Shares of Magna International MGA gained 11.7% since the company reported third-quarter 2024 results. The auto equipment provider reported adjusted earnings of $1.28 per share, which declined from the year-ago quarter’s $1.46 and missed the Zacks Consensus Estimate of $1.48.

Net sales declined 3.8% year over year to $10.3 billion and missed the Zacks Consensus Estimate of $10.6 billion.

Stay up-to-date with the quarterly releases: See Zacks Earnings Calendar.

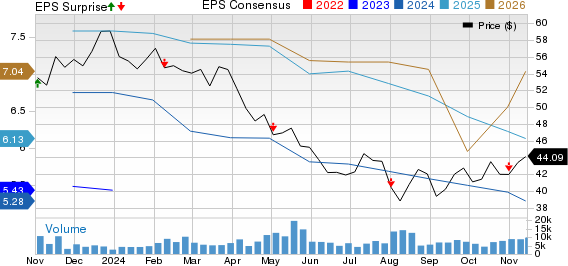

Magna International Inc. Price, Consensus and EPS Surprise

Magna International Inc. price-consensus-eps-surprise-chart | Magna International Inc. Quote

Segmental Performance

The Body Exteriors & Structures segment’s revenues were $4.04 billion, down 4% year over year. This can be attributed to the end of production of certain programs, lower production on a few programs, divestitures and customer price concessions. Revenues also lagged the Zacks Consensus Estimate of $4.32 billion. The segment reported an adjusted EBIT of $273 million, down from $358 million recorded in the year-ago period. The metric also missed the Zacks Consensus Estimate of $345 million because of higher production input costs net of customer recoveries, reduced earnings on lower sales, supply chain premiums and higher pre-operating costs.

The Power & Vision segment’s revenues increased 2% year over year to $3.84 billion on the launch of new programs, customer price increases, favorable foreign exchange translation and benefits from acquisitions. The metric also surpassed the Zacks Consensus Estimate of $3.83 billion. Segmental adjusted EBIT rose from $221 million to $279 million due to an increase in earnings on higher sales. The metric also topped the Zacks Consensus Estimate of $228 million.

Revenues from the Seating Systems segment fell 10% year over year to $1.38 billion and missed the Zacks Consensus Estimate of $1.46 billion due to lower production and end of production. Segmental adjusted EBIT fell from $70 million to $51 million due to reduced earnings on lower sales. The metric also missed the Zacks Consensus Estimate of $54 million.

The Complete Vehicles segment’s revenues decreased 2% year over year to $1.16 billion due to lower assembly volumes. The metric, however, beat the Zacks Consensus Estimate of $1.13 billion. The segment reported an adjusted EBIT of $27 million against an adjusted EBIT loss of $5 million reported in the year-ago period but outpaced the Zacks Consensus Estimate of $8.98 million.

Financials

Magna had $1.06 billion in cash and cash equivalents as of Sept. 30, 2024, down from $1.2 billion as of Dec. 31, 2023. As of Sept. 30, 2024, long-term debt was $4.91 billion, up from $4.18 billion as of Dec. 31, 2023.

In the reported quarter, cash provided from operating activities totaled $727 million, down from the year-ago figure of $797 million.

The company declared a third-quarter dividend of 47.5 cents per common share. The dividend will be paid on Nov. 29, 2024, to shareholders of record as of Nov. 15, 2024.

Magna Revises 2024 Outlook

Magna has revised its full-year projections. It now expects 2024 revenues in the band of $42.2-$43.2 billion, down from $42.5-$44.1 billion guided earlier. Adjusted EBIT margin is projected in the band of 5.4-5.5% compared with the earlier estimate of 5.4-5.8%. Adjusted net income is estimated between $1.45 billion and $1.55 billion, down from the earlier estimate of $1.5-$1.7 billion. Capex is projected in the band of $2.2-$2.3 billion, down from the previous estimate of $2.3-$2.4 billion.

Zacks Rank & Key Picks

WPRT currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the auto space are Dorman Products, Inc. DORM, Tesla, Inc. TSLA and BYD Company Limited BYDDY, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for DORM’s 2024 sales and earnings suggests year-over-year growth of 3.66% and 51.98%, respectively. EPS estimates for 2024 and 2025 have improved 75 cents and 88 cents, respectively, in the past 30 days.

The Zacks Consensus Estimate for TSLA’s 2024 sales suggests year-over-year growth of 2.85%. EPS estimates for 2024 and 2025 have improved by 22 cents and 18 cents, respectively, in the past 30 days.

The Zacks Consensus Estimate for BYDDY’s 2024 sales and earnings suggests year-over-year growth of 25.07% and 31.51%, respectively. EPS estimates for 2024 and 2025 have improved by 35 cents and 39 cents, respectively, in the past 30 days.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Magna International Inc. (MGA) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Dorman Products, Inc. (DORM) : Free Stock Analysis Report

Byd Co., Ltd. (BYDDY) : Free Stock Analysis Report