Before investors leap into the jaws of Wall Street recommendations, let’s dissect the alluring facade of Advanced Micro Devices (AMD) and the numeric prowess of brokerage opinions.

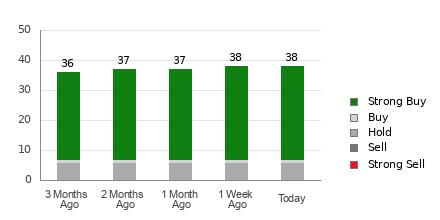

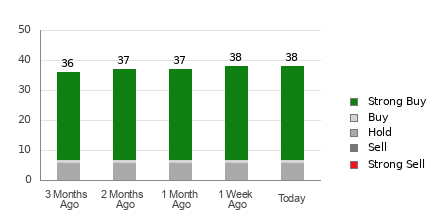

Crunching the numbers, Advanced Micro currently stands perched upon the average brokerage recommendation (ABR) of 1.34, nestled betwixt Strong Buy and Buy, ordained by the 38 brokerage stalwarts voicing their views. Among these, 31 bellow Strong Buy, while a single one calls to Buy, painting a picturesque landscape of optimism.

Charting The Waters of AMD’s Brokerage Recommendations

Yet, tether not your vessel solely to the siren song of brokerage to’s and fro’s. Studies whisper of brokerage biases favoring their covered stocks, casting a golden hue upon their analysis. For every bearish growl, five bullish roars echo from their quarters – a lighthouse that could lead astray rather than guide.

Enter the Zacks Rank, a ship hardened by the tempest of external audits, slicing through the storm of uncertainty with a sure compass. This tool, painting stocks in five hues from Strong Buy to Strong Sell, maps a chart more reliable in the art of fortunetelling.

Deciphering the Zacks Rank: A Glance Beyond the Veil

While ABR dances with brokerage whims, the Zacks Rank indulges in the feast of earnings revisions – a divergence unseen to the naked eye. Analysts, captivated by their own creations, paint rosier pictures than reality reveals, shrouding investors in a mist of innocence lost.

For the Zacks Rank, earnings march in lockstep with reality, whispering truths to those who listen. By aligning with the rhythm of earnings, this tool sows caution in the winds of change, a lighthouse abiding by the principles of empirical wisdom.

Unlike ABR, the Zacks Rank refreshes like the morning dew, attuned to the symphony of earnings trends. As analysts pen their revisions, the Zacks Rank quickens its pace, a timely prediction of the fortunes yet unseen.

Should You Venture into the Realm of AMD?

Casting a scrutinous gaze upon Advanced Micro, the Zacks Consensus Estimate whispers of caution, marking a 0% decline in the current year to $3.36. Analysts, united in their Symphony of Pessimism, chant in harmony towards a Zacks Rank #4 (Sell), a narrative painted with shadows of doubt.

Ergo, should you hearken to the Siren’s call of Buy per ABR, let it not be without a sprinkle of skepticism.

The Dawn of an Infrastructure Stock Boom

A grand crescendo heralds a renaissance in the American infrastructure, a bipartisan odyssey calling forth trillions in investment. As fortunes beckon, the clarion call resounds, echoing tales of wealth yet to be unearthed.

Amidst this epoch, the imperative lies in discerning the choicest stocks primed for glory early on, where growth knows no bounds.

Let Zacks be your compass on this voyage, unveiling 5 hidden gems poised to gleam amidst the rebuild.