Alphabet, the tech behemoth renowned for its Google Search and AI innovations, is strategically streamlining its operations by reducing focus on its smaller ventures, a move that I believe is pivotal in fortifying its AI capabilities and solidifying its competitive position in the coming decade. With this shift in focus alongside its compelling valuation relative to other top-tier tech giants like Apple, Microsoft, Amazon, Nvidia, Meta, and Tesla, Alphabet’s stock emerges as a prime investment choice.

Alphabet’s Diverse Ventures Beyond Core Business

While Alphabet is synonymous with Google Search and Gemini AI, it also houses a portfolio of nascent businesses under the “Other Bets” category. These ventures span across biotechnology, autonomous vehicles, smart home devices, and internet services.

The standout entities within “Other Bets” include Waymo, an autonomous driving pioneer; Verily, focused on healthcare and life sciences; and X, famously known as the “moonshot factory” for its groundbreaking technological pursuits.

Navigating the Role and Challenges of Alphabet’s “Other Bets”

Alphabet’s “Other Bets” segment serves as a breeding ground for exploring and entering new industries, akin to a venture capital model where a few major successes offset numerous failures. This strategy leverages revenue from Alphabet’s core Search and advertising businesses to fuel innovative forays into biotech, autonomous vehicles, and beyond.

Despite the financial losses incurred by this segment due to high R&D costs, Alphabet remains steadfast in its commitment to early-stage investments. However, recognizing the need for financial prudence, Alphabet is dialing back its moonshot projects under the X division to enhance profitability and channel more resources towards its crucial AI initiatives. This strategic realignment emphasizes the company’s aim at securing additional funding for innovation while safeguarding its core capital.

In my view, prioritizing AI over the “Other Bets” endeavors positions Alphabet to emerge as a frontrunner in intelligent technology, offering the potential for heightened revenue, profitability, and stock appreciation in the long term.

GOOGL Stock: A Value Proposition in Big Tech

With a forward P/E ratio of 21.5, Alphabet stands out as a compelling value proposition compared to its tech counterparts. For instance, Tesla boasts a towering forward P/E ratio of 101, while Microsoft hovers at 30.5. Furthermore, Alphabet is one of the rare tech majors trading near its intrinsic value, as indicated by a discounted cash flow analysis projecting steady FCF growth over the next two decades.

The stability exhibited by Alphabet in terms of EPS growth, averaging 21.8% over a decade, 25.9% across five years, and an impressive 41% in the past year without one-off items, further cements its allure for investors. This track record of consistent growth combined with manageable volatility paints a bullish outlook for GOOGL.

Should Alphabet pivot towards intensifying its focus on AI by trimming back its X division and “Other Bets,” it stands to fortify its competitive advantage in intelligent tech, potentially ushering in greater automation, higher margins, and an expanded user base gravitating towards its AI-driven offerings coalescing with Google Search.

Navigating Alphabet’s Competitive Arena

While Alphabet has made notable strides in areas like autonomous driving through Waymo, the looming competition, particularly from Tesla’s Full Self-Driving (FSD) technology and emerging players like OpenAI, poses challenges. Alphabet’s niche focus on innovative technologies at a smaller scale heightens its vulnerability to larger, more dominant rivals, potentially curbing its profit potential.

The fiercely contested landscape in AI, with entrants like OpenAI vying for supremacy, underscores the importance of Alphabet consolidating its foothold in this domain to ensure its long-term viability amid intensifying competition.

Analyzing the Future Trajectory of Alphabet Stock

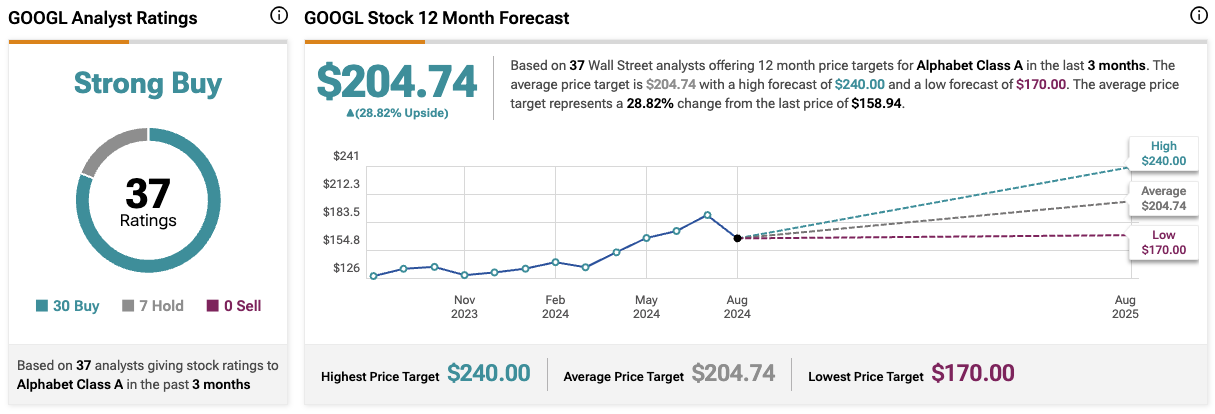

According to market analysts, Alphabet garners a Strong Buy rating, with 37 analysts voicing optimistic sentiments, underlining a bullish consensus. Forecasts indicate a potential 29% upside in GOOGL stock over the next year, accentuating the growth prospects that lie ahead.

Key Takeaway: Alphabet’s Undervalued Gem

Alphabet’s current undervaluation coupled with its proactive stance in fortifying its AI prowess amidst stiff competition positions it as a compelling investment opportunity. As a shareholder in GOOGL, I interpret the recent price dip as an attractive entry point and contemplate augmenting my stake in the near future.