Alibaba’s e-commerce flagship in Southeast Asia, Lazada, finds itself at a crossroads battling fierce competition in the region. With a strategic infusion of approximately $2 billion over the past couple of years, Alibaba is doubling down on generative AI to entice a broader audience in the bustling Southeast Asian market.

The region has become a battleground with Lazada facing pressure from Shopee, which commands a hefty 45% market share, and TikTok Shop swiftly securing a 20% slice of the pie. While Lazada has traditionally appealed to more mature consumers, rivals like Shopee and TikTok Shop are winning over the younger, tech-savvy demographic.

In response to these challenges, Lazada is ramping up its AI capabilities to woo a larger user base and simplify transactions for both buyers and sellers alike. The platform is set to leverage AI for personalized recommendations, enhanced after-sales services through AI agents, as well as enabling sellers to craft tailored content for diverse markets, predict demands accurately, and optimize logistics efficiently.

Alibaba Expands Horizons Beyond China

Alibaba’s strategic investments in Southeast Asia epitomize its larger ambitions of expanding its footprint beyond its home turf in China. As the Chinese economy grapples with regulatory hurdles and geopolitical complexities, Alibaba is harnessing the power of AI and technology to carve a niche for itself in the Southeast Asian landscape.

Is Alibaba a Lucrative Investment Opportunity?

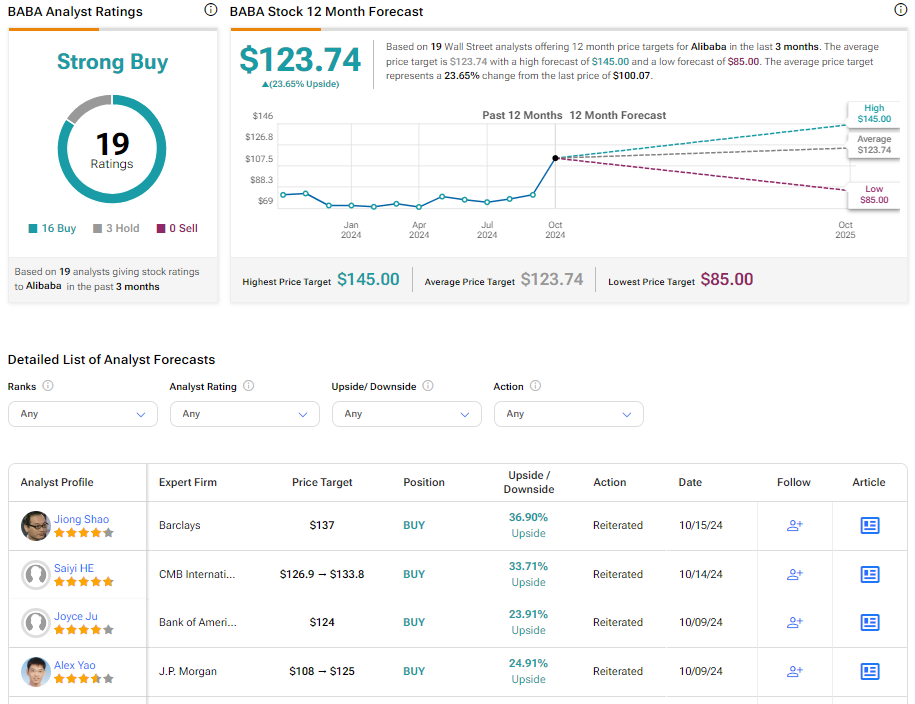

When looking through the lens of Wall Street, Alibaba boasts a Strong Buy consensus rating, backed by 16 Buy ratings and three Holds in the past quarter. With an average price target of $123.74, analysts forecast a promising 23.65% upside potential for Alibaba. Notably, the stock has surged approximately 32% since the beginning of the year.

Explore more insights on Alibaba’s performance from analysts.