Highlighted on the financial horizon are four consumer discretionary stocks that might be sending a cautionary blink to investors who prize the momentum metric.

Measuring momentum is like comparing a sprinter’s speed on the upward and downward slopes of a hilly terrain. This intricate dance can hint at a stock’s immediate future. An asset often triggers alarms when its Relative Strength Index (RSI) climbs above 70, says the wise folks at Benzinga Pro.

List of Prime Overbought Contenders

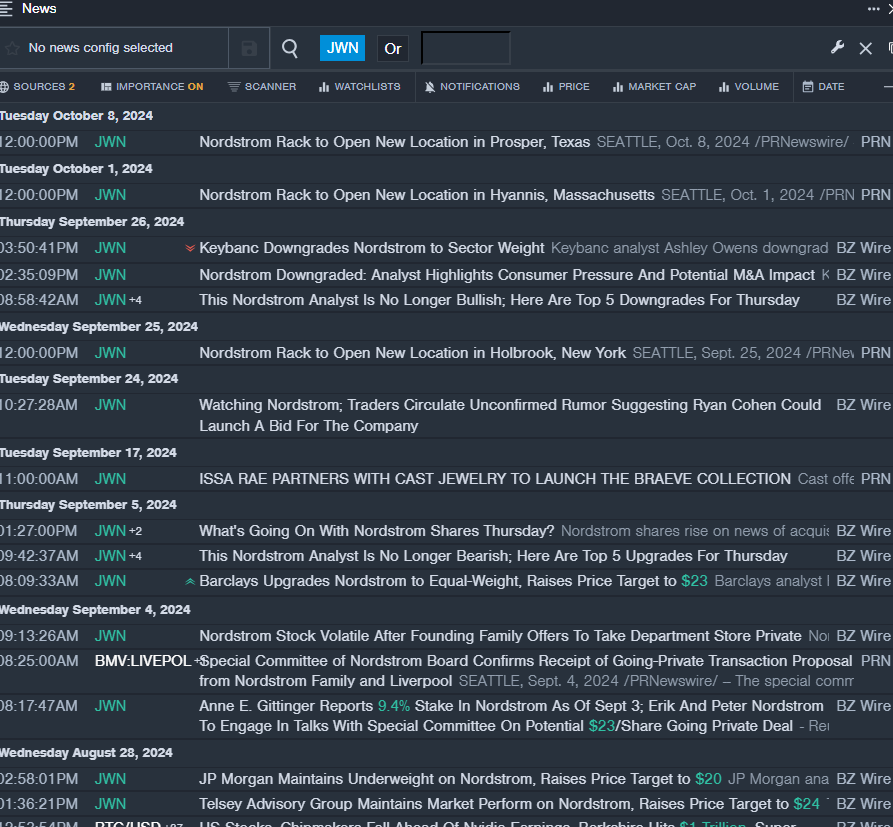

Reviewing Nordstrom Inc (JWN)

- Recently, on Sept. 26, Keybanc’s Ashley Owens downgraded Nordstrom from Overweight to Sector Weight. Nordstrom’s stock sprinted up 10% over five days, perched close to its 52-week pinnacle of $24.93.

- RSI Value: 76.29

- JWN Price Action: Nordstrom’s shares glided up 0.9% to $24.67 on Friday.

- Alert! Benzinga Pro’s grapevine carried the latest JWN whispers.

Inspecting Toll Brothers Inc (TOL)

- Recently, on Oct. 2, Oppenheimer’s Tyler Batory placed Toll Brothers on an Outperform pedestal and lifted the price target from $168 to $189. TOL stock roared 6% over five days, not far from its 52-week summit of $160.12.

- RSI Value: 72.41

- TOL Price Action: Toll Brothers’ stock edged up 1.9% to $159.58 on Friday.

- Heads up! Benzinga Pro’s binoculars spotted hints of potential trends in TOL’s journey.

Surveying Autoliv Inc (ALV)

- On Oct. 18, Autoliv unveiled a cheery third-quarter sales report, showcasing numbers that surpassed expectations. CEO Mikael Bratt detailed a story of resilience: “Despite a sluggish third-quarter vehicle production, Autoliv managed to defy gravity, virtually maintaining sales and profit levels unchanged, all while grappling with a $14 million supplier settlement.” ALV’s shares surged 6% in a week, lingering close to its 52-week peak of $129.38.

- RSI Value: 70.49

- ALV Price Action: Autoliv’s stocks leaped 6% to $99.52 as the week drew to a close.

- Tip-off! Benzinga Pro’s scent detected a potential breakthrough in ALV’s journey.

Observing McDonald’s Corp (MCD)

- Recently, on Oct. 16, TD Cowen’s Andrew Charles observed McDonald’s with a Hold rating and an uptick in the price target from $280 to $300. MCD shares enjoyed a 6% bounce over the previous month, not too distant from its 52-week altitude of $317.18.

- RSI Value: 82.85

- MCD Price Action: McDonald’s stocks perked up by 0.6% to $316.56 on the most recent Friday.

- Forecast using Benzinga Pro’s crystal ball to follow MCD’s forthcoming earnings festivities.

Investors, beware of potential turbulence in the shares of these prominent contenders.

Read More: