Amazon (NASDAQ:AMZN) is poised to present its Q2 results on July 25, leaving investors pondering the potential of this e-commerce and cloud giant as an investment opportunity. Despite concerns surrounding its valuation after a 54% surge in share price in the last year, Amazon continues to demonstrate compelling reasons for a bullish outlook. Unveiling three core bullish signals supporting the stock’s long-term investment appeal and highlighting one looming risk, the sentiment remains bullish on AMZN stock.

Robust Growth Across Segments

The strength of Amazon’s growth across all its segments stands out as a key catalyst. In Q1, the company displayed remarkable momentum in Retail, Advertising, and Amazon Web Services (AWS), signaling no signs of slowing down.

Retail Segment Performance

Amazon’s Retail business thrives on expanding offerings and competitive pricing. Q1 saw North American sales up 12% YoY at $86.3 billion, with International sales growing by 11% in constant currency to $31.9 billion. The increasing mix of third-party sellers drove Services revenues up by 16%, leading to notable operating income improvements.

Advertising Success

Amazon’s Advertising revenue rose by 24% YoY in Q1, driven by strong performance in sponsored products and enhanced relevancy and measurement capabilities, accentuating future growth potential.

Amazon Web Services (AWS) Growth

AWS, Amazon’s high-growth revenue stream, saw a 17.2% YoY revenue rise in the previous quarter, showcasing its importance in a competitive cloud landscape. The acceleration of AWS underlines its significance in driving future growth, especially with expanding AI technology adoption.

Technological Innovations and AI Integration

Amazon’s significant technological advancements, notably in artificial intelligence, are driving its growth trajectory at the core of retail, cloud computing, and AI. AWS’s AI capabilities, such as SageMaker, generated substantial revenues, positioning Amazon at the forefront of the AI domain.

For example, Perplexity AI reported a 40% faster model training rate using SageMaker, while NatWest Group witnessed significantly reduced time-to-value for AI projects, enhancing Amazon’s competitive edge in AI services.

Free Cash Flow Surge

Amazon’s soaring free cash flow emerges as a formidable bullish catalyst for its current rally. Rising operating income margins in both the Retail and AWS segments, coupled with moderated capital expenditures, have propelled the surge in free cash flow.

Amazon generated a record free cash flow of $50.1 billion over the past four quarters, aligning with expectations for continued growth. Forecasts anticipate free cash flow to reach significant milestones of $62.0 billion, $78.8 billion, and $102.2 billion in 2024, 2025, and 2026, respectively, sustaining positive investor sentiment.

Potential Valuation Concern

While the bullish signals are potent, a looming valuation concern could impact Amazon’s future returns. Despite immense growth prospects, the stock currently trades at rich multiples of 33.6 times and 26.4 times this year’s and next year’s free cash flow, respectively. The lofty valuation poses a risk if Amazon falls short of meeting aggressive free cash flow growth targets projected by the market.

Analyst Perspectives

Despite the prolonged uptrend, Wall Street maintains a Strong Buy consensus on Amazon, supported by 42 unanimous Buy ratings in the past three months. The average Amazon stock price target of $2,217.70 hints at a 10.85% upside potential.

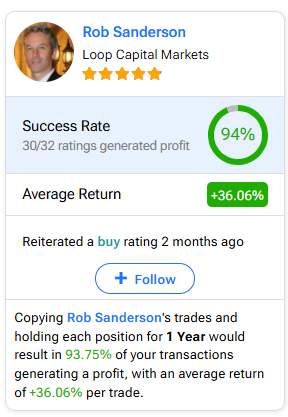

For investors navigating analyst recommendations, Rob Sanderson from Loop Capital Markets emerges as the top-performing analyst for Amazon stock, boasting an impressive average return of 36.06% per rating and a success rate of 94% on a one-year timeframe.

Conclusion

Amazon’s upcoming Q2 results reflect sustained growth across Retail, Advertising, and AWS segments, backed by profitability improvements and advancements in AI technology. While the stock shows promise, concerns linger around its premium valuation. Wall Street’s high expectations underscore the necessity for Amazon to meet or exceed forecasts to sustain its current valuation. Investors need to tread cautiously amid the mix of positive trends and valuation risks.