The tech sector in 2024 has set sail on a buoyant course, with the S&P 500 index boasting a commendable gain of over 5% year to date. Spearheaded by software juggernauts riding the wave of artificial intelligence (AI) advancements, the fervor in the market is palpable. However, amidst the roaring success of familiar giants lie hidden treasures, waiting to be unearthed by discerning investors.

Exploring Automation with UiPath Studio

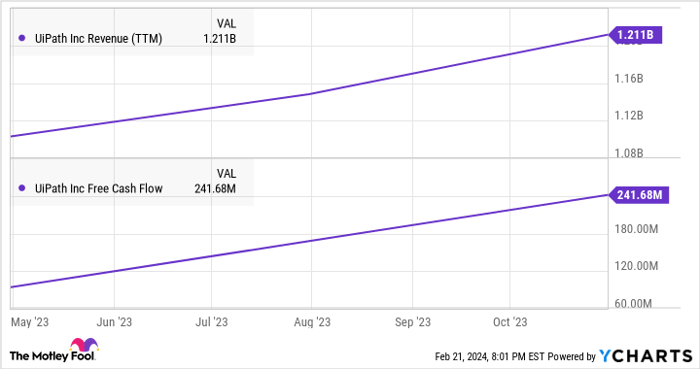

Anders Bylund delves into the world of robotic process automation (RPA) with insights on UiPath. While RPA may not immediately ignite one’s passion, its rapid growth trajectory intertwined with AI flair speaks volumes. UiPath is a pioneer in this domain, offering a platform for streamlining business processes through automation. At the heart of its operations lies UiPath Studio, a cutting-edge asset facilitating the creation of AI-controlled software robots to automate diverse tasks and workflows.

Renowned for its user-friendly graphical interface, extensive range of automation endpoints, and swift development cycles, UiPath Studio stands tall. Its seamless transition from issue identification to full-fledged production, augmented by a rich repository of task templates, makes it a formidable contender in the automation arena.

While behemoths like Microsoft present their RPA tool, Power Automate, UiPath remains a preferred choice for enterprises seeking top-notch automation solutions. As UiPath CFO Ashim Gupta proudly proclaimed at a recent conference, “Microsoft has named us their preferred automation partner,” lauding UiPath’s prowess in diverse automation realms.

UiPath’s consistent outperformance of analyst expectations, weathering economic storms with finesse, underscores its mettle as a robust, all-weather AI investment option. For investors seeking a dependable ally in the ever-evolving tech landscape, UiPath emerges as a beacon of promise.

Shooting for the Stars with IonQ’s Quantum Computing

Billy Duberstein propels us into the realm of quantum computing, a domain poised to disrupt the AI narrative. Quantum computing, characterized by its utilization of quantum “qbits,” possesses the potential to revolutionize data processing, eclipsing the binary confines of traditional electronic transistors.

One name at the forefront of this revolution is IonQ, the vanguard of pure-play quantum computing in the public domain. With a market cap eclipsing $2 billion, IonQ innovates through its atomic ion trap methodology, a distinct path to commercialization defined by its efficiency and scalability.

IonQ’s recent milestone achievement of an #AQ 35 algorithmic qbit system ahead of schedule marks a pivotal turning point. This accomplishment signifies IonQ’s march towards quantum supremacy for specific applications, positioning it as a frontrunner in the quantum computing race.

Moreover, IonQ’s strategic expansion, highlighted by the establishment of a quantum manufacturing center and a secondary quantum data hub outside of Seattle, cements its commitment to technological advancement. With the quantum computing horizon beckoning, IonQ emerges as a potent force, ready to redefine computational paradigms.

Shaping the Financial Landscape in 2024 and Beyond

Steering Towards Quantum Success

As major cloud computing platforms pave the way, 2024 could mark a significant shift for IonQ, propelling it from an experimental start-up to a robust money-making entity. A quantum ChatGPT-like moment may be looming on the horizon in the near future.

Exploring Growth Opportunities in Finance

Shift4 Payments, a small digital payments provider, stands out as a compelling story of growth amidst intense competition in the digital payments space. While established players like PayPal Holdings face challenges, Shift4 Payments has been steadily expanding its revenue, showing a 28% year-over-year increase in the first nine months of 2023.

With a strategic move to cater to big sports stadiums and entertainment venues, coupled with a recent acquisition to fuel its European expansion, Shift4 Payments demonstrates resilience and potential for further growth. The company’s solid financial performance, including a 58% surge in GAAP net income and a 149% increase in free cash flow to $242 million, indicates a promising trajectory.

Challenges and Opportunities Ahead

While Shift4 Payments showcases robust growth, caution is advised as the company grapples with maintaining a healthy balance sheet. With $692 million in cash and short-term investments offset by debt of $1.75 billion due to past acquisitions, ensuring a stable financial structure remains a key focus area.

Despite potential challenges, Shift4 Payments’ shares present an attractive proposition, trading at 46 times trailing 12-month earnings per share and 20 times free cash flow. A forward-looking perspective on the company’s growth potential into 2024 and beyond could position investors favorably in the long term.

Assessing Investment Opportunities

Prior to investing in IonQ, investors are advised to consider various factors. The Motley Fool Stock Advisor’s analyst team recently identified the top 10 stocks for investors to consider, with IonQ not making the cut. The highlighted stocks are projected to offer substantial returns in the future, emphasizing the importance of thorough research and strategic investment decisions.

The Stock Advisor service provides investors with a comprehensive guide to success, offering insights on portfolio management, analyst updates, and monthly stock recommendations that have significantly outperformed the S&P 500 since 2002.

*Stock Advisor returns as of February 26, 2024