Anticipated Performance in Q3

Tesla, the electric vehicle giant, is set to unveil its financial results for the third quarter of 2024 on October 23. Analysts expect earnings per share to stand at 58 cents, with revenues projected at $25.57 billion. However, the company’s previous quarter displayed a decline in earnings and missed expectations by a significant margin. With a four-quarter average negative earnings surprise of 7.99%, Tesla faces challenges heading into this announcement.

Estimate Revisions for Q3

In recent days, the consensus estimate for Tesla’s Q3 earnings per share has seen a marginal increase. Despite this, analysts foresee a year-over-year decrease of 12.12% in earnings. Projections suggest a revenue uptick of 9.49%, indicating a mixed outlook for the upcoming release.

Factors Influencing Q3 Results

Tesla reported deliveries of 462,890 vehicles in Q3, slightly below forecasts. Automotive revenue is expected to grow by 13.1%, reaching $22.19 billion. However, escalating production costs and aggressive pricing strategies could squeeze margins, with the automotive gross margin likely to contract. On the flip side, revenues from the Energy Generation and Storage segment are on a robust growth trajectory, providing a counterbalance to potential automotive challenges.

Energy storage deployment soared by 73.3% year over year, with revenues from this segment projected to see a 39.1% increase. Additionally, the Services/Other unit is expected to grow by 6.5% compared to the previous year.

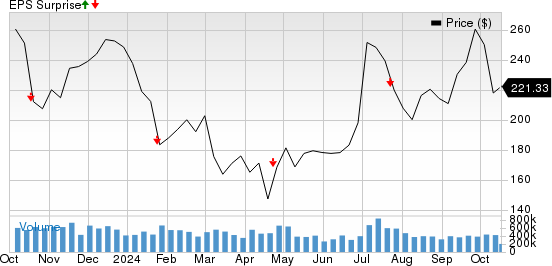

Earnings Forecast and Stock Performance

Analysts’ models do not definitively predict an earnings beat for Tesla this quarter. Despite the company’s current Zacks Rank of 2, the Earnings ESP stands at -1.28%, hinting at potential challenges ahead. While Tesla faces uncertainties, other players like Allison Transmission Holdings, Cummins Inc., and Rivian Automotive Inc. appear better positioned for a positive performance this quarter.

Potential Competitors with Earnings Potential

In contrast to Tesla’s uncertain outlook, competitors such as Allison Transmission Holdings, Cummins Inc., and Rivian Automotive Inc. show promise for beating earnings estimates. With favorable combinations of a strong Earnings ESP and Zacks Rank, these companies are positioned well to deliver positive results.

Each company presents unique opportunities with anticipated earnings and revenue figures, showcasing a varied landscape within the automotive sector. Investors keen on potential winners in this space may find value in considering a diversified approach to investment strategies.