Shares in Apple (NASDAQ: AAPL) have soared to new heights, reaching a record-breaking $237 per share in mid-July, marking an impressive 8% increase over the last month. This uptrend comes as a refreshing breeze for Apple after a sluggish performance in the first half of the year, putting the tech giant back on the radar of investors.

The recent surge in Apple’s stock price is particularly noteworthy given its resurgence in the artificial intelligence (AI) arena, outpacing major competitors like Microsoft, Alphabet, and Nvidia after a period of stagnation. Apple’s strategic foray into AI was catalyzed by the introduction of Apple Intelligence, a substantial software revamp geared towards integrating AI features across its diverse product range.

The company’s delayed entry into the AI realm had initially hindered its stock performance, but Apple’s concerted efforts to catch up have been met with growing optimism on Wall Street, especially with the highly anticipated unveiling of the first iPhone optimized for AI functionalities slated for September.

Apple’s AI Expansion Signals Growth Potential in Surging Market

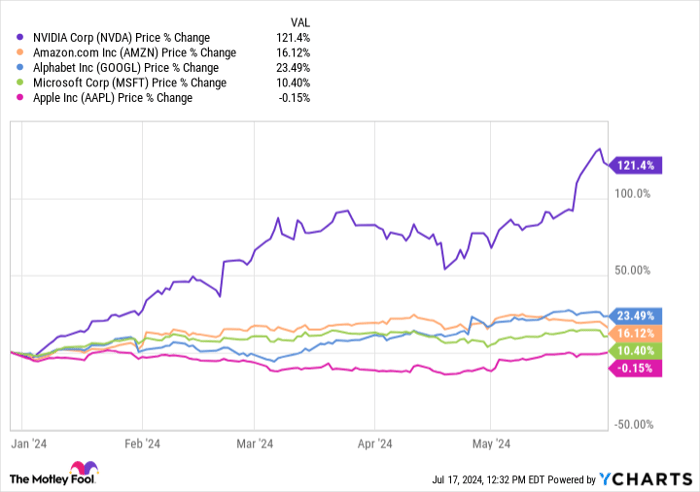

The AI boom ignited by the launch of OpenAI’s ChatGPT in late 2022 continues to sway investor sentiment, reflected in the 31% surge in the Nasdaq-100 Technology Sector index over the past year. While tech behemoths like Nvidia and Alphabet have reaped significant stock gains by unveiling innovative AI products, Apple’s more cautious AI strategy has led to a modest 20% stock increase during the same period.

However, Apple’s accelerating push into AI through the imminent Apple Intelligence rollout and the upcoming iPhone 16 release presents an opportune moment for investors to capitalize on the company’s AI-driven growth trajectory before it attains full momentum.

Undervalued Stock Position Amid Promising Growth Avenues

An analysis of Apple’s Price/Earnings-to-Growth (PEG) ratio over the past year reveals a remarkable 98% dip, suggesting the stock’s undervaluation despite the recent price surge. A low PEG ratio indicates favorable valuation based on growth prospects, positioning Apple as a compelling buy at one of its most attractive price points in months.

Besides AI, Apple’s flourishing services business, encompassing revenue sources from the App Store and subscription-based services like Apple TV+ and Music, underscores the company’s diversified income streams. The services segment’s robust 14% revenue growth and impressive 75% profit margin in Q2 of 2024 overshadow other divisions, hinting at Apple’s multifaceted growth story.

Future Outlook and Investment Considerations

As Apple gears up for a pivotal September unveil, investors are poised to witness the synergistic impact of Apple Intelligence and the latest iPhone iteration on the company’s growth trajectory. With AI steering the innovation narrative, Apple’s stock holds substantial promise for the remainder of 2024, enticing investors to double down on their positions.

While Apple’s stock surge is grabbing headlines, the company’s evolution into an AI-driven juggernaut and its resilient services segment indicate a compelling investment opportunity amidst a dynamic tech landscape.