Starboard’s Decisive Evaluation of Pfizer’s Performance

Starboard Value, the prominent activist investor, has intensified its scrutiny of Pfizer Inc., rebuking the pharmaceutical giant for its lackluster Research and Development (R&D) initiatives and excessive spending on acquisitions.

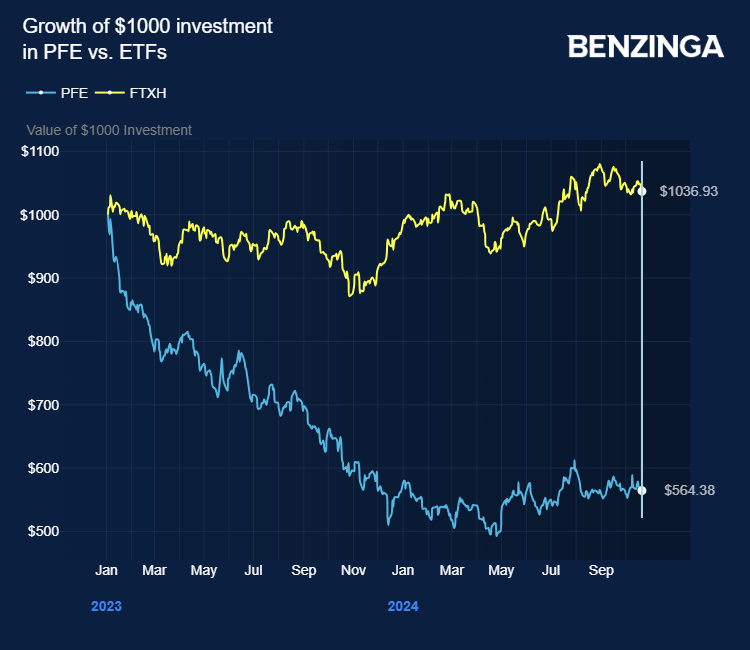

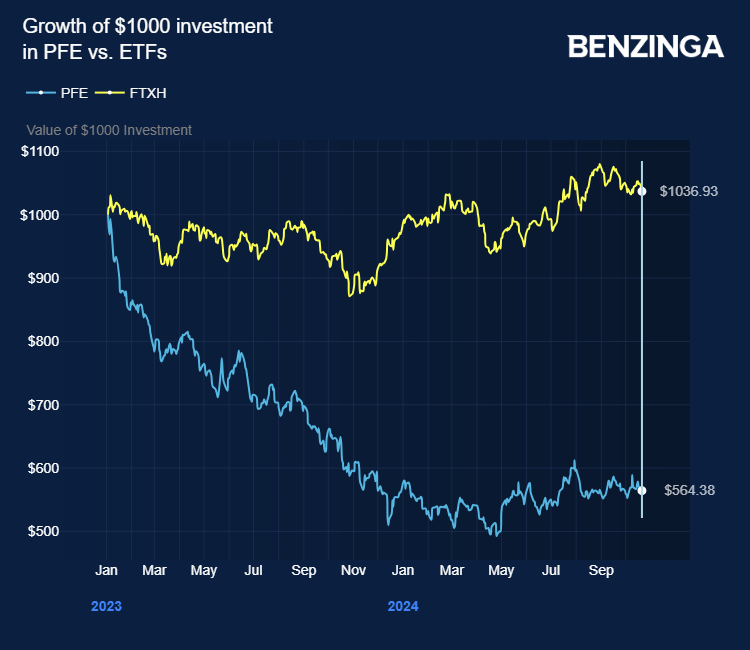

Dissimilar to its modest stake in Pfizer, Starboard’s reproach encapsulates a more widespread investor discontent with the company’s stock, plummeting by around 50% since 2021.

At the Active-Passive Investor Summit, Starboard underscored Pfizer’s failure to leverage its post-COVID momentum, attributing substantial underperformance in R&D and merger and acquisition (M&A) activities to the leadership of CEO Albert Bourla.

Starboard’s Insights on Pfizer’s Financial Standing

Starboard’s presentation, released on Tuesday, highlighted Pfizer’s staggering $20 billion decline in market value since 2019, overshadowing a $40 billion surge from its COVID-19 portfolio.

Expressing apprehensions regarding Pfizer’s debt-ridden balance sheet potential impact on future acquisitions and growth prospects, Starboard emphasized the company’s inability to meet ambitious targets set by Bourla upon assuming the CEO position in 2019.

Starboard particularly scrutinized Pfizer’s extensive external investment endeavors, questioning the viability of its $70 billion M&A activities since 2022, including major transactions like the $43 billion Seagen acquisition, which failed to yield anticipated returns.

Challenges Faced by Pfizer and Starboard’s Projections

Starboard pointed out Pfizer’s withdrawal of Oxbryta for sickle cell disease, originally obtained through the $5.4 billion Global Blood Therapeutics acquisition in 2022, and criticized Pfizer for overpaying for subsequent acquisitions post-COVID, with analyst sales expectations falling short of Pfizer’s projected $20.5 billion target by 2030.

In spotlighting Pfizer’s internal innovation struggles, notably in the GLP-1 program with danuglipron, Starboard highlighted significant reductions in forecasted 2030 sales, well below both management’s and Wall Street estimates.

Starboard cast doubt on Pfizer’s projected revenue return on R&D and M&A investments from 2023 to 2030, significantly trailing the industry median of 38%, with the hedge fund claiming a substantial revenue shortfall of $29 billion by 2030 to align with industry standards.

In a critical tone, Starboard suggested that Pfizer is unlikely to reach the $79 billion revenue projection by 2030, branding Pfizer’s returns on R&D and M&A as inadequate and advocating for stringent board oversight on future investment strategies to propel Pfizer towards excellence.

Price Action: PFE stock observed a 0.12% decline, trading at $28.90 at the latest market check on Tuesday.

Market News and Data brought to you by Benzinga APIs