The market dynamics surrounding the “Magnificent Seven” are akin to a rollercoaster ride through the financial skies. These titans of the stock world, comprising Microsoft, Apple, Nvidia, Alphabet, Amazon, Meta Platforms, and Tesla, have been the paramount drivers of market gains in recent times. However, as the dust settles, imperfections in their armor have come to light.

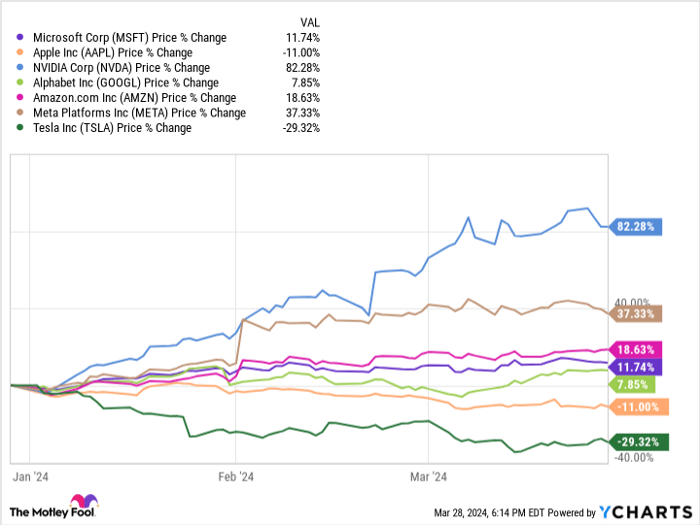

2023 witnessed a crescendo of success for these behemoths, with returns that would make any investor’s heart sing. Alas, 2024 tells a different tale – a turbulent saga of erratic performances, wavering valuations, and a looming question mark hanging over the realm of investment.

Assessing the Performance Shift

Each member of the “Magnificent Seven” has had its day in the sun. Microsoft, Apple, Nvidia, Alphabet, Amazon, Meta Platforms, and Tesla have seen their fair share of highs and lows. However, the luster that once shone so brightly seems dimmed, with cracks in their once impervious armor now visible to keen-eyed investors.

Varying Shades of Valuation

Casting a discerning eye on these market phenomena unveils a varied landscape. Tesla, grappling with a tumultuous year, stands amidst the rubble of diminished value, with investors shying away from the once-soaring stock, now perched at 55 times forward earnings.

Meanwhile, Apple’s struggles paint a somber picture, with a growth trajectory more reminiscent of a sedate stroll than a sprint. Valued at 26 times forward earnings, the tech giant finds itself in a precarious position, teetering on the edge of market expectations.

Fluctuating fortunes characterize the remaining five; some may be diamonds in the rough, awaiting discovery by savvy investors. Alphabet and Meta Platforms emerge as beacons of hope, with valuations that seem within reason, poised for continued growth in the ad-driven digital landscape.

Nvidia, the torchbearer of the AI revolution, commands a premium at 38 times forward earnings, a testament to its pivotal position in the technological realm.

Amazon, with its eyes set on profit optimization, presents a conundrum – its 42 times earnings hint at a future where profits may soar, and valuations find equilibrium.

Lastly, Microsoft, the venerated titan of the tech world, stands tall with a lofty valuation of 37 times forward earnings, an ode to its AI prowess and expanding cloud computing dominion.

Weighing the Scales: Valuation Rankings

Ranking these juggernauts solely based on their forward price-to-earnings multiples does not unveil the full tapestry of growth and potential each possesses. Thus, a nuanced perspective is vital in ascertaining their true investment value.

From the cheapest to the most expensive in my reckoning, Alphabet and Meta Platforms lead the pack, radiating promise with their relatively modest valuations. Amazon and Nvidia follow suit, offering growth potential that may justify their seemingly steep valuations in the grand scheme of market dynamics.

Tesla’s uncertainty clouds its position, while Microsoft and Apple, though formidable in stature, find themselves navigating a complex landscape of valuation and growth prospects.

The Tale of Expensive Giants in the Tech Industry

An Apple a Day Keeps Investors Away?

Amidst the bustling world of tech stocks, Microsoft and Apple stand tall, known for their hefty price tags. Yet, Apple seems to take the cake as the worst offender, with sluggish growth rates leaving investors scratching their heads. The stock market drama between these tech giants has become a main event, luring in investors hoping to strike gold. But is the grass truly greener on the other side?

Investing Wisely in Nvidia

As investors ponder their next move, the spotlight shifts to Nvidia. The burning question on everyone’s mind – should you put $1,000 into this tech behemoth? Before taking the leap, it’s essential to consider all the variables at play. The Motley Fool’s Stock Advisor team has cast their discerning eye over the situation, singling out what they believe to be the cream of the crop among tech stocks. Surprisingly, Nvidia fails to make the cut, leaving aspiring investors to wonder about the monster returns potentially awaiting with the chosen ten.

The Stock Advisor Magic Touch

Stock Advisor doesn’t just offer a run-of-the-mill investment package. It’s a treasure trove of guidance, giving investors a roadmap to navigate the unpredictable waters of the market. With insights on portfolio construction, regular analyst updates, and two fresh stock picks each month, this service has distinguished itself by tripling the S&P 500’s return since 2002. A track record that speaks volumes in the volatile world of stocks.

A Word of Caution

As the investing landscape continues to shift and evolve, a word of caution is in order. The allure of tech giants like Microsoft, Apple, and Nvidia may be strong, but prudent decision-making is key. With historical data to guide and the Stock Advisor team steering the ship, investors have the tools needed to make informed choices. The story of tech stocks is ever-changing – investors must be prepared for the plot twists that lie ahead.