Key Takeaways

- Strong momentum stocks of the moment include Amazon, KLA Corp, Newmont Corp, Uber Technologies Inc. and S&P Global Inc.

- Momentum investing calls for constant vetting of stocks that look to climb in the short and intermediate term.

- Register now to see our 7 Best Stocks for the Next 30 Days report – free today!

With just one and a half months of trading left in 2024, Wall Street is likely to repeat its impressive rally of 2023. Last year, the three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — were up 13.7%, 23.9% and 43.4%, respectively. Year to date, the Dow, the S&P 500 and the Nasdaq Composite – have advanced 17.4%, 26.5% and 30.7%, respectively.

During the astonishing rally of the past 22 months, several stocks, especially corporate bigwigs have skyrocketed. Despite this phenomenal growth of U.S. stock markets, stocks of various giant corporates have provided returns that are below the return of the broad-market index – the S&P 500.

We recommend investing in such stocks that boast strong momentum and carry a favorable Zacks Rank. Moreover, these stocks have double-digit upside potential in the short term. Five such stocks are – Amazon.com Inc. AMZN, KLA Corp. KLAC, Newmont Corp. NEM, Uber Technologies Inc. UBER and S&P Global Inc. SPGI.

Momentum Likely to Continue

Momentum investing calls for continued appraisal of stocks, ensuring that an investor does not pick a beaten-down name or overlook a thriving one. Momentum investors buy high on the anticipation that a stock will only ascend in the short to intermediate term.

We are still not clear about economic policies (especially imposition of tariff and lowering of corporate tax) of the President-elect Donald Trump for his second term. While this could cause occasional market fluctuations, the overall movement of Wall Street is likely to remain northbound due to three main drivers.

First, the fundamentals of the U.S. economy are rock-solid. U.S. GDP grew at 1.6%, 3% and 2.8%, respectively, in the first three quarters of 2024. On Nov 7, the Atlanta Fed GDPNow tracker estimated 2.5% GDP growth for the fourth quarter. These numbers are higher than the pre-pandemic period.

Second, as of Nov 8, 452 S&P 500 companies reported their quarterly financial numbers. Total earnings of these companies are up 7.1% year over year on 5.5% higher revenues, with 73.5% beating earnings per share (EPS) estimates and 61.5% beating revenue estimates.

Looking at the third quarter as a whole, total earnings of the S&P 500 Index are expected to be up 7.4% from the same period last year on 5.6% higher revenues.

Third, the Fed reduced the benchmark lending rate by 25 basis-points in its November FOMC meeting after cutting an aggressive 50 basis-points in the Fed fund rate in September. The Fed fund rate is currently in the range of 4.50-4.75% compared with a 23-year high of 5.25-5.5% till mid-September. The

CME FedWatch interest rate derivative tool currently shows that market participants have provided a 70% probability of another 25 basis-point rate cut in December.

Buy 5 Momentum Stocks With Strong Short-Term Upside

We have narrowed our search to five large-cap momentum stocks that have witnessed robust earnings estimate revisions in the last 30 days and have strong upside left for the rest of 2024. Each of our picks carries a Zacks Rank #2 (Buy) and has a Momentum Score of A. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

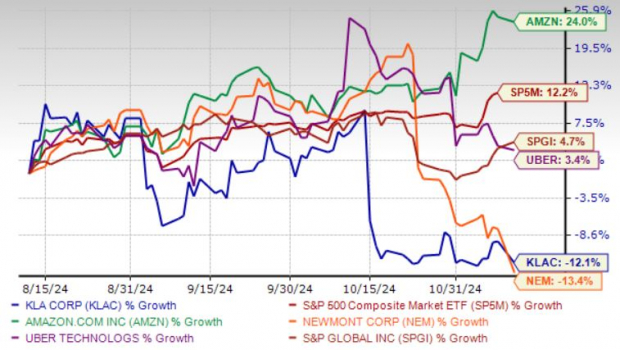

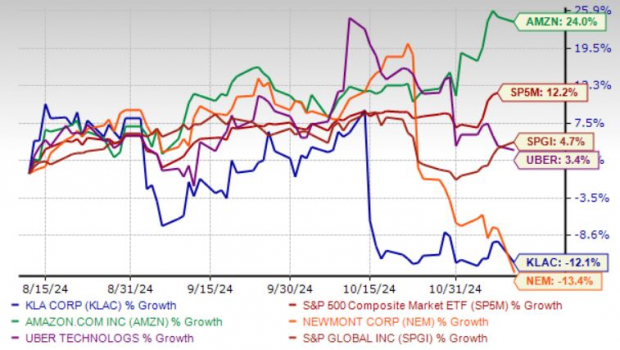

The chart below shows the price performance of our five picks in the past three months.

Image Source: Zacks Investment Research

Amazon.com Inc.

Amazon.com’s third-quarter results were driven by Prime and AWS momentum. Strengthening AWS services portfolio and AMZN’s growing adoption rate contributed well to AWS performance. Ultrafast delivery services and an expanding content portfolio were beneficial. The strengthening relationship with third-party sellers was a positive.

Robust advertising business contributed well. AMZN’s expanding global presence remains a positive. Growing capabilities in grocery, pharmacy, healthcare and autonomous driving are other positives for Amazon.com. Deepening focus on generative AI is a major plus. AMZN issued positive fourth-quarter 2024 guidance fueling investor enthusiasm.

Strong Price Upside Potential for AMZN Stock

The average short-term price target of brokerage firms represents an increase of 13.7% from the last closing price of $206.84. The brokerage target price is currently in the range of $197-$285. This indicates a maximum upside of 37.8% and no downside.

Amazon.com has an expected revenue and earnings growth rate of 10.8% and 78.3%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.2% in the last seven days.

KLA Corp.

KLA is benefiting from the strong performance of the wafer inspection business owing to rising demand for advanced wafer inspection applications in leading-edge technology development. KLAC is benefiting from the higher volume of wafer manufacturing, more complex designs, larger die and chip size driven by strong AI adoption.

Increasing advanced packaging demands which support an increase in process control intensity bodes well for KLAC. Growing investments across multiple nodes and rising capital intensity in Foundry & Logic are driving top-line growth. KLAC’s emphasis on the integration of AI into its solutions has driven its outperformance in the semiconductor market.

Impressive Price Upside Potential for KLAC Shares

The average short-term price target of brokerage firms represents an increase of 20.8% from the last closing price of $666.03. The brokerage target price is currently in the range of $620-$977. This indicates a maximum upside of 46.7% and a maximum downside of 6.9%.

KLAC has an expected revenue and earnings growth rate of 19.6% and 30.2%, respectively, for the current year (ending June 2025). The Zacks Consensus Estimate for current-year earnings has improved 6.1% in the last 30 days.

Newmont Corp.

Newmont is making notable progress with its growth projects. NEM is likely to gain from several projects, including the Tanami expansion. The acquisition of Newcrest also created an industry-leading portfolio and provided opportunities for significant synergies. NEM also remains focused on improving operational efficiency and returning value to shareholders. NEM is making notable progress with efficiency improvement programs.

Gold prices are hitting record highs this year, and the yellow metal has been among the best-performing assets. The rally has been driven by strong demand from central banks, a dovish Fed interest rate outlook, global uncertainties and a surge in safe-haven demand thanks to geopolitical tensions. Increased tensions in the Middle East and concerns over an economic slowdown also fueled safe-haven demand.

Robust Price Upside Potential for NEM Stock

The average short-term price target of brokerage firms represents an increase of 31.6% from the last closing price of $42.33. The brokerage target price is currently in the range of $47-$72.32. This indicates a maximum upside of 70.9% and no downside.

Newmont has an expected revenue and earnings growth rate of 53.3% and 95.7%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 6.1% in the last 30 days.

Uber Technologies Inc.

Uber Technologies’ Delivery business benefits from robust online order volumes. UBER’s efforts to expand its delivery operations through successive acquisitions are encouraging. Continued recovery in Mobility operations is also aiding UBER. For third-quarter 2024, UBER expects gross bookings of $40.25-$41.75 billion.

Apart from the recovery in Mobility operations and the strong performance of the Delivery unit, UBER’s focus on financial discipline is encouraging as well. For third-quarter 2024, adjusted EBITDA is estimated between $1.58 billion and $1.68 billion.

Excellent Price Upside Potential for UBER Shares

The average short-term price target of brokerage firms represents an increase of 26.8% from the last closing price of $71.65. The brokerage target price is currently in the range of $66 -$120. This indicates a maximum upside of 67.5% and a maximum downside of 7.9%

Uber Technologies has an expected revenue and earnings growth rate of 17.3% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 7.6% in the last seven days.

S&P Global Inc.

S&P Global remains well-poised to gain from the growing demand for business information services. Buyouts help innovate, increase differentiated content and develop products. The latest service launches have been aiding SPGI’s growth.

Dividend payments and share buybacks boost investors’ confidence and positively impact earnings per share of SPGI. A current ratio of more than 1 indicates that SPGI will easily pay off its short-term obligations.

Solid Price Upside Potential for SPGI Shares

The average short-term price target of brokerage firms represents an increase of 15.8% from the last closing price of $507.26. The brokerage target price is currently in the range of $535 – $620. This indicates a maximum upside of 22.2% and no downside.

S&P Global has an expected revenue and earnings growth rate of 12% and 20.1%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.5% in the last seven days.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

KLA Corporation (KLAC) : Free Stock Analysis Report

Newmont Corporation (NEM) : Free Stock Analysis Report

S&P Global Inc. (SPGI) : Free Stock Analysis Report

Uber Technologies, Inc. (UBER) : Free Stock Analysis Report