Target Corporation TGT, a prominent player in the retail sector, is currently trading at a forward 12-month price-to-earnings (P/E) multiple of 14.4X, which positions it at a discount compared to the Retail – Discount Store industry’s average of 29.36X. The stock is also trading below its median P/E level of 15.31, observed over the past year. This suggests that TGT stock is priced attractively relative to its peers and historical levels, positioning it as a potential bargain.

Assessing TGT Stock Valuation

Image Source: Zacks Investment Research

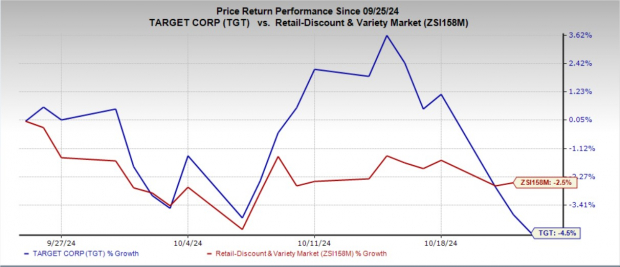

However, Target’s stock has experienced a 4.5% drop over the past month, which may have contributed to its discounted trading status. This decline could indicate broader challenges or specific issues affecting Target’s performance.

Examining TGT Stock Past Performance

Image Source: Zacks Investment Research

While Target’s lower P/E ratio signals potential value, a thorough analysis is essential for making an informed investment decision on whether to buy, hold or sell the stock. It is crucial to examine Target’s fundamental drivers and strategic initiatives. If the company can effectively navigate challenges and demonstrate a clear growth path, the current discounted valuation may present a compelling entry point for investors.

Target stock closed at $148.05 during yesterday’s trading session, sitting 18.6% below its 52-week high of $181.86, reached on April 1. With this in mind, let’s dive into TGT’s prospects and determine the best course of action for your portfolio.

Target’s Recipe for Retail Success

Target is capitalizing on its robust brand presence, wide range of product offerings, and expanding e-commerce capabilities to strengthen its market position and drive growth. With a focus on innovation and operational efficiency, TGT is laying the foundation for long-term success.

By integrating physical stores with a robust digital platform, Target enhances the shopping experience for customers, ensuring convenience and accessibility. The company’s emphasis on same-day delivery options, curbside pickup, and personalized online services has strengthened its competitive position against industry giants.

Target’s diverse assortment of owned and popular national brands makes it a one-stop shopping destination. The retailer has adapted to changing consumer preferences by expanding its assortment into various categories, demonstrating a proactive approach to meeting customer demands.

Amid the current economic conditions, Target’s pricing strategy has resonated with budget-conscious shoppers. The company’s proactive measures, including price reductions and loyalty programs, are expected to drive sales growth. Target’s commitment to operational excellence and margin expansion enhances its investment appeal.

With operating margins showing improvement, Target’s focus on enhancing customer experience and investing in technology positions the stock as a compelling option for investors seeking long-term growth.

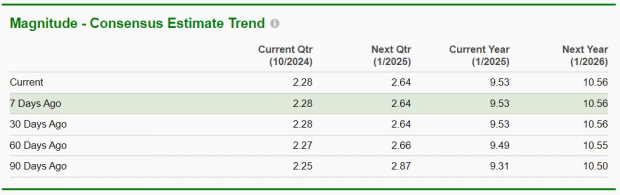

Analyzing Consensus Estimates for TGT Shares

Wall Street analysts have shown confidence in Target stock by raising their earnings per share estimates. Over the past 60 days, analysts have increased their estimates for the current and next fiscal year, suggesting year-over-year increases in earnings per share.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Image Source: Zacks Investment Research

Investment Outlook: Buy, Hold, or Sell TGT Stock?

Despite recent price fluctuations, Target’s growth strategy and customer engagement initiatives position the company for long-term success. Its ability to adapt to evolving consumer preferences, along with margin improvements, suggests potential for recovery.

With analysts increasingly bullish on earnings estimates, now could be an opportune moment for investors to consider TGT stock. Existing shareholders may opt to maintain their positions, while new investors could find the current valuation attractive for investment purposes. Target represents a compelling option for long-term investors.