Corporate buybacks have become a hot topic, drawing criticism from regulators and policymakers. In recent years, Washington, D.C., has considered proposals to tax or limit them.

Historically, buybacks were banned as a form of market manipulation, but in 1982, the SEC legalized open-market repurchases through Rule 10b-18.

Although intended to offer companies flexibility in managing capital, buybacks have evolved into tools often serving executive interests over broader shareholder value.

This article explores the mechanics of buybacks, how they impact markets, and whether they truly return capital to shareholders—or merely enrich insiders.

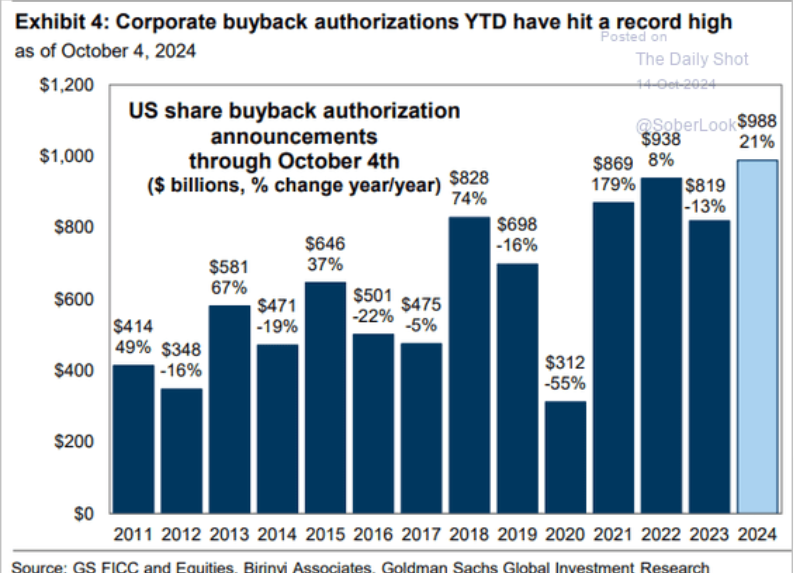

The Rise of Corporate Buybacks: By the Numbers

Since 2003, U.S. corporations have spent over $11 trillion on share repurchases. Corporate buyback activity has surged in recent years, even in volatile markets:

- 2021: $881 billion

- 2023: $795 billion

- 2024 (Projected): Expected to exceed $925 billion

Introducing a 1% excise tax on corporate buybacks in 2023 has barely slowed the trend. Companies prioritize repurchases over reinvesting in business growth, raising wages, or developing new technologies.

Apple (NASDAQ:) and Meta (NASDAQ:), among others, regularly allocate billions toward buybacks, supporting their stock prices and meeting shareholder expectations.

How Buybacks Affect Markets

The impact of buybacks extends beyond individual companies. Since 2000, net corporate buybacks have accounted for 100% of the equity market’s net asset purchases—a reflection of the diminished participation from pensions, mutual funds, and individual investors:

- Pensions & Mutual Funds: –$2.7 trillion

- Households & Foreign Investors: +$2.4 trillion

- Corporations (Buybacks): +$5.5 trillion

- Net Flow: +$5.2 trillion

There are often statements made that corporate buybacks have only a limited impact on stock prices. However, the evidence is pretty overwhelming to the contrary since 2012, when corporations became very aggressive about buybacks.

This trend raises important concerns. While buybacks temporarily support share prices, they can crowd out investments in innovation, capital expenditures, and employee compensation, contributing to long-term economic stagnation and inequality.

Who Benefits Most from Stock Buybacks?

Many analysts argue that buybacks return excess capital to shareholders. However, the reality is more complicated. Buybacks primarily benefit insiders through carefully timed stock sales, inflated earnings metrics, and compensation triggers:

Timing Insider Sales with Buybacks

- Insiders, aware of buyback schedules, can sell shares during repurchase periods when prices are temporarily elevated.

- This practice boosts insider profits without triggering price declines or regulatory scrutiny.

Boosting Earnings Per Share (EPS) to Unlock Bonuses

- Buybacks reduce the number of outstanding shares, artificially inflating EPS.

- Since many executive compensation packages tie bonuses to EPS growth, buybacks help executives meet targets and secure stock awards.

Offsetting Dilution from Stock Options and RSUs

- Buybacks reabsorb shares issued through stock options and restricted stock units (RSUs), preventing dilution and keeping share prices elevated for insiders.

Despite these benefits to executives, the average shareholder sees little return unless they sell their shares during buyback periods. This creates an uneven distribution of profits, favoring insiders and short-term traders over long-term investors.

Companies often market corporate buybacks as a “return of capital to shareholders,” but this framing is somewhat misleading. Unlike dividends, which distribute cash to all shareholders equally, buybacks benefit those who sell their shares. As a result, buybacks:

- Prioritize short-term stock price gains over long-term investments.

- Signal a lack of business reinvestment opportunities—or a deliberate choice not to pursue them.

- Concentrate benefits among insiders and executives, whose compensation is tied to stock performance.

A study from the Securities and Exchange Commission (SEC) found that executives often sell significant amounts of stock shortly after buybacks are announced, reinforcing the idea that buybacks serve insiders more than ordinary shareholders.

Alternatives to Buybacks: Real Ways to Return Capital

To promote sustainable growth and equitable returns, companies could shift their focus from buybacks to more transparent and shareholder-friendly strategies.

- Tender Offers

- Tender offers involve buying back shares at a pre-determined premium, ensuring all shareholders have a fair opportunity to participate.

- This process reduces the risk of manipulation and aligns better with shareholder interests.

- Dividends

- Dividends provide predictable income to all shareholders, promoting financial stability, especially for retirees and long-term investors.

- Regular dividend payments encourage companies to focus on profitability rather than temporary stock price boosts.

- Long-Term Investment in Growth

- Companies can create sustainable value over time by reinvesting profits into research, innovation, and employee compensation.

- This approach aligns corporate management with broader economic growth rather than short-term financial engineering.

While corporate buybacks can support stock prices in the short term, they do little to enhance long-term business performance.

Studies, including the Bank for International Settlements research, have shown that buybacks prioritize EPS manipulation over actual value creation. This emphasis on stock price gains discourages investment in productive assets and innovation, weakening companies’ ability to grow sustainably.

William Lazonick, in his seminal article “Profits Without Prosperity,” highlighted how stock buybacks divert corporate resources away from economic growth and into executive compensation.

Between 2003 and 2012, companies allocated 54% of their earnings to buybacks and another 37% to dividends (91% of total earnings), leaving little for business expansion, wages, or job creation investments.

Conclusion: A Shift Away from Buybacks Is Necessary

While corporate buybacks are marketed as a “return of capital,” they primarily benefit insiders and short-term traders. Their rise reflects a broader shift in corporate priorities—from investing in growth and innovation to maximizing executive compensation through financial engineering.

To promote long-term shareholder value and economic prosperity, companies should adopt more transparent capital return strategies, such as tender offers and dividends.

These methods distribute profits more equitably and encourage sustainable growth. A shift in focus could rebuild trust between corporations and shareholders, aligning business strategies with broader economic health.