Cryptocurrency vs. Central Banks: A Battle of Value Perception

Neel Kashkari, a Federal Reserve Governor, raised eyebrows by proclaiming the Fed’s ability to produce an infinite amount of dollars, all while dismissing Bitcoin’s value. A case of irony so profound that it shattered the irony meter. Despite his claims, the U.S. dollar continues to depreciate in purchasing power due to relentless money printing. As central banks like the Fed dance on the brink of financial missteps, Bitcoin emerges as the 6th largest monetary asset globally, underscoring the inherent value of scarcity in digital assets. While traditional currencies spiral into devaluation, Bitcoin’s capped supply of 21 million coins stands resilient, providing a haven against the perils of incessant money creation.

Critics highlight the repercussions of reckless money creation by the Fed.

DKI Takeaway: While conventional currencies falter under the weight of inflation, Bitcoin, a decentralized asset immune to central bank manipulations, emerges as a sanctuary for investors seeking stability amid fiscal uncertainties.

The Power Play: Tech Titans Investing in Nuclear Energy

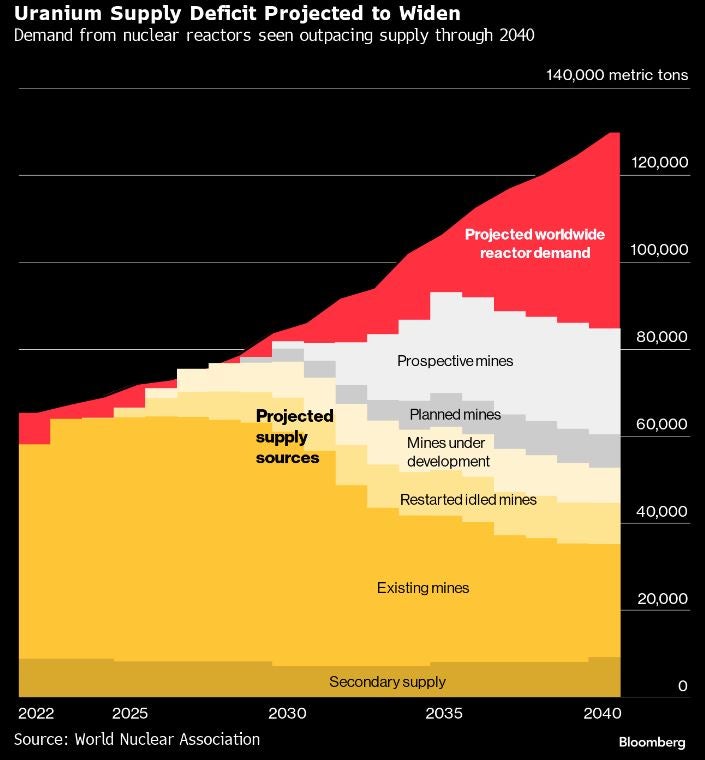

Following a burgeoning trend, Google joins Amazon and Microsoft in investing heavily in nuclear energy to fuel their AI data centers. Google’s partnership with Kairos, an energy company specializing in small modular reactors, underscores the tech giant’s commitment to sustainable and reliable power sources for its operational needs. The surge in artificial intelligence applications is propelling major tech firms to allocate substantial investments in secure energy infrastructure to bolster their innovative AI models. Additionally, the positive momentum extends to uranium markets, where a shortage in supply compared to escalating demand indicates a promising outlook for uranium prices.

DKI Takeaway: The growing reliance on nuclear power for AI development positions uranium as a favorable investment choice, with demand outpacing supply and fostering a bullish trajectory for uranium prices in the foreseeable future.

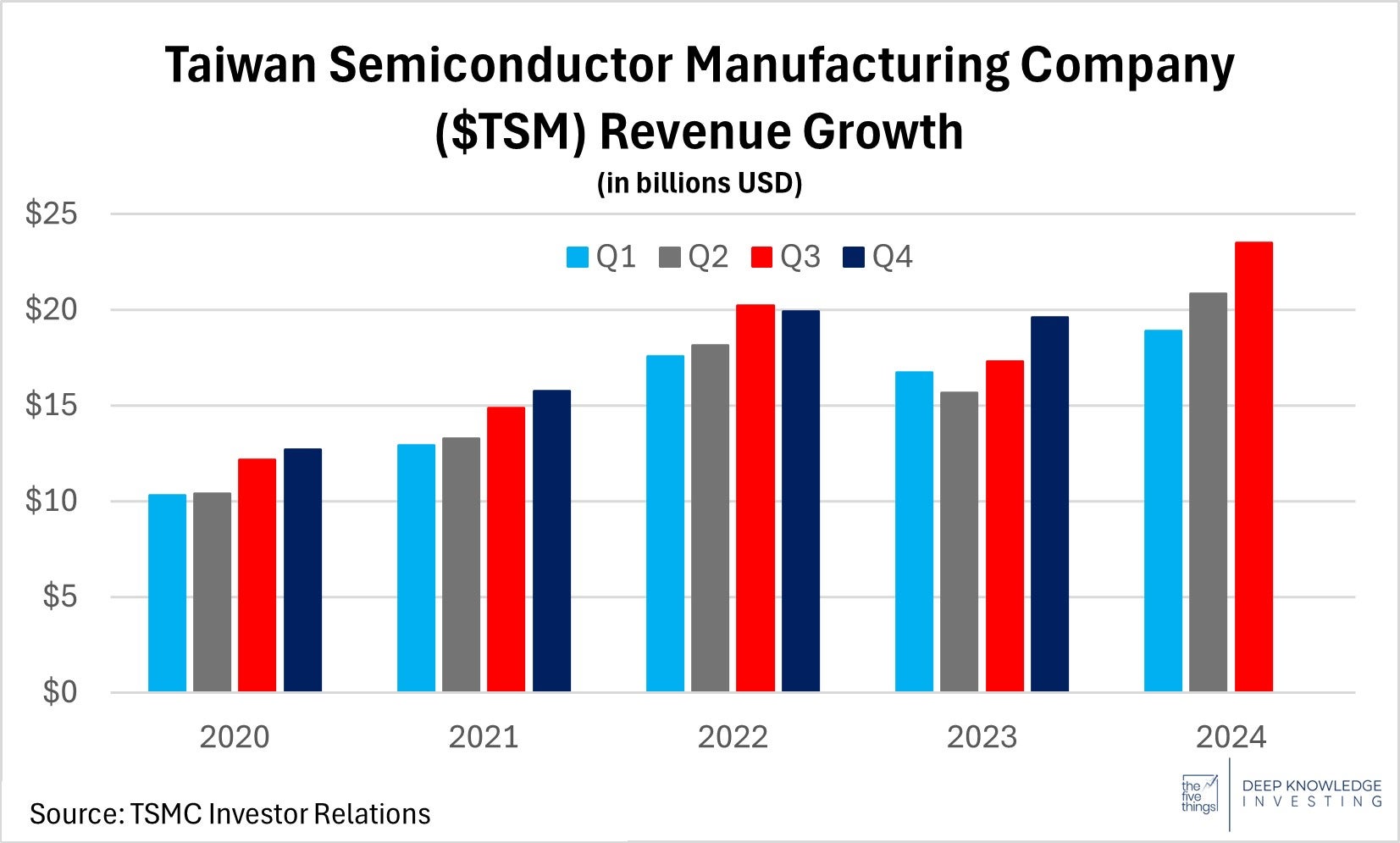

AI Ascendancy: Taiwan Semiconductor’s Revenue Surge

Taiwan Semiconductor Manufacturing Company (TSMC), a leading chip manufacturer, reports a robust revenue growth of 36% year-over-year, driven primarily by the escalating demand for AI chips. The market’s positive response to TSMC’s earnings mirrors the optimistic outlook for AI-oriented companies, including Nvidia, whose chips are manufactured by TSMC. With the AI sector witnessing substantial cash inflows and intensifying competition, established players like Google, Amazon, Apple, and Meta are poised to dominate the market landscape. The AI ecosystem is evolving rapidly, necessitating significant power generation capacity to sustain the industry’s expansion.

DKI Takeaway: The exponential growth in AI-focused entities presents lucrative investment prospects, with titans and startups alike vying for supremacy in a rapidly evolving technological landscape where power generation plays a pivotal role in sustaining innovation.

Reassessing Financial Landscapes

Unraveling ECB’s Double-Edged Sword

Christine Lagarde, President of the European Central Bank (ECB), recently made headlines by cutting rates by 25 basis points, bringing them down to 3.25%. However, in a surprising twist, Lagarde has also issued a solemn alert: “Inflation is on the rise in the near future.” This contradiction beckons a pivotal query: why decrease rates amidst an inflation surge? The reasoning is as crystal clear as a pristine diamond: the ECB finds itself drowning in debt. This maneuver doesn’t merely stem from an aftermath of decelerating growth; rather, it epitomizes an urgent distress signal that the central bank is ensnared by the unsustainable debt levels pervasive in the eurozone. The ECB’s once formidable arsenal is losing its edge. Caught in a quagmire, it faces two unenviable scenarios: either yield to mounting inflation or escalate interest expenses which, in turn, would only fuel inflation further. The suffocating weight of Europe’s debt quagmire is palpable, and the ECB’s maneuvers are starting to appear as a surreal blend of contradictions. The euro is being deliberately sacrificed, devalued in a futile endeavor to mitigate the escalating debt catastrophe. As the very credibility of the bank hangs precariously in the balance against a backdrop of surging inflation, the future of the euro teeters on increasingly fragile ground.

Deciphering the Enigma of Bitcoin

Seeking answers on the enigmatic terrain of investments, a University of Tennessee student recently posed a probing question: “What does investing in Bitcoin equate to? Is it akin to the dollar or more reminiscent of a tangible asset, such as gold?” This query strikes at the core of Bitcoin’s often misconstrued essence as being “worthless” sans any tangible security. In stark contrast to the dollar, Bitcoin embodies a finite supply, as illustrated in the graphic below. Bitcoin represents a novel technological paradigm. Millennia ago, during the inception of utilizing gold as a repository of value, apprehensions likely shadowed its adoption, akin to any nascent technology. To underscore how lightly esteemed gold was, at one juncture, the price of pepper per ounce surpassed it. The key divergence in Bitcoin lies in its inscription on the blockchain. Upon purchasing Bitcoin, your ownership tenure is enshrined within the blockchain’s code—an indelible registry that underpins your reservoir of value.

Striking Gold in Unconventional Assets

Bitcoin emerges as a bulwark of value similar to gold by virtue of its restricted supply and an escalating demand trajectory. Yet, Bitcoin boasts a competitive edge over gold in its liquidity and ease of trading, rendering it a more accessible avenue compared to delving into physical gold ventures. An intrinsic element of owning Bitcoin revolves around self-custody, endowing you with absolute dominion over your investments in contrast to the sometimes tenuous stability of exchanges. Reflect on our informational thread on X for deeper insights into the self-custody blueprint. Amidst the milieu of a rapidly dwindling dollar value, assets the likes of gold and Bitcoin act as indispensable shields against impending inflation. It’s intriguing to posit a counter-question to proponents who dismiss Bitcoin’s intrinsic value: why harbor a sense of comfort regarding the dollar’s value? Its endorsement stems from “faith and credit”. To uphold the dollar, one must wholeheartedly trust that the solvency of an entity saddled with $36 trillion in debt remains unassailable. One need not embody the fervor of a Bitcoin advocate to seize a 1% position. Alternatively, one could stand witness as Neel Kashkari and the Federal Reserve orchestrate the debasement of your dollars into oblivion.