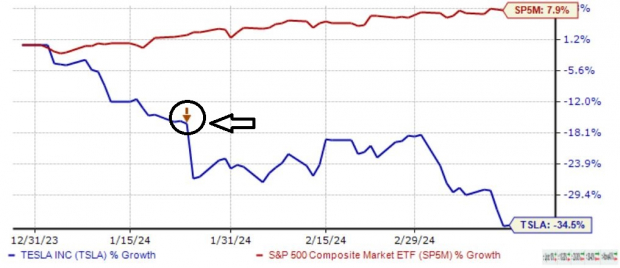

The year 2024 has galloped in on the coattails of the previous year’s market euphoria, with the S&P 500 notching an impressive 8% rise year-to-date. This performance owes much to the robust presence of top-tier technology stocks, leading the charge in market buoyancy.

However, the celebratory air has been dampened by a cohort of underperforming S&P 500 constituents, notably Tesla TSLA, Humana HUM, and Boeing BA. These three equities have proven to be anchors, wallowing in the crimson sea of 2024.

Tesla

Skidding 34% lower this year, Tesla has traversed a tumultuous path, with its most recent quarterly results triggering an avalanche of selling pressure. Encumbered by diminished margins, lackluster hybrid prospects, and fierce competition in China, Tesla finds itself grappling with multiple adversities.

Humana

Languishing 24% year-to-date, Humana witnessed a sell-off post-earnings, following disappointing figures in its latest financial disclosure. Falling egregiously short of the Zacks Consensus EPS estimate and managing only a modest revenue beat, Humana was left wanting.

Boeing

Plummeting 30%, Boeing’s descent has been catalyzed by a litany of maintenance woes plaguing its aircraft fleet in 2024. Just recently, a disconcerting incident wherein one of its planes nosedived mid-flight due to cockpit malfunctions has further battered the company’s image.

Current Scenario and Suggestions

Despite the struggles of Tesla, Humana, and Boeing, their predicaments offer a moment for contemplation. While Tesla remains an enticing prospect for EV enthusiasts in the long run, uncertainties cloud its immediate future. Analogously, Humana and Boeing confront dour earnings forecasts, reflected in their unfavorable Zacks Ranks.

For investors seeking solace amidst the stormy seas, directing attention towards equities sporting a Zacks Rank #1 (Strong Buy) or Zacks Rank #2 (Buy) may prove to be a more prudent course. These stocks boast the positive momentum necessary for an upward trajectory.

7 Best Stocks for the Next 30 Days

Unveiling 7 elite stocks designated as “Most Likely for Early Price Pops” by seasoned experts from amongst 220 Zacks Rank #1 Strong Buys. This coveted list has outpaced the market by over 2X since 1988, boasting an average annual gain of +24.2%. Thus, these hand-picked selections merit immediate scrutiny.