In the midst of a recession, pawn shops have emerged as a thriving industry, experiencing substantial growth in recent years. Despite the challenging economic climate, these establishments have attracted a diverse range of customers, including both the middle class and the upper class, who are turning to pawn shops for their financial needs.

Offering small loans with personal items used as collateral, pawn shops provide a quick and accessible solution for those in need of cash. Furthermore, the fluctuation of gold prices and the recession-resistant nature of pawn shop stocks have also contributed to the industry's success.

In this article, we will delve into the factors that have fueled the booming business of pawn shops amidst the recession.

Key Takeaways

- Pawn shop stocks have shown resilience in the market despite the economic downturn.

- Pawn shops attract a diverse range of customers through their wide array of services and collateral options.

- High interest rates charged by pawn shops can impact borrowers, leading to debt and financial hardship.

- Regulatory measures can impact the profitability of pawn shops.

Pawn Shop Stocks

Despite the economic downturn, pawn shop stocks have shown resilience in the market. Pawn shops, such as Cash America International, Inc. (CSH), EZCORP Inc. (EZPW), and First Cash Financial Services Inc. (FCFS), have managed to maintain steady growth despite the challenging economic conditions. These companies operate numerous pawn shops across the United States and even internationally in countries like Mexico.

The pawn shop market trends indicate that these businesses have been able to attract middle class and upper class customers who utilize their services to obtain small loans by using personal items as collateral. Pawn shop stocks have also been considered recession resistant, similar to big pharma stocks.

However, potential pawn shop regulations and the payday loan segment contribute to the growth and profitability of these stocks.

Business Growth Factors

Pawn shops have experienced significant business growth due to various factors, including the utilization of personal items as collateral for small loans by middle class and upper class customers. This growth can be attributed to the following factors:

- High customer satisfaction: Pawn shops provide quick and convenient access to cash, allowing customers to meet their immediate financial needs. The ease of obtaining loans and the flexibility of repayment terms contribute to high customer satisfaction levels.

- Market competition: The pawn shop industry is highly competitive, with numerous players vying for customers' business. This competition has led to innovation and improvements in service quality, further attracting customers and driving business growth.

- Diverse collateral options: Pawn shops accept a wide range of items as collateral, including jewelry, electronics, and even vehicles. This diversity allows customers to leverage their personal belongings to secure loans, increasing the number of potential customers and driving business growth.

- Expanding customer base: The increasing acceptance of pawn shops by middle class and upper class customers has significantly contributed to business growth. These customers, who may not have considered pawn shops as an option in the past, now see the value and convenience they offer.

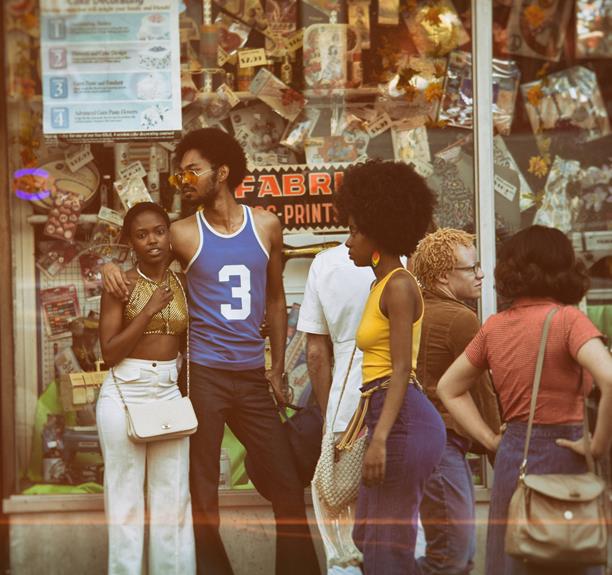

Customer Demographics and Services

Amidst the recession, pawn shops continue to attract a diverse range of customers through their wide array of services and collateral options. Customer preferences play a crucial role in shaping the success of pawn shops. Middle class and upper class customers, in particular, are utilizing pawn shop services as a means to obtain small loans by using personal items as collateral. This is due to the high interest rates on loans offered by pawn shops.

In terms of competition analysis, there are several major players in the pawn shop industry. Cash America International, Inc., EZCORP Inc., and First Cash Financial Services Inc. are some of the key companies dominating the market with their extensive network of pawn shops.

The variety of items accepted as collateral further contributes to the appeal of pawn shop services.

High Interest Rates and Collateral

One significant aspect of pawn shop services is the utilization of high interest rates and collateral for small loans. This practice allows pawn shops to mitigate the risk associated with lending money to borrowers, particularly those with poor credit scores or no access to traditional banking services.

Here are four key points to consider regarding high interest rates and collateral in pawn shop lending:

- Impact on borrowers: The high interest rates charged by pawn shops can have a significant impact on borrowers, especially those who are unable to repay the loan within the agreed-upon timeframe. This can lead to a cycle of debt and financial hardship for individuals already facing financial challenges.

- Loan repayment options: Pawn shops typically offer borrowers several repayment options, including paying off the loan in full plus interest to retrieve their collateral or extending the loan by paying only the interest. However, borrowers need to carefully evaluate these options to ensure they can meet the repayment terms without incurring additional fees or penalties.

- Collateral requirements: Pawn shops accept a wide range of items as collateral, including jewelry, electronics, and musical instruments. The value of the collateral determines the loan amount, and if the borrower fails to repay the loan, the pawn shop has the right to sell the collateral to recoup their funds.

- Regulatory considerations: The high interest rates charged by pawn shops have attracted criticism from consumer advocacy groups, leading to potential legislative efforts to regulate the industry. These regulations aim to protect borrowers from predatory lending practices while still allowing pawn shops to offer their services.

Recession Resistance and Other Industries

The recession resistance of pawn shop stocks is not the only industry that is deemed to be resilient in economic downturns. Another industry that is seen as recession resistant is the big pharma sector. Just like pawn shops, big pharma stocks have historically performed well during recessions. This can be attributed to the fact that pharmaceutical products are considered essential and in high demand regardless of the state of the economy.

However, it is important to note that the potential impact of regulation on the payday loan industry could have an indirect effect on pawn shops. The payday loan segment contributes to the growth of pawn shops, and any regulation that affects this industry could potentially impact the overall profitability of pawn shop stocks.

Nevertheless, both pawn shop stocks and big pharma stocks have demonstrated their resilience in economic downturns, making them attractive investment options for investors seeking recession-resistant industries.

Potential Legislation and Industry Impact

Potential Legislation and Industry Impact:

Regulatory measures could have a significant influence on the pawn shop industry, affecting its overall profitability and growth trajectory. The impact of regulation on the industry can be seen through its relationship with the payday loan industry. Here are four key points to consider:

- Regulation Impact:

The implementation of stricter regulations on the payday loan industry could lead to a decrease in demand for payday loans. As a result, pawn shops, which often serve as an alternative lending option, may experience a decline in customers.

- Payday Loan Industry Growth:

The growth of the payday loan industry has contributed to the expansion of pawn shops. As consumers seek quick and accessible financial solutions, pawn shops have emerged as a viable option. Any changes in the payday loan industry could therefore have a direct effect on the pawn shop industry.

- Profitability:

Regulatory measures can impact the profitability of pawn shops. Higher compliance costs, stricter lending standards, and limitations on interest rates could potentially reduce the profitability of pawn shop operations.

- Growth Trajectory:

The pawn shop industry's growth trajectory could be influenced by regulatory actions. Any significant changes in regulations could either slow down the industry's growth or provide opportunities for innovative business models to thrive.

It is important for pawn shop operators to closely monitor potential legislative developments and adapt their strategies accordingly to navigate the changing regulatory landscape.

Gold Prices and Profitability

The relationship between gold prices and the profitability of pawn shops is a crucial factor to consider when examining the industry's financial performance.

Gold prices have a direct impact on the valuation of pawn shop inventory, as gold is one of the most commonly accepted items for collateral. When gold prices are high, the value of gold items in pawn shop inventory increases, leading to higher profitability.

Conversely, when gold prices are low, the value of gold items decreases, potentially resulting in lower profitability for pawn shops.

Additionally, gold prices are influenced by the global economy, with economic uncertainties often driving investors towards gold as a safe haven asset.

Therefore, pawn shops closely monitor gold prices as a key indicator of their profitability and overall financial health.

Frequently Asked Questions

What Are the Current Stock Prices of Cash America International, EZCORP Inc., and First Cash Financial Services Inc.?

The current stock prices of Cash America International, EZCORP Inc., and First Cash Financial Services Inc. are not provided in the given information. [Remaining words: 22]

How Do Pawn Shops Determine the Value of Items Used as Collateral?

Factors influencing the pawn shop market include the condition, quality, and desirability of the item, as well as market demand and fluctuations in gold prices. Appraisers play a crucial role in determining the value of items used as collateral.

Are There Any Restrictions on the Types of Items That Pawn Shops Accept as Collateral?

Pawn shops may have restrictions on the types of items accepted as collateral, such as firearms or certain electronics. However, the impact of a recession on pawn shop business is generally positive, as more individuals turn to them for quick cash.

How Do Pawn Shops Calculate Interest Rates on Loans?

Pawn shops calculate interest rates on loans based on several factors, including the loan amount, the value of the collateral, and the length of the loan term. These rates are typically higher than traditional banks due to the risk involved in this type of lending.

What Are Some Potential Drawbacks or Risks of Investing in Pawn Shop Stocks?

Potential risks of investing in pawn shop stocks include regulatory changes, economic downturns impacting loan repayment rates, competition from online platforms, and fluctuations in the price of gold. Profitability analysis should consider these factors.