Zacks Thematic Screens lets you dive into 30 dynamic investment themes shaping the future. Whether you’re interested in cutting-edge technology, renewable energy, or healthcare innovations, our themes help you invest in ideas that matter to you.

For those interested in viewing the Thematic lists, please click here >>> Thematic Screens – Zacks Investment Research.

Let’s take a closer look at the ‘Cloud Computing’ theme and analyze a few stocks within.

Cloud Computing Overview

Cloud computing refers to the on-demand seamless access of computing resources such as servers, storage, databases, networking, software, analytics, and intelligence over the Internet (the cloud) on a pay-per-use pricing model.

It marks a paradigm shift from traditional on-premises infrastructure storage to remote cloud-based storage facilities and relies heavily on virtualization and automation technologies. Instead of buying, owning, and maintaining physical data centers and servers, organizations access a virtual pool of shared resources from a cloud service provider on an as-needed basis.

This lowers operating costs, increases productivity with greater agility and flexibility, and improves scalability with higher economies of scale. Please click here for a direct link to the Cloud Computing thematic list – Cloud Computing.

Let’s take a closer look at a stock that the screen returned.

Amazon to Report Quarterly Results

Amazon AMZN shares reflect an excellent opportunity for investors to obtain exposure to cloud computing thanks to Amazon Web Services (AWS). AWS is the dominant player in the cloud computing market, flexing a significant market share globally. It provides various services, including computing power, storage, databases, and AI/ML tools.

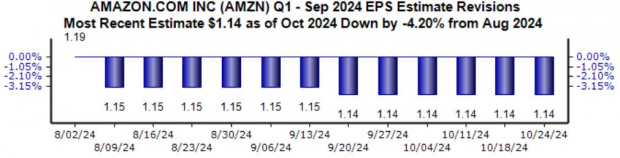

The company is on the reporting docket for this week, with its results expected after the market’s close on Thursday. Earnings expectations for the quarter to be reported have been slightly bearish, with the $1.14 Zacks Consensus EPS estimate down 4% since the beginning of August.

Still, big growth is forecasted, with the estimate suggesting 34% EPS growth year-over-year.

Image Source: Zacks Investment Research

As shown below, AWS results have exceeded our consensus expectations in four of its last six releases. For the quarter to be reported, the Zacks Consensus estimate for AWS revenue stands at $27.6 billion, nearly 20% higher than the year-ago period.

The YoY growth rate here in AWS is quite significant, with AWS now showing a reacceleration. Several periods of slowing growth raised concerns, but the AI frenzy has seemingly helped push those concerns to the side.

Image Source: Zacks Investment Research

The valuation picture here isn’t stretched, with the current 33.3X forward 12-month earnings multiple a fraction of the 60.3X five-year median and five-year highs of 123.4X. And the current PEG ratio works out to 1.2X, again well beneath historical averages.

Image Source: Zacks Investment Research

It’s reasonable to expect extensive commentary surrounding AWS results given the current AI frenzy, which will likely dictate the post-earnings move. It’s worth noting that shares have primarily consolidated over the last three months, perhaps setting up a strong post-earnings move if results please investors.

Bottom Line

Thematic investing has emerged as a powerful way for investors to sync their portfolios with emerging trends. A mix of long-term and short-term themes is increasingly dictating which companies lead as economies expand and markets shift.

And upon running the Zacks Cloud Computing Thematic screen, Amazon AMZN was returned, who also reports quarterly results this week after the market’s close on Thursday.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report