Amazon is revving up for its 10th two-day global shopping extravaganza, Prime Day, starting on July 16. Anticipating this momentous event, the retail giant has unleashed early deals to allow customers to bask in Prime Day savings well in advance.

The early deals span a range of enticing options on select Amazon devices, featuring innovative products like the Ring Battery Doorbell Plus, Blink Outdoor multi-packs, Fire TV Cube, Kindle Scribe, and more. Customers can also snag deals on items from popular brands like Nordic Track, poppi Prebiotic Sodas, and Hatch, as well as products from small businesses.

Amazon is also extending early deals to products from businesses spanning different ownership backgrounds, including black-owned, women-owned, military family-owned, Hispanic-owned, AANHPI-owned, and LGBTQIA-owned companies.

Aside from these early bargains, Amazon has unveiled ‘Back to School and College’ shopping guides along with a host of related deals. Moreover, the company is offering enticing discounts on Amazon Music Unlimited, Prime Video shows, movies, and channels.

The Prime Day extravaganza is not limited to the U.S. but will also be conducted in various countries worldwide. These include the United Kingdom, Australia, Japan, Brazil, and several European nations.

The Financial Implications of Amazon’s Prime Day Approach

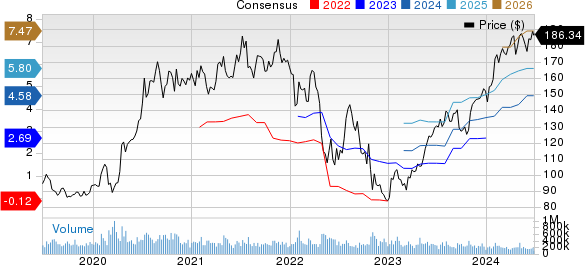

Amazon’s shares have witnessed a respectable 22.7% uptick year-to-date, outpacing the industry’s rally of 16.6%. The driving force behind this growth is Amazon’s formidable Prime program, which continues to serve as a key growth catalyst for the company.

Key initiatives like bolstering delivery services, enhancing music and video content, and fostering a robust loyalty system are constantly attracting new subscribers to Amazon Prime. Prime Day’s festivities have proven to be a profit-generating powerhouse for Amazon, benefiting both shoppers and third-party sellers.

Amazon’s early deal strategy for Prime Day is an integral part of maximizing sales and driving customer engagement. These tempting offers are positioned to fuel Amazon’s Prime Day success, attract new program subscribers, and ultimately boost subscription revenues for the company.

In the future, Amazon’s financial performance is expected to flourish, with the Zacks Consensus Estimate for 2024 projecting revenue growth of 11% to $638.24 billion. The estimated earnings per share for 2024 stand at $4.58, showcasing an impressive year-over-year growth of 57.9%.

Amazon’s Position in the Market and Stock Recommendations

As of now, Amazon holds a Zacks Rank #3 (Hold) designation. In the broader retail-wholesale sector, several stocks stand out, including Walmart, Burlington Stores, and DICK’S Sporting Goods, each currently carrying a Zacks Rank #2 (Buy).

Walmart has seen a solid 29.9% gain year-to-date, with a projected long-term earnings growth rate of 7.15%. Burlington Stores and DICK’S Sporting Goods have also posted impressive gains this year, showcasing solid growth potential in the retail sector.