CACI International Inc CACI reported better-than-expected first-quarter financial results and issued FY25 revenue guidance above estimates, after the closing bell on Wednesday.

CACI International reported quarterly earnings of $5.93 per share which beat the analyst consensus estimate of $5.07 per share. The company reported quarterly sales of $2.057 billion which beat the analyst consensus estimate of $1.921 billion.

“In the first quarter, CACI delivered exceptional financial results across the board with revenue growth of 11%, healthy profitability and cash flow, and strong awards and backlog. In addition, we demonstrated our flexible and opportunistic approach to capital deployment by announcing two strategic acquisitions, Azure Summit Technology and Applied Insight,” said John Mengucci, CACI President and Chief Executive Officer. “Our continued momentum allows us to raise our fiscal year 2025 guidance. CACI is well positioned to continue driving long-term value for our customers and our shareholders.”

CACI International shares fell 0.7% to trade at $548.67 on Friday.

These analysts made changes to their price targets on Tyler Technologies following earnings announcement.

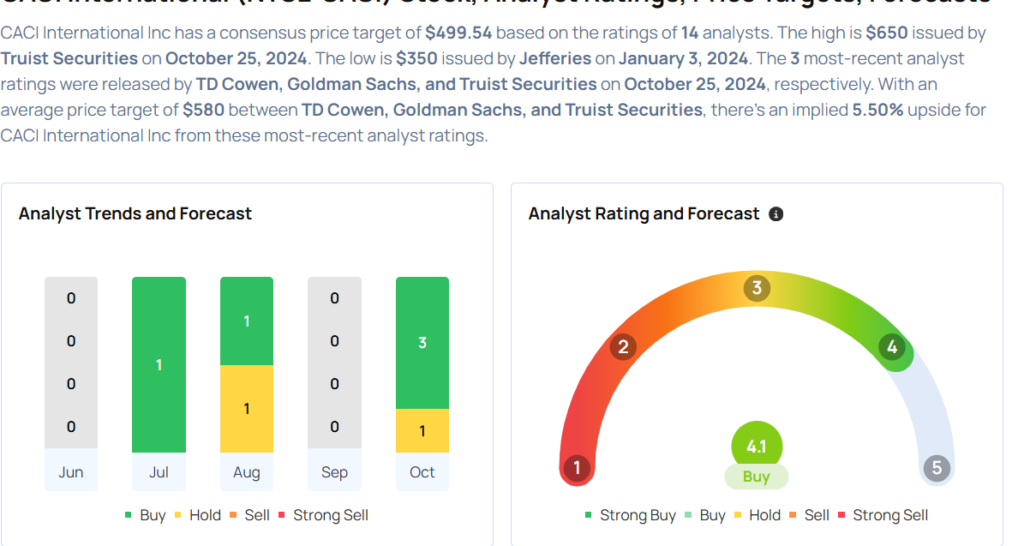

- Baird analyst Peter Arment maintained CACI International with an Outperform and raised the price target from $533 to $640.

- Truist Securities analyst Tobey Sommer reiterated CACI International with a Buy and raised the price target from $520 to $650.

- Goldman Sachs analyst Gavin Parsons maintained CACI International with a Neutral and raised the price target from $471 to $520.

- TD Cowen analyst Cai von Rumohr maintained the stock with a Buy and boosted the price target from $545 to $570.

Considering buying CACI stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs