After a forgettable 2023, Tesla (NASDAQ: TSLA) finally scored some redemption in its third-quarter earnings report last week.

The stock soared 22% in a single day on Thursday, its best one-day performance in years as it overcame tepid sales growth in its automotive division to post strong profit growth. Operating income jumped 54% to $2.7 billion.

That performance was driven by strong increases in its energy generation and storage business and its services segment, as well as the company controlling costs after a round of layoffs in the second quarter. Tesla also achieved its lowest cost of goods sold per vehicle ever at $35,100.

In addition to the strong profit growth, CEO Elon Musk’s production growth forecast also encouraged investors for next year, as he expects the company to increase production by 20% to 30% in 2025. The company is on track to manufacture roughly 1.8 million vehicles, meaning it aims to increase production by 360,000 to 540,000 vehicles next year.

It’s not entirely clear where that would come from. Tesla plans to begin production of the Cybercab, which it just introduced, next year, and sees it scaling production in 2026, saying the company is aiming for at least 2 million units per year of the two-seater autonomous vehicle.

However, there’s one constraint that Tesla investors didn’t seem to be considering as they sent the stock soaring last week.

Image source: Tesla.

Is the EV market plateauing?

The electric vehicle (EV) industry has struggled as pure plays like Tesla have mostly posted flat or disappointing growth, and legacy automakers like General Motors and Ford Motor Company have tamped down expectations for their EV businesses, blaming high costs, bad economics, and weak demand.

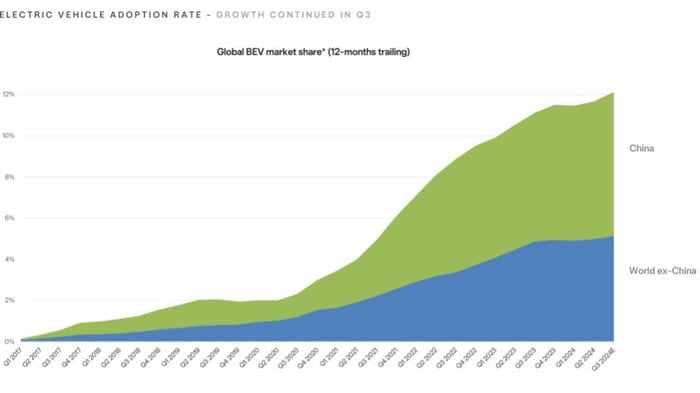

Musk said he believes Tesla is the only profitable EV company, and that there is no EV division of any automobile manufacturer that is profitable. That’s a credit to Tesla, but demand growth in the industry has also slowed significantly as the chart below shows, which Tesla shared in its earnings presentation.

Image source: Tesla.

As you can see, EV growth, especially outside of China, has essentially plateaued over the last four quarters. There’s no single reason for that trend. Instead, it seems to owe to a combination of higher prices for EVs compared to internal combustion engine (ICE) vehicles, range anxiety, early adopters having purchased EVs already, and general preferences for gas vehicles like convenient fill-ups.

Notably, sales of hybrids have taken off in place of battery electric vehicles, showing that consumers like the efficiency of an electric car, but may prefer the convenience of the hybrid.

Tesla presents this chart to support the idea that there is a significant opportunity for growth in EVs, as electric vehicles are anticipated to capture market share from ICE vehicles. Nonetheless, the transition to new technologies may not always follow a smooth and predictable path, particularly when the new technology is pricier. For example, some prognosticators expected e-books to make print books obsolete, but that hasn’t happened.

Musk seems to think that Tesla is capable of growing the market on its own with a new model like the Cybercab as it was able to do back in 2020, but the EV market has evolved substantially since then. There are dozens of EV models on the market from a range of auto companies, and most vehicle model options, from pickup trucks to sedans, are available.

At this point, it will be more difficult for Tesla to grow the EV market on its own than it was in 2020 when the Model Y came out.

The big question facing Tesla

As an autonomous vehicle without a steering wheel or pedals, the Cybercab has the ability to be transformative, but it hasn’t yet received regulatory approval in Texas or California, the two states it’s aiming to launch in.

Even assuming Tesla gets approval, it’s hard to imagine millions of these vehicles hitting the road in a year or two as Musk seems to expect, given the regulatory hurdles and slow rollouts that other autonomous vehicle companies have faced. Even just one accident could present a significant setback to Musk’s autonomous dreams.

In other words, Tesla will have to continue achieving growth in its core business until it’s clear that EVs can be a viable business, and that seems difficult with the market plateauing and a general malaise in the industry.

For a traditional automaker, whose stocks often trade for single-digit price-to-earnings ratios, that would be less of a risk, but Tesla is far from a traditional automaker and it isn’t priced like one. The stock currently trades at a price-to-earnings ratio of over 100 based on trailing adjusted earnings per share.

To sustain that valuation, the company will need to come through with a production boom next year or make significant headway with the Cybercab. Neither one of those will be easy, and if Tesla falls short, the stock could plunge again next year, much like it did in early 2024.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,492!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,204!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $409,559!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 28, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool recommends General Motors and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.