SPDR Gold Trust’s Bearish Options Activity

A recent buzz emerged around the SPDR Gold Trust (GLD), a gold-tracking ETF, flagged for “bearish” options activity despite a 32% year-to-date market value increase. The purchase of 125 GLD call options at a $193 strike price, with a $73.60 premium, painted a wary picture with a $266.60 break-even threshold.

Professional investors seemed to be selling calls, assuming a capped growth trajectory for the gold fund contrary to prevailing bullish sentiments.

Potential Bearish Sentiment Amid Cooling Inflation Trends

Concerns over cooling inflation trends might be fueling the bearish outlook on gold. While inflation remains a worry for many, a shift towards disinflation could spell a downward trajectory for gold, historically buoyed by inflationary pressures.

Renowned economist Mohamed El-Erian emphasized the importance of gold for western nations, contrasting with the current bearish sentiment.

Leveraged Opportunities with Direxion ETFs

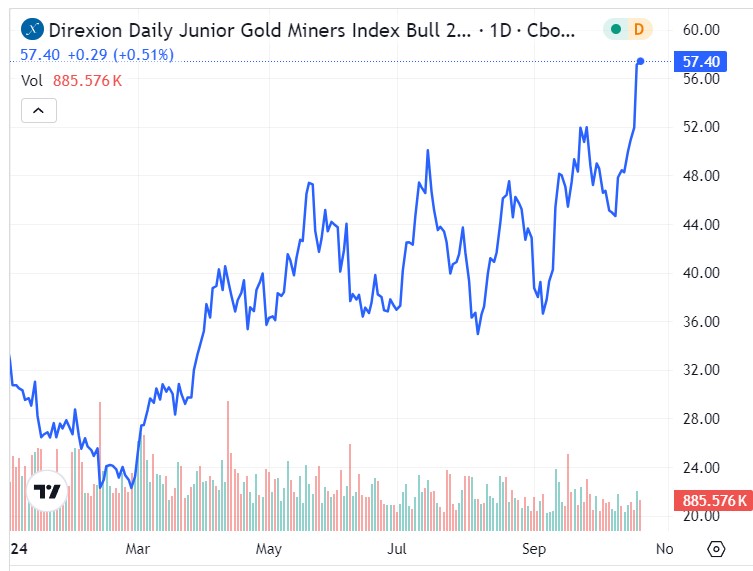

The Direxion Daily Junior Gold Miners Index Bull 2X Shares (JNUG) and Bear 2X Shares (JDST) offer leveraged exposure to the gold market, responding to shifts in sentiment.

While JNUG saw a robust 75% gain this year buoyed by strong gold sentiment, JDST struggled, losing over 62% in value amidst lingering inflation challenges post-COVID-19.

Short-Term Focus on Leveraged ETFs

Investors eyeing JNUG and JDST must note the short-term nature of these leveraged funds, optimized for daily exposure due to volatility compounding risks over longer periods.

JNUG’s uptrend, supported by its 200-day moving average, hints at continued strength in the gold market. In contrast, JDST faces resistance below its 200-day moving average, signaling persisting challenges.

Despite recent selling pressure on JDST, a decline in selling volume since August may indicate a potential reversal, offering a glimmer of hope for the bearish gold bear fund.