Apple’s 2023 Performance and Current Outlook

Apple’s stock witnessed a commendable growth of 49% in 2023, outshining the Nasdaq Composite’s 44% returns. Despite this, it emerged as the weakest performer among FAANG stocks. However, the start of 2024 hasn’t been favorable for the tech giant, as three brokerages have recently downgraded the stock.

Reasons Behind Apple’s Underperformance in 2023

Apple’s fiscal year 2023 saw negative revenue growth across all four quarters, marking the first time since 2001. Its outlook for the December quarter failed to inspire confidence, contrasting with the favorable results and market reactions of its FAANG peers post the 2022 crash.

2024 Prediction for Apple Stock

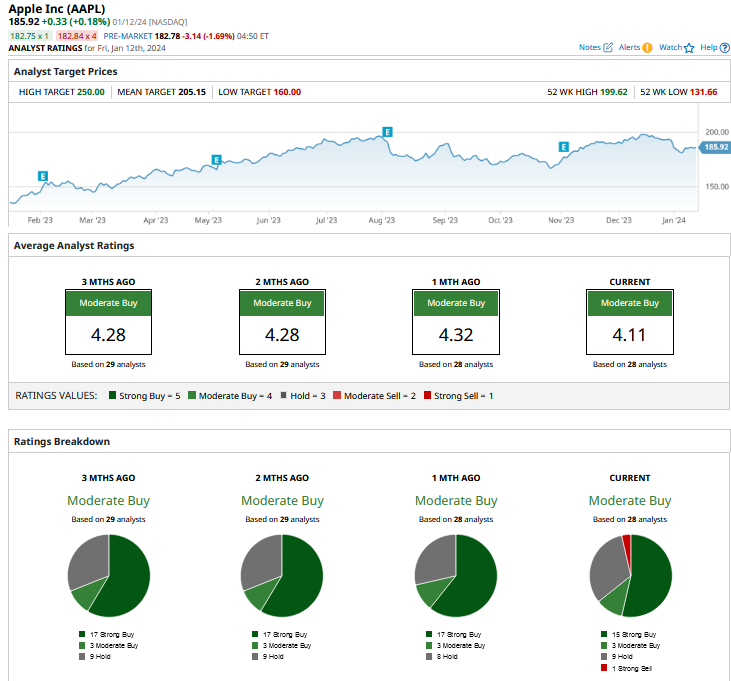

Of the 28 analysts covering Apple stock, 15 rate it as a “Strong Buy,” while 3 call it a “Moderate Buy.” However, recent downgrades by key brokerages indicate a growing bearish sentiment towards Apple. Nonetheless, the mean target price of $205.15 represents a premium of more than 10% to its current stock price.

Addressing Analysts’ Bearish Sentiment towards Apple

Analysts are expressing concerns about a potential prolonged slowdown in iPhone sales, especially in China, one of Apple’s crucial markets. The company faces tough competition from Chinese smartphone manufacturers, leading to fears of declining market share.

Evaluating the Investment Potential

Despite its noteworthy initiatives, such as targeting the Indian market and introducing augmented reality headsets, Apple’s future growth drivers appear to be less dazzling. The company’s extravagant valuations and the current risk-reward ratio may discourage potential investors from considering new positions.