The Gold Rush in Contemporary Economic Terrain

Gold’s historical status as a haven in stormy financial weather is once again taking center stage. With the Federal Reserve making strides against inflation, yet facing stubborn challenges like escalating housing costs, investors are seeking refuge in the timeless allure of the precious metal.

This renewed interest in precious metals received a significant boost from Goldman Sachs, whose analysts predict an upward trajectory that could see spot gold breaching the $2,700 mark by early next year. The geopolitical landscape, often a prism through which gold’s value is enhanced, is also playing a pivotal role. Seen as a trusted sanctuary in times of uncertainty, gold tends to surge when fear looms large. Furthermore, the specter of upcoming Fed rate reductions is poised to elevate the appeal of tangible assets.

The Economic Conundrum and Market Dynamics

Post-pandemic dynamics bring certain economic headwinds into sharp relief, none more so than the spike in benchmark interest rates. A necessary corrective measure following the monetary largesse dispensed during the COVID-19 crisis, high borrowing costs have stifled economic activities. Lowering this barrier could potentially inject fresh vigor into the economy.

Conversely, the recent Labor Department announcement, revising non-farm payrolls downward by 818,000 between April of the previous year and March of the present year, has further fueled discussions around the desirability of preemptive dovish monetary policies. The historical role of rate cuts as indicators of economic distress, rather than opportunity, complicates the landscape, potentially posing challenges for long-term investors in gold.

Unveiling Direxion’s Leveraged ETFs

Despite the oscillations and uncertainties, there exists a unique window of trading opportunities for retail investors eyeing the gold market. Direxion caters to this niche with two leveraged exchange-traded funds tailored for divergent market sentiments.

For enthusiasts of the golden metal and its mining counterparts, the Direxion Daily Gold Miners Index Bull 2X Shares (NUGT) present an avenue for optimistic ventures. Conversely, those with a bearish outlook may find favor with the Direxion Daily Gold Miners Index Bear 2X Shares (DUST). Both ETFs mirror the NYSE Arca Gold Miners Index but pursue contrasting objectives, with NUGT seeking 200% of the daily index return and DUST endeavoring to capture 200% of the inverse performance.

However, investors must tread cautiously, recognizing the transient nature of these vehicles akin to finely crafted analog watches. Initially precise in function, such instruments experience calibration deviations as they run their course—a phenomenon mirroring the behavior of leveraged ETFs.

The NUGT ETF: A Performance Saga

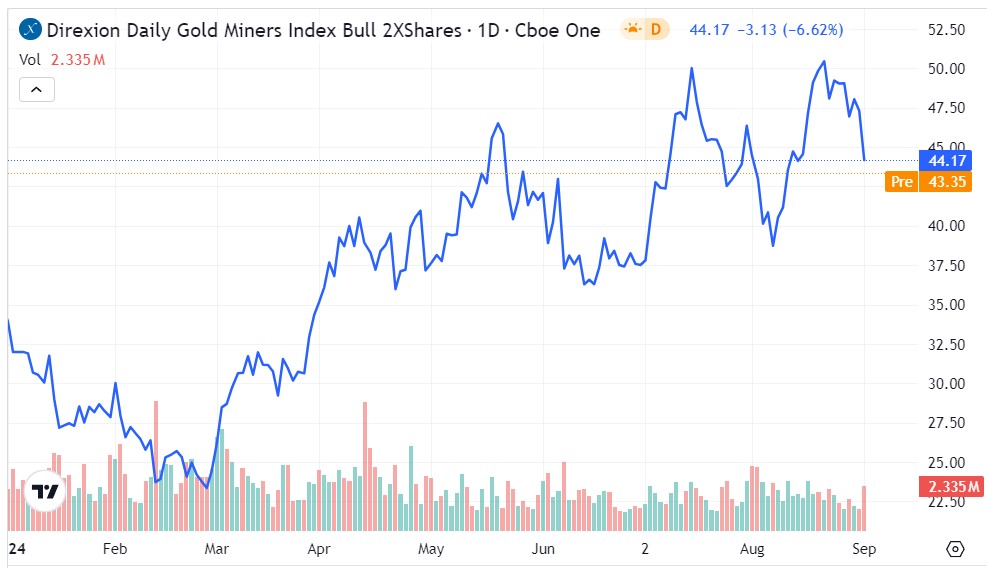

While NUGT has delivered commendable performances this year, recent retractions have cast a shadow over its trajectory. With a notable 8.5% decline over the past five sessions, the 2X bull fund’s robust gains now lie under scrutiny.

- Observers buoyed by the uptrend since late March this year may find solace in NUGT’s consistent ascent within a channel marked by higher highs and higher lows.

- Yet, complacency is not an option, as the volatility witnessed on Tuesday has placed the price precariously atop NUGT’s 50-day moving average ($44.17).

The DUST ETF: Navigating Contrarian Currents

On the contrary, DUST’s performance trajectory has been less stellar in recent times. Despite this, the inverse leveraged fund displayed resilience by accruing a 9% market value increase across the last five trading sessions.

- Evident lower highs and lower lows in the trend channel registered since late March confer predictability to DUST’s overall trajectory.

- Nevertheless, bears are closely monitoring for signs of a reversal, particularly noting DUST’s recent traversal over the 20-day exponential moving average ($6.01).