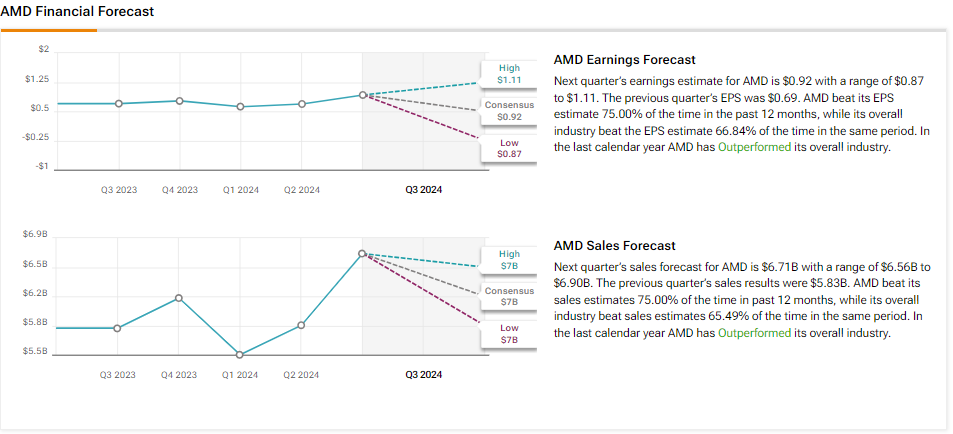

Shares of chipmaker Advanced Micro Devices (AMD) are up in today’s trading as investors await its Q3 earnings results on October 29 after the market closes. Analysts are expecting earnings per share to come in at $0.92 on revenue of $6.71 billion. This equates to 15.7% and 31.4% year-over-year increases, respectively, according to TipRanks’ data.

This is ideal because earnings per share should grow faster than revenue as this demonstrates a high degree of operating and financial leverage in the business. It’s also worth noting that AMD has beaten earnings estimates six times during the past eight quarters. And it seems like AMD could exceed earnings again this quarter, at least that is what analysts at Piper Sandler are hoping for.

Five-star analyst Harsh Kumar, who has a Buy rating and a $200 price target, thinks the company’s performance, particularly in the data center segment, could beat expectations due to the adoption of its MI300 GPU. In addition, he anticipates GPU revenue to exceed the $5 billion target set for Fiscal Year 2024, which is a key goal many investors are keeping an eye on. It’s worth noting that, so far, Kumar has enjoyed an 81% success rate on AMD stock, with an average return of 28.1% per rating.

Investor Sentiment Is Currently Negative

Interestingly, despite Kumar’s optimism, investor sentiment among TipRanks investors appears to be negative. In fact, 1.2% of the investors who hold shares of AMD have reduced their position sizes during the past 30 days. Nevertheless, given that the average portfolio weighting among the 6.2% of portfolios tracked by TipRanks is 7.31%, this could simply be the result of portfolio rebalancing, as the stock’s price has rallied nearly 12% in the past three months.

Is AMD Stock a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Strong Buy consensus rating on AMD stock based on 25 Buys, six Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 67% rally in its share price over the past year, the average AMD price target of $188.96 per share implies 21% upside potential.