Advanced Micro Devices (NASDAQ:AMD) is displaying its prowess as a formidable player in the exciting realm of AI (Artificial Intelligence) thanks to its expanding generative AI offerings. Investors have seen a colossal upward trajectory in AMD’s stock price, surging by approximately 130% since the start of the year. While AMD stands poised to benefit from the flourishing landscape of AI, the luster of its current market valuation appears to encapsulate the positives to the point of crowding out potential upsides.

It is pertinent to note that AMD stock currently trades at a forward price-to-earnings multiple of 54.97, significantly surpassing the sector median of 25.16. Furthermore, its price-to-sales ratio of 10.41 also outpaces the sector median of 3.08 and its own five-year average of 6.99.

The Street’s Outlook on AMD

The Wall Street sentiment towards AMD remains bullish, riding on the coattails of substantial growth avenues propelled by the evolving AI space. For instance, AMD’s CEO, Lisa Su, anticipates the data center accelerator TAM (total addressable market) to witness a robust CAGR of over 70% over the next four years, culminating in a projected $400 billion market value by 2027. This signifies a profusion of growth prospects for the company.

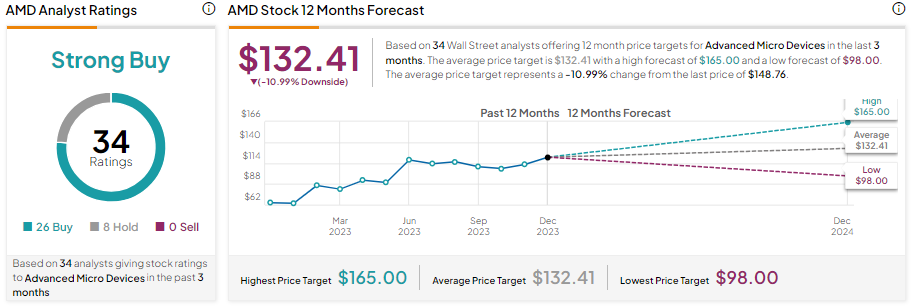

Goldman Sachs analyst Toshiya Hari accordingly elevated AMD’s price target to $157 from $137 on December 17. The analyst upheld his Buy rating on AMD’s stock, citing the burgeoning adoption of its “MI300 Data Center GPU offering across the cloud and enterprise markets.” Presently, AMD’s stock commands 26 Buy and eight Hold recommendations, coalescing into a Strong Buy consensus rating. Nevertheless, the analysts’ average price target of $132.41 implies a downside potential of 10.99% from the current levels.

Concluding Remarks

The robust uptake of AMD’s latest AI GPU, the concerted efforts to diversify its product portfolio, and an expansive addressable market collectively present compelling growth prospects for the company. However, the overextended valuation looms as a cause for concern, corroborated by the analysts’ average price target, indicative of a potential downturn from prevailing levels.