Kingsway Financial Services Inc. KFS reported a loss per share of 10 cents in the third quarter of fiscal 2024, wider than the year-ago period’s loss of 4 cents per share.

KFS’ Revenues in Detail

Kingsway Financial registered revenues of $27.1 million in the fiscal third quarter, up 9.5% year over year.

Higher revenues from both segments drove the topline.

Shares of this company lost nearly 2.3% till yesterday’s trading.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Kingsway Financial’s Segment Details

Kingsway Financial derives revenues from two segments — Extended Warranty and Kingsway Search Xcelerator.

For the quarter under review, Extended Warranty service fee and commission revenues were $17.8 million, up 3.4% year over year.

Kingsway Search Xcelerator segment’s fiscal third-quarter revenues were $9.3 million, up 23.3% year over year.

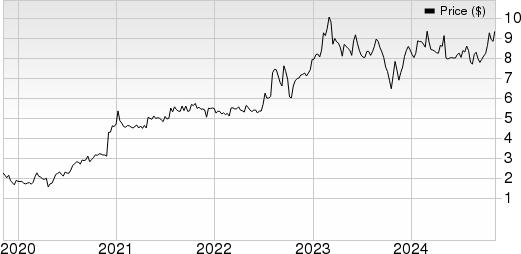

Kingsway Financial Services, Inc. Price, Consensus and EPS Surprise

Kingsway Financial Services, Inc. price-consensus-eps-surprise-chart | Kingsway Financial Services, Inc. Quote

KFS’ Operating Expenses Analysis

For third-quarter fiscal 2024, general and administrative expenses increased 15% year over year to $11.9 million, while the cost of services sold increased 9.5% year over year to $6.8 million.

At the fiscal third-quarter end, claims authorized on vehicle service agreements increased 7.5% year over year to $6.3 million, while commissions increased 8.9% to $2.8 million.

Kingsway Financial’s Profitability

The operating loss for third-quarter fiscal 2024 totaled $0.7 million compared with the year-ago quarter’s operating loss of $0.2 million.

For the fiscal third quarter, Kingsway Financial’s net loss was $2.3 million compared with the year-ago quarter’s net loss of $0.7 million.

For the fiscal third quarter, adjusted EBITDA increased 27.8% year over year to $2.9 million.

KFS’ Liquidity & Debt Management

Kingsway Financial exited third-quarter fiscal 2024 with cash and cash equivalents and short-term investments of $6.7 million compared with $9.8 million at the fiscal second-quarter end.

Cumulative net cash provided by operating activities at the end of third-quarter fiscal 2024 was $1.2 million against the cumulative net cash used in operating activities of $25.3 million a year ago.

Our Take

Kingsway Financial exited third-quarter fiscal 2024 with encouraging top-line results and strong revenues from both segments. During the reported quarter, the company purchased an information technology managed services provider, Image Solutions LLC, and completed the sale of the VA Layfette subsidiary. These raise our optimism about the stock.

However, dismal bottom-line results during the quarter were disappointing.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Kingsway Financial Services, Inc. (KFS) : Free Stock Analysis Report