Alibaba Group ((NYSE: BABA) has faced a tumultuous period recently, with its stock plummeting close to 60% over the past five years. Nevertheless, the company’s billionaire co-founder, Jack Ma, has recently lauded Alibaba’s strategic initiatives and restructuring endeavors. Ma acknowledged past missteps but emphasized the positive outcomes arising from the company’s division into six distinct sections, leading to enhanced agility and a more customer-centric approach.

Unlocking a Cash Flow Behemoth

Amidst its challenges, Alibaba has consistently demonstrated exceptional prowess in generating copious amounts of cash flow. For the fiscal third quarter ending in December, the company reported operating cash flow of $9.1 billion and free cash flow of $8 billion. Across the initial nine months of the fiscal year, Alibaba amassed $22.4 billion in operating cash flow.

The robust cash flow positions companies advantageously, offering flexibility for reinvestment to fuel growth or facilitating acquisitions. Alibaba has proactively engaged in share repurchasing activities, introducing a $25 billion buyback program in tandem with its fiscal Q3 results in February. Subsequently, the company swiftly executed on this initiative, repurchasing $4.8 billion in shares within the first three months of 2024. Over the past two years, Alibaba has raked in $23.3 billion through share buybacks.

Furthermore, Alibaba is diligently investing in its core e-commerce and cloud computing segments as part of its strategies to reignite growth. In the e-commerce domain, the company is focusing on enhancing price competitiveness, service quality, and user experience. Initiatives include enriching product supply, incorporating more branded and direct-from-manufacturer items onto its platform, fostering flexible models for suppliers to ensure optimal pricing, and augmenting the overall customer experience from pre-sale to logistics. Additionally, Alibaba is piloting an internally developed large language model (LLM) in early phases to fortify its artificial intelligence (AI) capabilities, particularly in search and advertising functions.

As for its cloud computing division, Alibaba aims to migrate customers from low-margin project-oriented contracts to its public cloud service. The company is scaling investments in AI-related hardware and software and expanding its infrastructure to meet the burgeoning demand for AI-powered computing prowess.

Image source: Getty Images.

Navigating Through Potential Risks

Chinese enterprises face hurdles in leveraging AI capabilities due to restrictions on the latest GPU technology from key players like Nvidia. Therefore, Alibaba might not realize immediate benefits akin to U.S. cloud computing giants such as Microsoft and Alphabet. Concurrently, Alibaba has reduced cloud computing prices to attract AI developers to its data center services. While AI holds long-term promise, it might present near-term challenges.

Meanwhile, competition in Alibaba’s e-commerce domain has intensified, with the success of rival PDD Holdings and its popular Pinduoduo platform eroding market share. Despite the competitive landscape, Alibaba’s T-Mall and Taobao platforms remain stalwarts in Chinese e-commerce, particularly at the high end.

The aftermath of pandemic-induced lockdowns has posed constraints on Alibaba, mirroring a lackluster Chinese economy. Although signs of an economic uptick emerged in the first quarter, the Chinese government’s pledges to buoy the economy bode well for Alibaba, albeit with lingering risks.

An Alluringly Inexpensive Stock

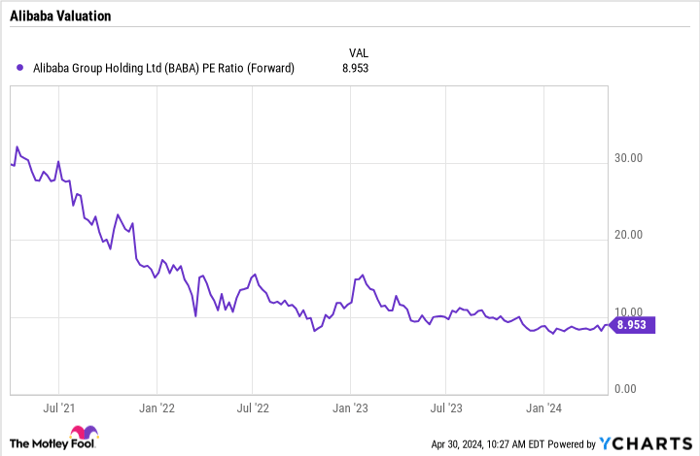

Alibaba’s valuation stands out prominently. Trading at approximately a 9x forward P/E ratio, the stock appears markedly undervalued for a company that has witnessed a 9% revenue growth over the past nine months while generating substantial cash flow.

BABA PE Ratio (Forward) data by YCharts

While an attractive valuation alone does not warrant investment, Alibaba stands as a compelling choice among Chinese titans, boasting significant cash reserves dedicated to share repurchases and business expansions to stimulate growth. Despite inherent risks, the stock’s upside potential in the forthcoming years appears captivating with these distinctive attributes. Therefore, Alibaba’s stock emerges as a convincing buy proposition at present.

Contemplating an Investment in Alibaba Group

Prior to delving into Alibaba Group’s shares, it’s prudent to contemplate this:

The Motley Fool Stock Advisor analysts have recently unveiled what they deem the 10 best stocks for investment opportunities ahead… with Alibaba Group not making the list. The identified stocks possess the potential to yield substantial returns in the foreseeable future.

Reflect on the monumental success story of Nvidia, which made it to this list back on April 15, 2005. An investment of $1,000 based on our recommendation would have amounted to a staggering $544,015 by now!*.

Stock Advisor offers a user-friendly blueprint for investment triumph, comprising portfolio structuring guidance, regular analyst updates, and bimonthly stock recommendations. The service has surpassed the S&P 500 return by over fourfold since 2002*.

*Stock Advisor returns as of May 3, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alibaba Group and Alphabet. The Motley Fool has positions in and recommends Alphabet, Microsoft, and Nvidia. The Motley Fool recommends Alibaba Group and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.