Is AMD’s Latest Performance a Cause for Concern?

Advanced Micro Devices (AMD) has faced an 11% stock dip in the last quarter despite a 147% surge in 2023 fueled by AI market growth. This rise paralleled Nvidia’s domination in AI chips, leading to high expectations for AMD. The recent earnings report indicated a mixed bag for AMD as solid growth in some segments was offset by significant declines in others. In comparison, Nvidia’s soaring revenue figures magnified AMD’s challenges, hinting at a tougher road ahead.

AMD’s Uphill Battle in AI Sector

Nvidia’s stronghold on the AI GPU market, with a 70% to 95% share, poses a daunting challenge for AMD to catch up. Historical market trends show Nvidia’s consistent market share increase and AMD’s struggle to gain ground. Similarly, AMD faces an uphill battle against Intel in the CPU segment. While AMD’s Ryzen processors gained traction, Intel maintained its dominance. The data highlights the difficulty AMD faces in overtaking industry giants like Nvidia and Intel.

Comparing Value and Investment Potential

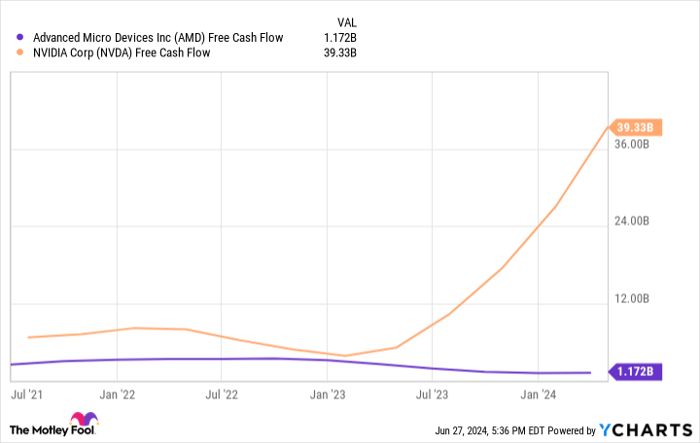

AMD’s stock not only lags behind its peers in financial performance but also portrays a higher price-to-earnings ratio. Nvidia and Intel stand out as better-valued options in comparison. This disparity raises doubts about the long-term investment potential of AMD as it falls behind in value metrics.

Considering AMD’s recent performance and competitive landscape, investors may find better opportunities with rivals such as Nvidia and Intel. The need for AMD to carve a unique niche in the industry becomes evident as it grapples to differentiate itself from these market leaders.

Therefore, while AMD’s recent stock dip may seem tantalizing for some investors, a deeper analysis suggests that other competitors present more attractive investment prospects in the ever-evolving AI and chip markets.