The most oversold stocks in the communication services sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

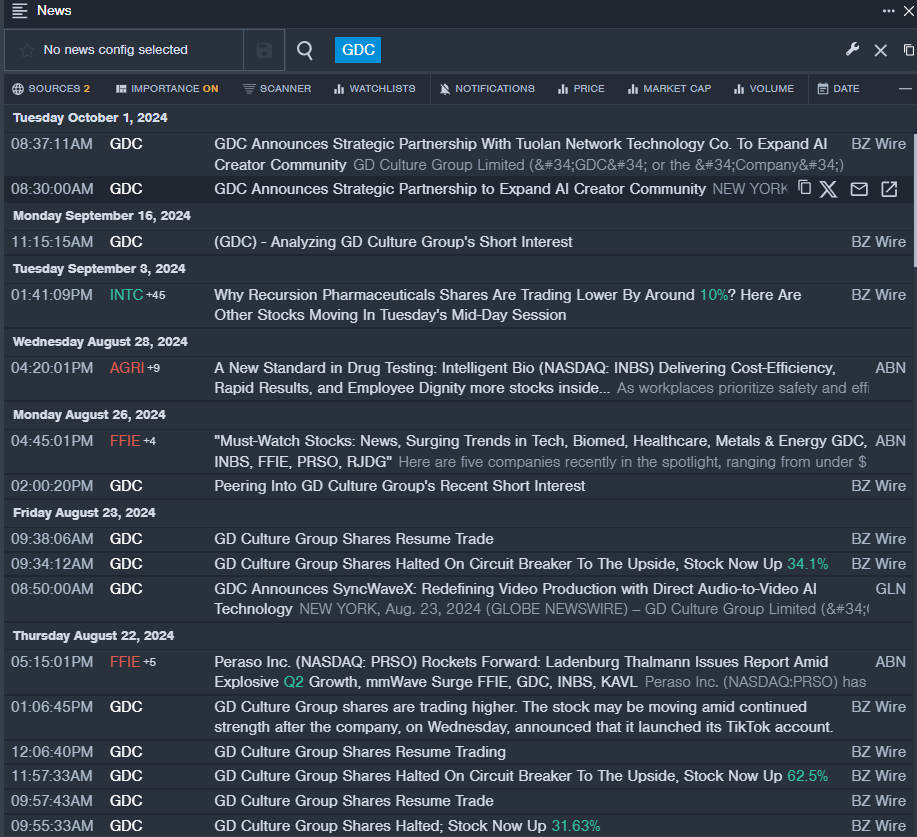

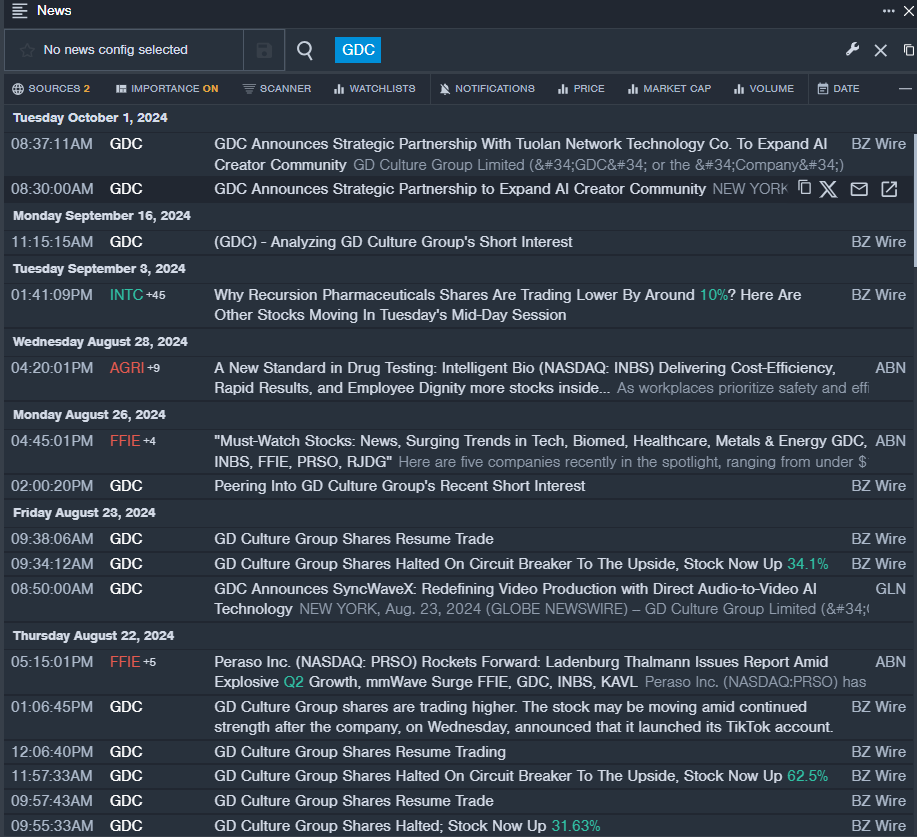

GD Culture Group Ltd GDC

- On Oct. 1, GDC announced a strategic partnership with Tuolan Network Technology Co. to expand AI creator community. “Our AI Creator Community is dedicated to engage and support creators worldwide.” said Mr. Xiaojian Wang, Chairman and Chief Executive Officer of the Company. “This partnership represents a significant opportunity to enhance the capabilities of creators. By combining our resources, we aim to provide creators with valuable opportunities to showcase their talents and expand their knowledge through targeted educational programs.” The company’s stock fell around 54% over the past month and has a 52-week low of $0.59.

- RSI Value: 25.40

- GDC Price Action: Shares of GD Culture fell 1.7% to close at $1.70 on Monday.

- Benzinga Pro’s real-time newsfeed alerted to latest GDC news.

Paltalk Inc PALT

- Paltalk said on Oct. 8, an order granting motion for final judgement was entered into District Court for the Western District of Texas in connection with the company’s patent infringement lawsuit against Cisco. The company’s stock fell around 37% over the past month and has a 52-week low of $1.54.

- RSI Value: 29.47

- PALT Price Action: Shares of Paltalk gained 6.2% to close at $2.05 on Monday.

- Benzinga Pro’s charting tool helped identify the trend in PALT stock.

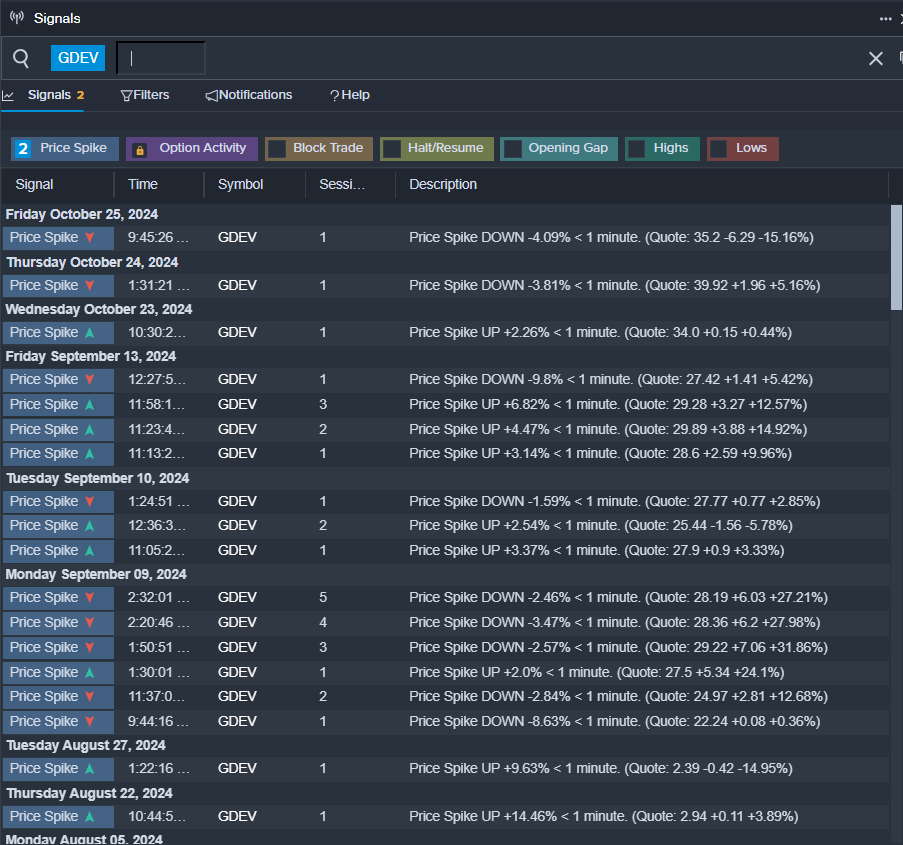

GDEV Inc GDEV

- On Sept. 17, Noble Capital Markets analyst Michael Kupinski maintained GDEV with an Outperform and raised the price target from $60 to $70. The company has a 52-week low of $19.00.

- RSI Value: 24.00

- GDEV Price Action: Shares of GDEV rose 1.1% to close at $37.55 on Monday.

- Benzinga Pro’s signals feature notified of a potential breakout in GDEV shares.

Read More:

Market News and Data brought to you by Benzinga APIs