Natural gas supplier Clean Energy Fuels Corp. CLNE is slated to release third-quarter 2024 results on Nov. 6, after market close. The Zacks Consensus Estimate for the to-be-reported quarter is pegged at a loss of 2 cents on revenues of $105.2 million.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

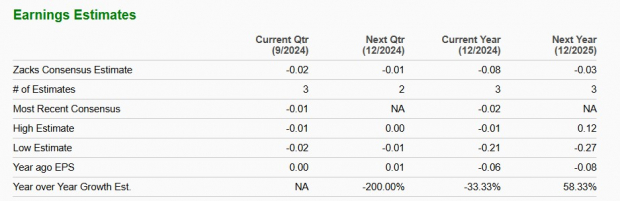

The earnings estimates for the to-be-reported quarter have remained unchanged over the past 30 days. The bottom-line projection indicates a decline from break-even earnings achieved in the year-ago period. The Zacks Consensus Estimate for quarterly revenues, however, suggests a year-over-year increase of 10.1%.

For the current year, the Zacks Consensus Estimate for CVX’s revenues is pegged at $414.5 million, implying a drop of 2.5% year over year. The consensus mark for 2024 EPS is pegged at a loss of 8 cents, indicating a contraction of around 33.3%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

In the trailing four quarters, the Newport Beach, CA-based leading renewable energy company surpassed EPS estimates thrice and missed in the other, which resulted in an average earnings surprise of 60.4%. This is reflected in the chart below.

Clean Energy Fuels Corp. Price and EPS Surprise

Clean Energy Fuels Corp. price-eps-surprise | Clean Energy Fuels Corp. Quote

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Clean Energy this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Clean Energy has an Earnings ESP of 0.00%. This is because the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at a loss of 2 cents per share each.

Zacks Rank: CLNE currently carries a Zacks Rank #3, which increases the predictive power of ESP. However, the company’s 0.00% ESP makes surprise prediction difficult this earnings season.

You can see the complete list of today’s Zacks #1 Rank stocks here.

What’s Shaping Q3 Results?

Clean Energy’s third-quarter results are likely to have been buoyed by higher renewable natural gas (“RNG”) sales volume. As a matter of fact, for the to-be-reported quarter, the Zacks Consensus Estimate for CLNE’s total RNG volume is pegged at 60 million gallons, indicating a rise from the prior-year quarter’s figure of 56.7 million gallons. The anticipated rise in fuel volumes, despite a decline in natural gas prices, is likely to have aided the company’s revenues.

CLNE’s second-quarter results show signs of improvement. Despite a net loss, the company posted a positive non-GAAP EPS and an adjusted EBITDA of $18.9 million, up from $12.1 million in the previous quarter. This financial turnaround is supported by solid operating cash flow, which reached $21.4 million for the first half of 2024, compared to a negative cash flow during the same period last year. We expect further progress in the third quarter.

However, Clean Energy is expected to have suffered from higher costs during the quarter. In the second quarter of 2024, the company’s total operating expenses of $134.3 million rose 15% from a year ago. This trend is most likely to have continued in the July-September period of 2024.

Price Performance & Valuation

In the past six months, Clean Energy has outperformed the industry and the S&P 500.

CLNE 6-Month Stock Performance

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

From a valuation standpoint, CLNE appears unattractive. Based on EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization), Clean Energy is not as compelling compared to similar companies in the renewable energy space, especially with its market cap being historically low at $650 million compared to the previous highs of $3.5 billion. The stock also has a poor Value Score of D despite its low share price.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Assessing Clean Energy’s Prospects: Hold the Stock

As CLNE increases its ownership of RNG production facilities through joint ventures with BP plc BP and TotalEnergies TTE, the company is well-positioned to capitalize on projected growth in renewable fuel demand. Collaborations with major customers like Amazon AMZN and partnerships with firms like Tourmaline to develop fueling stations in Canada further solidify Clean Energy’s market position. However, valuation risk presents a concern for prospective investors.

Image Source: Clean Energy Fuels Corp.

Image Source: Clean Energy Fuels Corp.

CLNE’s dependence on third-party RNG supply remains a challenge. Despite strategic partnerships, proprietary production is set to make up less than 10% of its total RNG sales, limiting potential margin improvements and exposing the company to price volatility and supply risks.

In summary, Clean Energy might appeal to investors seeking a high-risk, high-reward opportunity, while those with lower risk tolerance may want to hold off. As clean energy stocks gain favor amid a growing emphasis on environmental sustainability, CLNE’s stock could see potential upside.

As the third-quarter earnings approach, investors might want to focus on Clean Energy’s revenue growth, sales volumes, and the overall financial performance before deciding to Buy or Sell this penny stock.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

BP p.l.c. (BP) : Free Stock Analysis Report

Clean Energy Fuels Corp. (CLNE) : Free Stock Analysis Report

TotalEnergies SE Sponsored ADR (TTE) : Free Stock Analysis Report