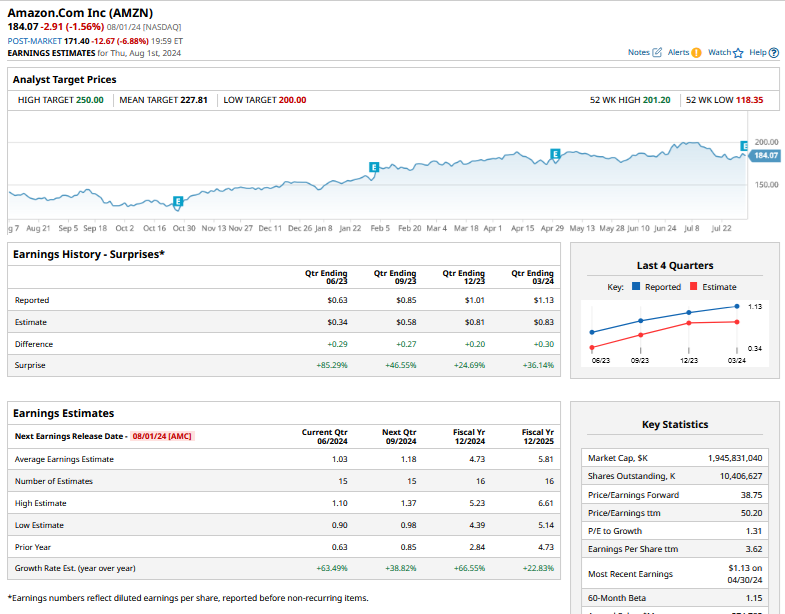

The recent quarterly earnings reports for tech giants have been a mixed bag, with Meta Platforms emerging as a standout performer. Following the latest earnings releases from Apple and Amazon, the stock market reactions have been divergent. While Apple is trading higher post earnings beat, Amazon finds itself on the opposite end, facing a significant drop in share price as a result of missing revenue estimates for the second quarter and offering a weaker-than-expected guidance for the third quarter.

Deconstruction of Amazon’s Market Movement Post Q2 Earnings

The revenue dynamics within Amazon’s various segments reveal a story of contrasting performances. While the enterprise-focused Amazon Web Services (AWS) outperformed expectations with a robust revenue growth of nearly 19% year-on-year, the online store segment saw a modest 5% increase in sales. Additionally, the advertising arm of Amazon witnessed a 20% growth in Q2, slightly below consensus estimates.

Amazon’s recurrent trend of disappointing guidance continued into the third quarter, with revenue and operating income forecasts falling short of analysts’ expectations for the third successive quarter.

Exploring the Investment Opportunity Amidst the Market Movement

Despite the short-term market reactions, Amazon presents a compelling investment opportunity for a multitude of reasons:

1. Bright Prospects in AWS and AI Domain

The growth trajectory of Amazon Web Services (AWS) has regained momentum after overcoming prior challenges. During the earnings call, Amazon’s CEO Andy Jassy outlined three key trends expected to fuel AWS growth: companies shifting focus from cost optimization to innovation, transitioning from on-premise infrastructure to the cloud, and the increasing demand for AI services, all of which bode well for AWS’s future trajectory.

2. Potential Upside in Amazon’s Advertising Segment

Amazon’s advertising business boasts a robust annualized revenue run rate exceeding $50 billion, indicating significant growth potential ahead, particularly with the upcoming expansion of video ads on Prime’s ad-supported platform.

3. Ongoing E-commerce Evolution

The ongoing transition from physical retail to e-commerce represents a favorable trend for Amazon. Enhancements in delivery speed aim to boost sales of everyday items, solidifying customer loyalty. Amidst intensifying competition, Amazon’s strategic initiatives in the pharmacy and business-to-business (B2B) sectors are poised to be additional growth drivers.

Despite the near-term challenges highlighted by CFO Brian Olsavsky, related to the cautious consumer sentiment and economic uncertainties, the underlying robust growth themes in Amazon’s core businesses position it favorably for long-term success.

Looking ahead, the steadfast presence of Amazon across high-growth sectors, including e-commerce, cloud services, AI, streaming, and digital advertising, reinforces its position as a resilient investment choice. Despite the recent market dips, the current valuations seem reasonable, especially considering Amazon’s strong revenue and profit growth potential.

In conclusion, while Amazon’s Q2 results may not have met immediate market expectations, its long-term outlook remains promising. For investors with a horizon beyond 2025, Amazon emerges as a compelling choice offering a blend of growth prospects and value at its current valuation levels.