Affirm Holdings Inc AFRM stock saw an uptick as B of A Securities analyst

Jason Kupferberg raised the rating from Neutral to Buy, setting a price target of $36.

Kupferberg’s outlook suggests that GAAP profitability could materialize sooner than the consensus anticipates.

The upcoming fourth-quarter results and guidance are poised to act as favorable triggers, with fiscal 2025

projections appearing within reach.

A notable point highlighted by Kupferberg is the potential impact of lower interest rates, which bodes well for

RLTC (revenue minus transaction costs) – a linchpin P&L metric. The analyst displayed optimism towards

Affirm’s collaborations, particularly with tech giants like Apple Inc AAPL.

Kupferberg also acknowledged the effective management of credit risk within the company.

During the November 2023 investor forum, Affirm Holdings divulged a medium-term profitability strategy that

Kupferberg commended as viable, especially given the frugal expense management thus far. Within this

context, the analyst pointed out a discrepancy in how warrant expense and share-based compensation are

modeled by the consensus.

With the gradual decline of warrant expense and Stock-based compensation (SBC) costs, Kupferberg foresaw GAAP

profitability potentially arriving by fiscal 2026, ahead of general expectations.

Anticipating multiple interest rate cuts in the upcoming years, Kupferberg highlighted the favorable

positioning of Affirm Holdings in a lower interest rate backdrop which would help reduce funding costs and

enhance profits from loan sales.

A strategic shift to a 36% annual percentage rate (APR) cap on loans for its merchants, up from the

previous 30%, is expected to provide continued support for yields and Gross Merchandise Value (GMV)

expansion as outlined by the analyst.

In light of recent underperformance in share value, Kupferberg hinted at the potential positive impact that

the fourth-quarter results might bring.

Looking ahead, Affirm Holdings is poised to convey a more optimistic stance on profitability while

presenting strong fourth-quarter results and guiding fiscal 2025 with robust consistency, according to the

analyst.

New affiliations with Apple, expanded utilization of Affirm Card, and potential geographical extensions of

existing significant partnerships like Amazon.Com Inc AMZN and Shopify

Inc SHOP are all viewed as pillars to bolster fiscal 2025 and 2026

prospects, as per Kupferberg.

The analyst’s projections include anticipated sales figures of $2.27 billion for fiscal 2024, $2.75 billion for

fiscal 2025, and $3.24 billion for fiscal 2026.

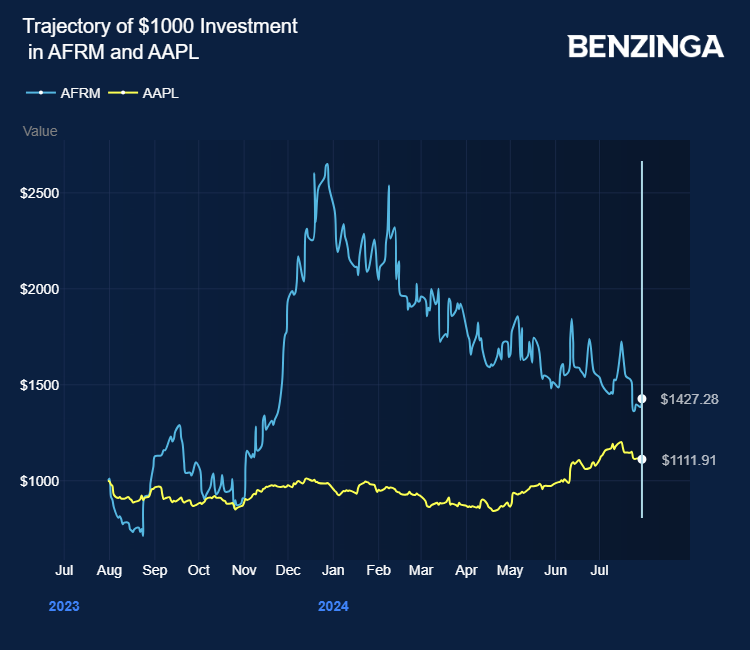

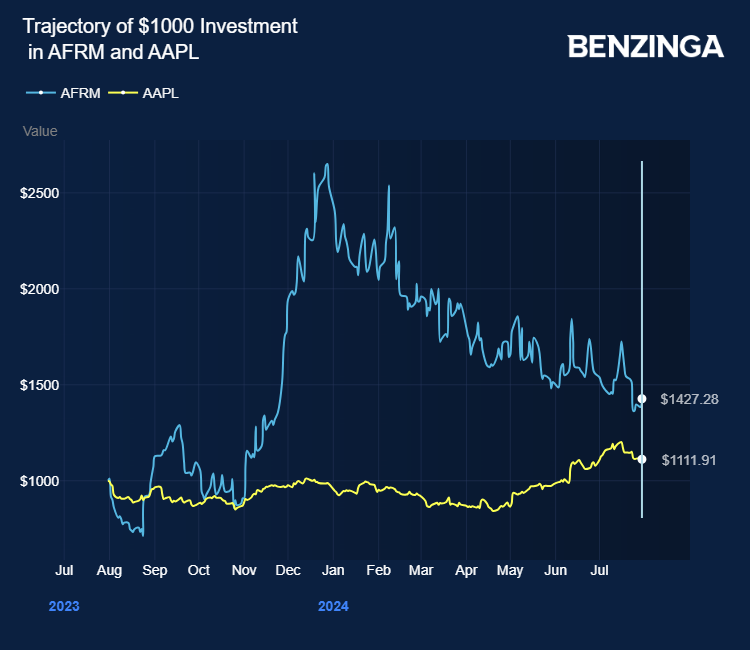

Price Action: AFRM shares concluded trading with a 2.31% increase, closing at $27.46 on

Tuesday.

Photo via Company