity drives catering to the escalating data needs of enterprises.

The Balancing Act: Margin Resurgence and Profitability

While Seagate experienced a dip in operating margin from 14% in FY 2021 to 1% in FY 2023, the tides turned as it rebounded to 6% in FY 2024. The future promises further profitability gains as the company steers towards an improved operating margin in the forecasted journey ahead.

The Stumbling Stones: Volatility and Investor Vigil

Investors have bestowed their patronage upon STX stock, cheering on the revival in storage sales and expanded profit margins. Yet, the roller-coaster returns portraying an 88% upswing in 2021 followed by a -51% downturn in 2022 and a 69% rebound in 2023 have left many gripping their seats. The contrasting saga of the HQ Portfolio, delivering stability in returns by outshining the S&P 500 each year, highlights the contrasting landscapes that investors navigate.

Crystallizing the Vision: Valuation Insights

Despite the tumultuous terrain, Seagate’s valuation emerges at $118 per share – a beacon of hope for investors signaling a 6% growth potential. This projection, rooted in a 16.9x price-to-earnings multiple and an adjusted earnings forecast for FY 2025, offers a compass amidst the market winds.

Peer-to-Peer: A Comparative Lens

An insightful journey into Seagate’s peers’ metrics unveils a comparative analysis that sheds light on industry dynamics. The interplay between organizations across varied landscapes adds depth to the narrative of Seagate’s trajectory.

Navigating Uncertainty: A Macrocosmic Lens

Amidst the looming specters of an uncertain macroeconomic climate riddled with rate cut whispers and global unquietudes, the market braces for the cloak-and-dagger dance of Seagate’s future. Will the tide favor Seagate’s sail, steering it towards a strong ascent, or will past shadows resurface, painting a picture of underperformance against the S&P yardstick?

| Returns | Oct 2024 MTD [1] |

2024 YTD [1] |

2017-24 Total [2] |

| STX Return | 2% | 34% | 317% |

| S&P 500 Return | 1% | 22% | 161% |

| Trefis Reinforced Value Portfolio | 3% | 18% | 789% |

[1] Returns as of 10/21/2024

[2] Cumulative total returns since the end of 2016

As investors brace for the unveiling of Seagate’s first-quarter results, the echoes of historical turbulence form a backdrop against which the company’s future endeavors will pave the way. Amidst the market’s unpredictable ebbs and flows, Seagate stands at the cusp of a new dawn, where innovation, demand dynamics, and investor sentiments paint a canvas of possibilities awaiting exploration.